Can Ethereum Price Cross $2,000 in May 2025?

After a relatively flat April marked with reduced network demand and sideways price actions, the second largest cryptocurrency, Ethereum (ETH), can be positioned for a shift.

ETH holders rely on May. This optimism has been fueled by strengthening the foundations, the expected PECTRA upgrade, and transforming interest from institutional investors through funds exchanged by ETH ETH (ETF).

Eth struggles in April, but can bring a glimmer of hope

In April, on-chain data showed a DIP on user activity throughout the Ethereum network, while the broader stagnation of the market was kept trading below the resistance levels.

According to Artemis, during the 30-day period, the user's demand for Ethereum has fallen, leading to a collapse in the number of active addresses, daily transactions, and consequently, network fees and its income.

This and the broader market collapse affect ETH performance, causing the leading price of Altcoin to remain below a $ 2,000 mark throughout April.

However, in an interview with Beincrypto, Gabriel Halm, a research analyst in Intotheblock, said the ETH price could break above the $ 2,000 price score in May and stabilize the top.

For HALM, the enhanced capital flowing into ETH SPOTS ETF, Ethereum's dominance in decentralized coin finances (DEFI) vertically, and the upcoming PECTRA upgrade can help bring it to fruit.

ETF Inflows, Defi Dominance, and Pectra: Triple Boost for Ethereum in May

According to Sosovalue, the monthly net flow to the ETFs costs $ 66.25 million in April, which signed a transfer to market sentiment compared to $ 403.37 million to net outflows recorded in March.

This inversion from heavy flow to moderate flows suggests that the investor's confidence in Altcoin is gradually returning. This indicates that institutional players may be positioning for a longer rebound, especially as the foundations of the Ethereum network are beginning to improve, one of which is its climbing dominance in the DeFI sector.

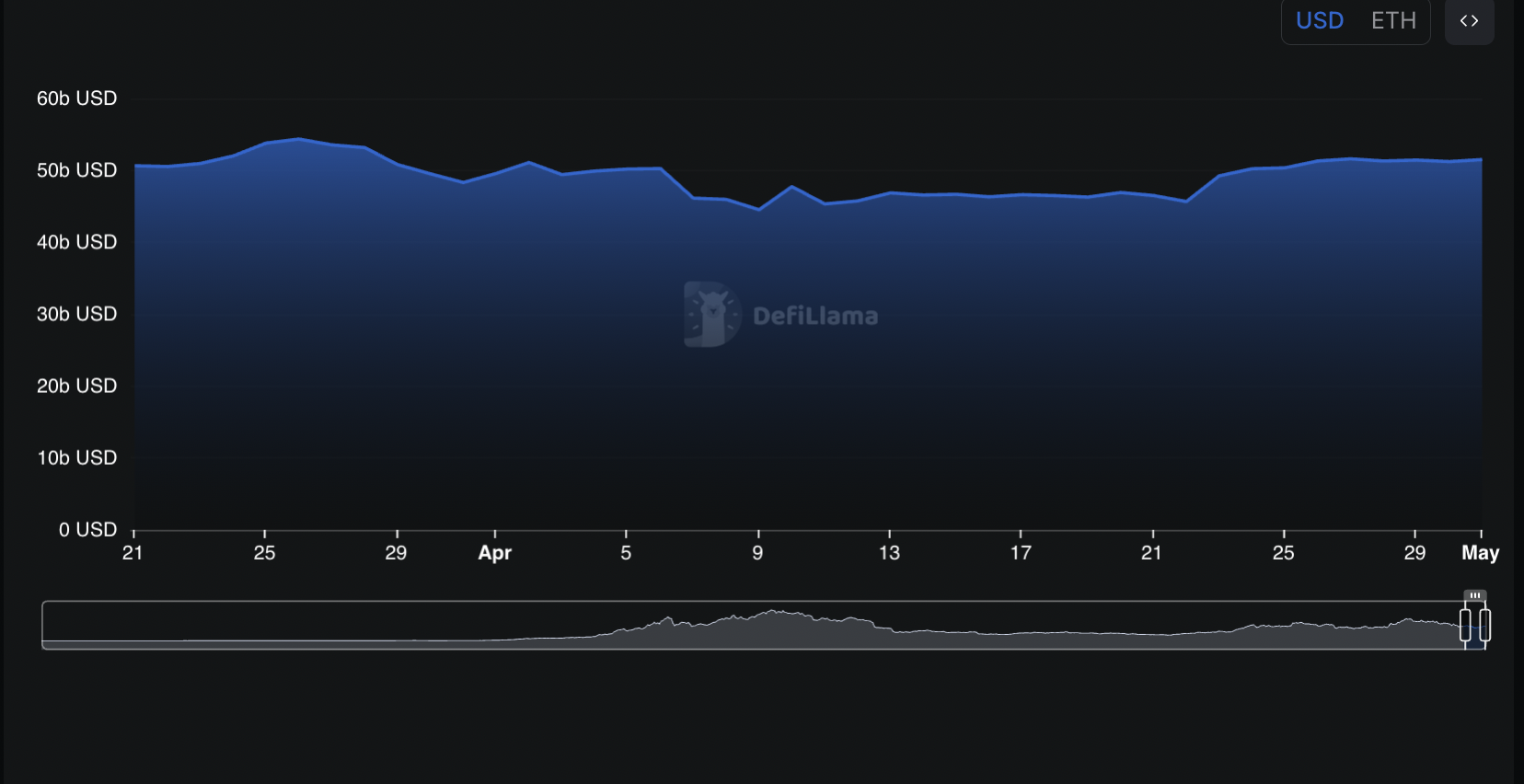

More than 50% of the total amount locked (TVL) in Defi Protocols still lives in the Ethereum blockchain. This means that layer-1 (L1) remains a preferred layer of settlement for a variety of financial applications, including lending, staking, yield farming, and decentralized exchange.

