Bybit recovers BTC liquidity after February hack

Bybit restored its Bitcoin (BTC) to the level of the market as it was hacked in February. The attack mostly influenced Ethereum (ETH), but it led to the outflow of traders and liquidity.

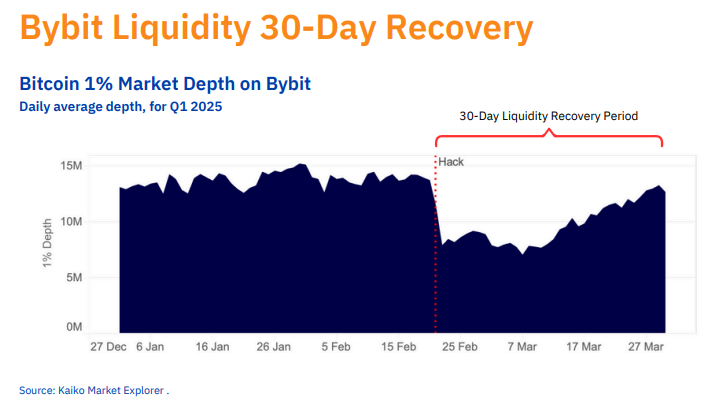

Bybit Exchange restored its Bitcoin (BTC) market liquidity, gradually improving the market depth from February hacking.

Data collected Kaito's research reveals the market durability and the current situation of reserves. The market operator became a crypto durability case analysis to control the slip of the market depth, while restoring the trust of the traders.

Bybit still offers its special liquidity depth for retail management, creating a deeper set of prices suitable for small -scale traders. This feature can further restore the trust of retailers.

Bybit recovered most of its liquidity in 30 days

Kaito noted that the first 30 days after hacking were critical to restore liquidity and the depth of the market.

The BTC market also collapsed, while Bybit kept loan terms to ensure that all payout requirements were met. Kaito Research pointed out that the exchange dealt with more than 350,000 withdrawal applications.

As of May 7, bybit was $ 2.8 billion in everyday trading volumes, while the BTC still dominated more than 39% of trading activities. The BTC market has a $ 2.8 million market depth for 2% slip based on Coingecko dataTo.

According to Kaito's report, the daily average depth of the average market is as much as $ 13 million. Nevertheless, Bybit is considered one of the thinner centralized markets.

The exchange lost some of its market share After exploitation and is currently trying to attract users to new trading productsTo. The stock was then faced with a general market drop related to US tariff negotiations and the threats of the trade war.

Hacking occurred during generally worsening. Almost all major shifts lost some of their liquidity. Bybit's organized approach to finding liquidity sources was the fastest among other shifts. Some shifts, such as HTX, Bithumb and Mexc, saw the slipping of liquidity after a month after hacking.

Kaito pointed out that big events interfere with the exchange of liquidity. Even Binance lost up to 80% of its liquidity during the bear market in 2023, after the June 2023 case. Some of the lost liquidity must still be returned. This makes the Bybit feat even more remarkable, following the largest exchange of crypto history.

Altcoins restore liquidity at a slower pace

Bybit is also a key market for altcoins and niches. After hacking, liquidity recovered more slowly. About a month after hacking, the stock was returning 80% of the usual market depth.

Bybit focused on the top 30 Altcoin, which is still to return to the pre-Hack-depth. The Altcoin market is also influenced by a thoughtful mood.

The restoration of the Altcoin market was benefited from the official Trump (Trump), which was the most liquid new signs of the exchange. Well -established coins and chips, such as sleep, ondo and LTC, increased their liquidity shortly after exploitation by 50%.

Your crypto news deserves attention – Main difference wire puts you on 250+ tops