Bybit to Expand Beyond Crypto With Planned US Stocks Trading

Crypto Exchange Bybit expands its scope beyond digital assets while preparing to launch new trading options, including US Equality, goods, and indices.

The exchange, known for crypto -use products, aims to introduce these offerings before the end of the current quarter.

Trump-era Pro-Crypto Policy Moving Fuel Bybit to Equal

On May 3, Bybit CEO Ben Zhou confirmed The development during a livestream event. He noted that users are about to have instruments such as gold, crude oil, and leading US stocks such as Apple and Microstrategy.

These additions significantly switch to the Bybit product approach and reflect the platform's ambition to deliver a broader range of investors and institutional investors.

Trade features will be included in the current Bybit infrastructure. This includes the Metatrader 5 (MT5) platform, which supports leveraged gold trading. Users can access up to 500x leverage with selected instruments, an appeal feature of high-risk businessmen.

Notably, gold and oil trading are available on the platform in a limited form. Thus, adding us stocks brings a more direct challenge to platforms such as Robinhood, which combines crypto with traditional finance.

Meanwhile, the Bybit transfer reflects a greater trend in the financial industry where the boundaries between crypto-native platforms and traditional brokers are becoming less defined.

In recent months, many traditional trading platforms have signed interest in offering crypto products. At the same time, exchanges such as Bybit add traditional possessions to match investor demand.

Shift also follows the growing policy support for digital assets under President Donald Trump's current administration.

Trump has adopted a more desirable stance towards the crypto change. This has resulted in a policy environment that drives companies such as Bybit to vary and remain competitive.

Meanwhile, the transfer of this product complies with a major security violation in February. The platform has recently been targeted with an exploitation that resulted in theft of 500,000 ETH, worth approximately $ 1.5 billion.

Zhou acknowledged that a portion of the stolen funds -without stopping 28% -was unobtrusive due to attacking efforts. However, the exchange works in the wider community to monitor the remaining funds.

Despite this setback, BYBIT will appear to recover the momentum.

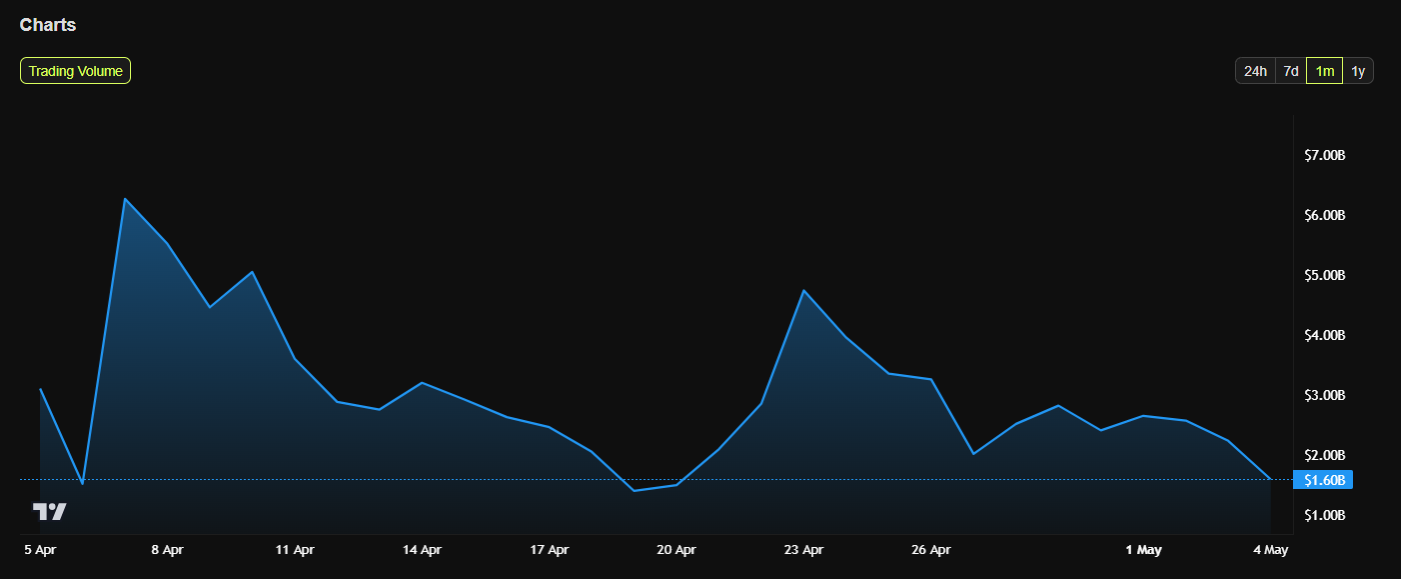

According to data from Beincrypto, user activity and trading volume go back to levels visible before exploitation, suggesting that the platform's trust is back.

Refusal

In compliance with the guidelines of the trust project, the beincrypto focuses on unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify the facts independently and consult a professional before making any decisions based on this content. Please note that our terms and conditions, privacy policy, and disclaimers are updated.