Therefore, in May, if the broader market conditions begin to improve, the updated capital flows in the Defi sector of the Ethereum may, in turn, drive demand for ETH and support its price rally.

Additionally, according to HALM, the upcoming PECTRA's upgrade of Ethereum, which is set to launch on May 7, 2025, may help with ETH price performance this month. The upgrade has promised to enhance network scalability, reduce transaction fees, improve security, and introduce smart accounts.

These improvements can fuel a surge in user demand throughout May, the potential election of the ETH price, given macroeconomic conditions will remain interesting.

ETH growth depends on the greater stability of the market

Despite this, greater economic pressure pacses a major risk to the ETH in May. Halm noted that “the upcoming CPI report on May 13th will be particularly important, potentially influenced the market sentiment and contributes to this volatility.”

This is because inflation or hawkish signals from the federal reserve can exacerbate sentiment at risk in the crypto market, putting pressure on ETH prices.

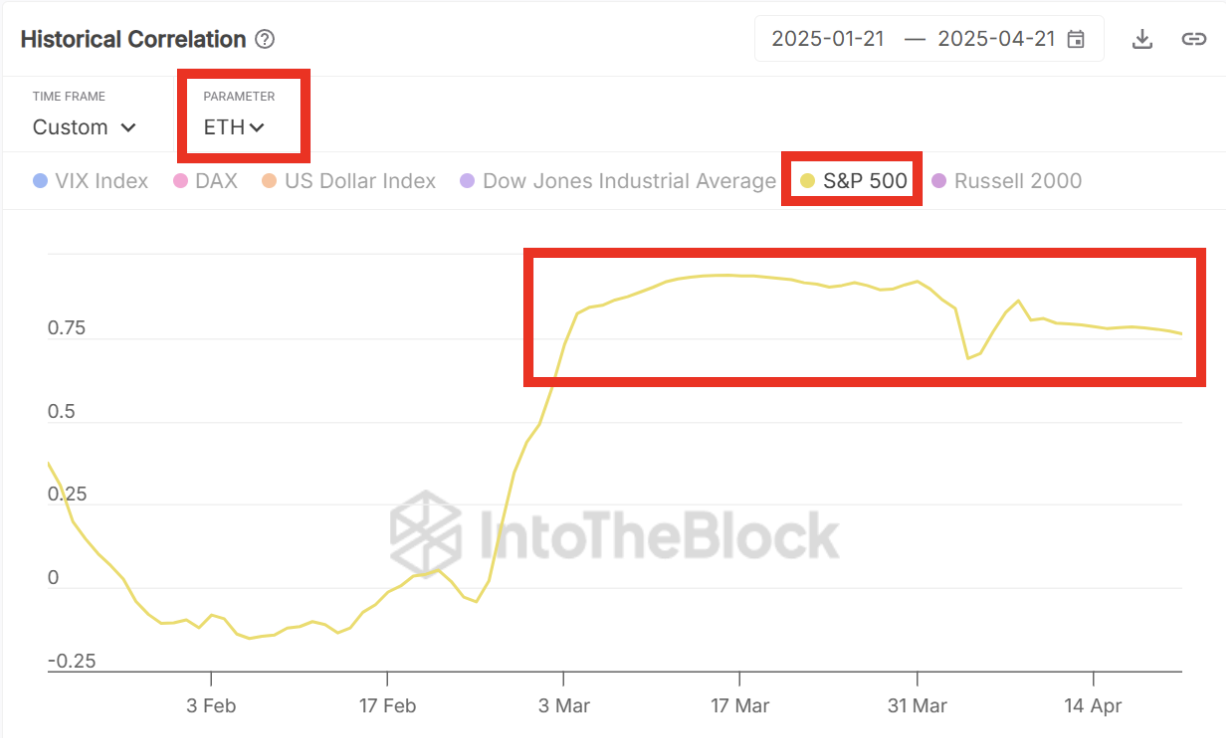

Halm also pointed out that the price of ETH remains strictly linked to US equality. Therefore, if the equity markets are faced with modified stress this month due to fears of inflation or rate expectations, altcoin may undergo a similar pressure.

“It is expected, if this high ties will continue, it indicates that Ethereum's weakness in market collapse and inflation-related harshness is likely to be similar to traditional risk properties such as those in the S&P 500. A collapse in the general market or increased concerns about inflation that affect the equits to the Equities by Gabriel Halm, the research analyst in IntotheBrock ,, “Gabriel Halm, the study research on intotot

While a prolonged push above $ 2,000 remains possible, any rally is likely to depend on the trends of inflation, the regional region of the traditional market, and how strictly the ETH remains tied to equality.

Refusal

In accordance with the guidelines of the trust project, this price assessment article is for information purposes only and should not consider financial or investment advice. Beincrypto is focused on accurate, unparalleled reporting, but market conditions are subject to change without notice. Always do your own research and consult a professional before making any financial decisions. Please note that our terms and conditions, privacy policy, and disclaimers are updated.