Bybit Bounces Back: Kaiko Validates Fast Liquidity Recovery Post-$1.5B Hack

Dubai, United Arab Emirates, May 7, 2025 / Chainwire / The day after the greatest hacking in the history of cryptography,

A new independent report of

On February 21, 2025, parbit was the target of a coordinated cyber attack, which led to $ 1.5 billion in unauthorized withdrawals. While the incident sent shock waves via the global cryptography ecosystem, Bybit's rapid response and the robust infrastructure assured that trading has remained uninterrupted.

In the following weeks, the liquidity of the platform, the depth of trading and the confidence of the users rebounded at a remarkable speed.

A 30 -day turnaround led by the innovation of the market structure

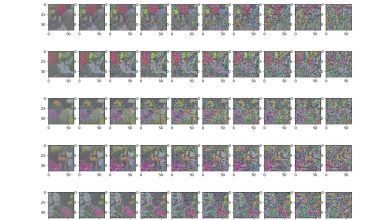

According to Kaiko's analysis, Bitcoin's liquidity of Bybit – measured by the depth of the market by 1% – achieved an average of $ 13 million per day by the end of the first quarter of 2025, corresponding to the pre -hack levels. Liquidity has recovered in all levels of order book, from 0.1% to 8% of average prices, highlighting deep institutional participation.

A key contributor to this recovery was the apparently launching of

In volatile days after the Inccidental, RPI orders helped stabilize trading, tighten gaps and protect manual users from predatory algorithmic behavior.

Altcoin Market Strength and shrinkage of deviations

The recovery of liquidity was not limited to Bitcoin. More than 80% of the depth of the pre-hack market for the first 30 altcoins by market capitalization has been restored by March. Spreads to major tokens – including high volatility assets like Doge and XRP – has taken considerably, indicating improved execution costs and renewed confidence of merchants.

The volatility of the propagation of BID-ASK, a key indicator of market stress, has also decreased throughout March, signaling an improvement in the stability of the command book and increased participation of liquidity suppliers.

Volumes are recovered faster than in previous crises

While the broader feeling of the market has remained cautious in the midst of a macroeconomic uncertainty, Bebit trading volumes rebounded faster than after comparable shocks such as the 2016 Bitfinex hack or the case of Binance 2023.

Kaiko's data show that the volume of hourly trading on the appeal has briefly increased to $ 1.2 billion immediately after the incident. Although volumes have led online with weekend trends, they have since normalized and started to climb regularly – a strong user retention and a growing feeling of confidence in the resilience of the Bybit market.

Transparency as a differentiating

One of the points to remember from the Kaiko report is Bybit's transparency throughout the recovery process. While other platforms in similar situations have undergone prolonged deterioration in liquidity, the open communication of Bybit and improvements in the structure of the proactive market have helped him regain confidence and stabilize conditions faster than the industry standard.

As the cryptography market matures, exchanges are more and more measured not only by performance during booms, but by the way they react to adversity. Bybit's rapid liquidity rebound and commitment to user innovation have established a new reference for operational resilience in industry.

#Bybit / #ThecryptoARK

About

By strongly emphasizing Web3, bybt partners strategically with the main blockchain protocols to provide a robust infrastructure and lead an innovation on the channel.

Repared for its secure guard, its various markets, its intuitive user experience and its advanced blockchain tools, fill the gap between tradfi and defi, empowering manufacturers, creators and enthusiasts to unlock the full potential of web3. Discover the future of decentralized finance at

For more details on Bybit, please visit

For media requests, please contact:

For updates, please follow:

Contact

Chief of pr

Tony at

Go through

[email protected]This story was published in the form of a press release by Chainwire under the Hackernoon commercial blog