Bybit X Block Scholes: BTC volatility hits new lowest

BybitThe world's second largest cryptocurrency exchange by trading volume has released it Last Weekly Crypto derivative analysis report In cooperation with Block Scholes. The latter edition highlights the six -day risk of assets profits driven by promoting signals around possible US trade transactions. The report includes a comprehensive analysis of macroeconomic indicators, local market activity and derivative trends between futures, permanent contracts and opportunities. It reflects the market, which is raised by renewed confidence, but still navigating recent volatility and increased risk awareness.

Main highlights:

PERP at a height of several months; Traders remain cautious

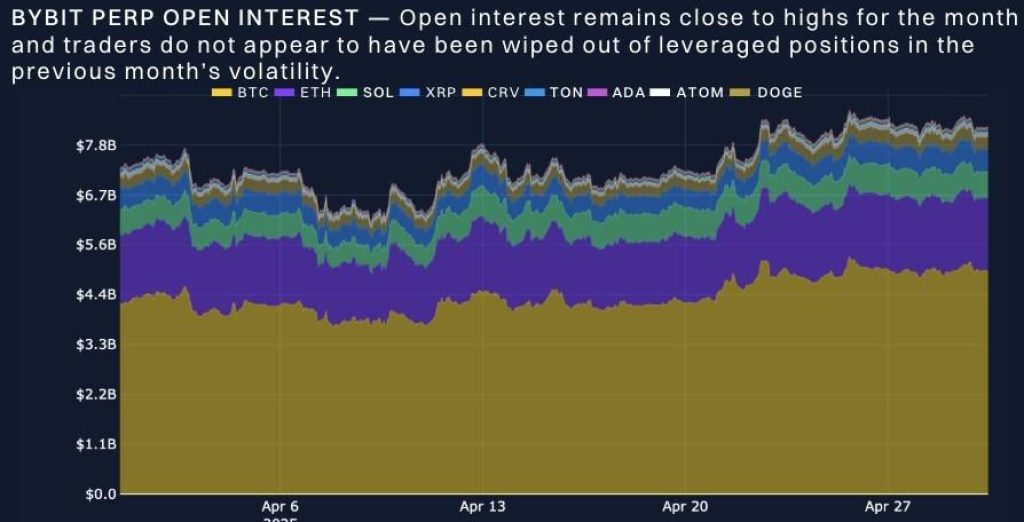

After growing from $ 75,000 to $ 95,000 in early April, Bitcoin is on a $ 94,000 nearby this week. Open interest has remained permanently in April, floating $ 8 billion at the high points of all time, while the daily trade volumes have fallen to $ 10 billion. The lower volumes have coincided with reduced realized volatility. Persetual Futures positioning suggests that traders are holding big bets while waiting for the next breakthrough while remaining cautious about recent outlets.

Bitcoin volatility falls to the 18-month low

Bitcoin's volatility has fallen towards the main support zone between 35 and 40% – the range from which it has repeatedly recovered over the last 18 months. Indirect volatility has followed an example of a 10-point decline in the order, which is just over 30%, which is the lower limit of its 18-month range. The flow of choices now shows PUT's preference, while the price of the place remains stable. Volatility smiles towards an out -of -money (OTM) requires longer updated options, while short -term options are neutral.

BTC volatility smile tilts otm calls

Bitcoin's volatility smile now favors the calls for all tenors (OTM), noting the inverted reversal in April. The ether shows a similar short-term recovery, although the long-term oblique of ETH is still modest. Despite the positive funding speed of ETH, the smiles of the longer dated variation are still prone to PUT, which shows the mixed sentiment. In contrast, BTC derivative markets reflect stronger bullish signals, including positive funding speeds, curves of upward-inclined futures and updated skewed OTM calls.

Access to a full report

A healthy report is available hereTo.

#Bybit / #thecryptoark / #bybibitreach

Bybit

Bybit The world's second largest cryptocurrency exchange is trading, serving over 60 million users of the global community. Established in 2018, Bybit defines openness in a decentralized world, creating a simpler, open and equal ecosystem for everyone. Focusing on a big focus on Web3, partner by Bybit with strategically leading block chain protocols to provide specific infrastructure and control innovation in the chain. Known for its safe custody, diverse marketplates, intuitive user experience and advanced blockchain tools, Bybit combines the difference between Tradf and Def, allowing builders, creators and enthusiasts to open the full potential of Web3. Discover the future of decentralized finance at the address Bybit.comTo.

For more information about Bybit, please visit Bybit Press

Contact: In order to get media requests: Media@bybit.com

Please follow: Bybit communities and social media

Mismatch | Facebook | Instagram | LinkedIn | Reddit | Telegram | Tictok | X | Youtube

![]()