Can Amgen keep the beat streak alive this earnings season?

AMGEN (AMGN – Free report) will report the results of the first quarter of 2025 on May 1, after closing the market. In the last quarter declared, the company beat the expectations of the 5.57%profits. The estimate of the ZACKS consensus for the first quarter sales and profits is set at $ 7.96 billion and $ 4.16 per share, respectively. (Find the latest estimates and surprises of profits on the zack's profits calendar.)

Factors to consider for Amgen

AMGEN products sales should have been motivated by strong growth in the volume of products such as Melsity, Repatha, Kyprolis and Blincyto, among others. However, the prices of most products should have decreased due to higher discounts to support extended access.

The estimate of the Zacks consensus for the unit, the sales of Repatha, Kyprolis and Blincyto is set at $ 406 million, $ 616 million, $ 381 million and $ 333.0 million, respectively.

Our estimates for the unit, the repathy, the Kyprolis and the sales of Blincyto are set at $ 370 million, $ 570.9 million, $ 380.8 million and $ 334.5 million, respectively.

Patents for RANKL antibodies (including sequences) for PROLIA and XGEVA expired in February 2025 in the United States, while they will expire in certain European countries in November 2025. Sales of these best-selling drugs should thunder considerably in 2025 due to patent erosion. Investors will look at the sales figures of ProLia and Xgeva to determine the impact of biosimilar competition.

The estimate of the Zacks consensus for Prolia and Xgeva is respectively $ 990.0 million and $ 542 million.

In addition, higher volumes of more recent drugs like Tezspire and Tavneos should have contributed to high -level growth, driven by the growth in the volume of new patients.

The American launch of Imdelltra (Tarlatamab), approved for lung cancer with small preterity cells (ES-SCLC) in May 2024, progressed well. The drug recorded high sequential growth in the third and fourth quarters of 2024. Positive growth is expected to continue in the first quarter of 2025.

Enbrel sales will probably have decreased due to the drop in prices. Oztezla sales were soft in the last quarters.

The sales of Oztezla and Enbrel should be lower in the first quarter of 2025 compared to the other quarters by historical trends due to the impact of the changes in service plan, the re-vivification of insurance and the increase in co-payment expenditure as American patients work thanks to franchises.

The estimate of the Zacks consensus to Oztezla is $ 402.0 million, while our estimate is $ 392.2 million.

The estimate of the Zacks consensus for Enbrel is $ 503.0 million, while our estimate is $ 414.7 million.

Sales of Tepezza, Krystexxa and Uplizna, acquired from the October 2023 acquisition, are likely to have developed the upper line.

The lower income of biosimilars in oncology (Kanjinti and MVASI) due to the increased competitive pressure and inherited established products should have harmed the upper line. However, the sales of Amjevita / Amgevita, a biosimilar version of Abbvie's Humira, have probably increased.

Amgen launched the biosimilar version of Stelara de J & J, Wezlana, in January and that of Eylea, Pavlu de Regeneron, in the fourth quarter of 2024. Investors will look at their sales numbers during the call conference. Bekemv, a biosimilar version of Soliris d'Astrazeneca, was approved in the United States in May 2024 and is expected to be launched in the second quarter of 2025.

In the first quarter of 2025, Amgen expects its operating room to be the lowest of the year at around 42% while for other quarters of the year, the operating margin should be around 46%. Although R&D costs should increase, SG&A costs, as a percentage of product sales, should decrease.

Investors will look for updates on the important candidate of the Amgen pipeline, marititide (MarideBart Cafraglutide), a GIPR / GLP-1 receiver for obesity.

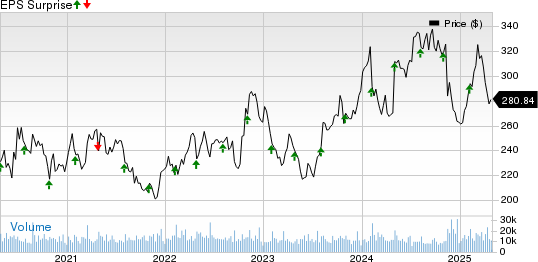

The story of AMGN Surprise gains

Amgen Inc. Price-Eps-surprise | Amgen Inc. quote

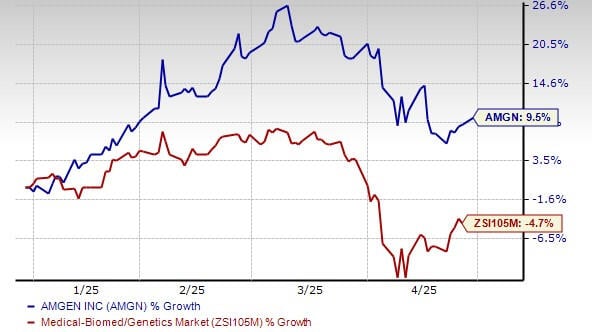

AMGEN's action has increased by 9.5% so far this year against a reduction of 4.7% for industry.

What our model says to Amgn

Our proven model does not conclude a beat of earnings for Amgen this time. The combination of a positive ESP benefit and a Zacks # 1 row (strong purchase), 2 (buy) or 3 (Hold) increases the chances of a flash of profits. But this is not the case here.

ESP gains: AMGEN ESP's benefits are -0.05%. You can discover the best actions to buy or sell before being reported with our ESP filter of profits.

Zacks Rank: Amgen has a Rank # 3 from Zacks.

Stocks to consider

Here are some drug / biotechnology actions that have the right combination of elements to beat on income this time:

Exelixis (Exel – Free report) has a salary of + 7.14% and a zacks row # 3. You can see the full list of Row Zacks # 1 actions here.

The stock of Exelixis has increased by 15.5% so far this year. Exelixis beat the profits estimates in three of the last four quarters when it lacked in one. EXEL has a profit surprise of four quarters of 26.87% on average.

Plan medication (BPMC – Free report) has an ESP benefit of + 84.44% and a Zacks # 3 rank.

The BluePrint Medicines stock has increased by 1.5% so far this year. BPMC beat the benefits of profits in three of the last four quarters when it lacked in the remaining quarter. On average, BPMC delivered a profits surprise of 13.10% in the last four quarters.

Denali Therapeutics (Dnli – Free report) has a profits of + 4.87% and a Zacks # 3 rank.

Denali's shares have increased by 20.2% over one year to date. DNLI has missed the benefits of profits in two of the last four quarters while beating twice. On average, Denali experienced a 6.51% profit surprise in the last four quarters.

Zacks names # 1 semiconductor stock

It was only 1/9000th of the size of Nvidia which has skyrocketed more than 800% since we recommended it. Nvidia is always solid, but our new stock of top fleas has much more space to explode.

With strong growth in profits and expanding customers, it is positioned to meet the rampant demand for artificial intelligence, automatic learning and internet of objects. The global manufacturing of semiconductors is expected to explode from $ 452 billion in 2021 to 803 billion dollars by 2028.

Do you want the latest recommendations from Zacks Investment Research? Download 7 best actions for the next 30 days. Click to get this free report Join our free newsletter now!