BlackRock raises Bitcoin exposure to $5.4 billion with fresh ETF and miner investments

The world's largest asset manager Blackrock has increased its exposure to Bitcoin in Q1 by 2025, according to the latest 13F filing. The filing shows that the firm has purchased a share of its own place Bitcoin exchange-traded fund (ETF) while also investing in competing ETFs for the first time.

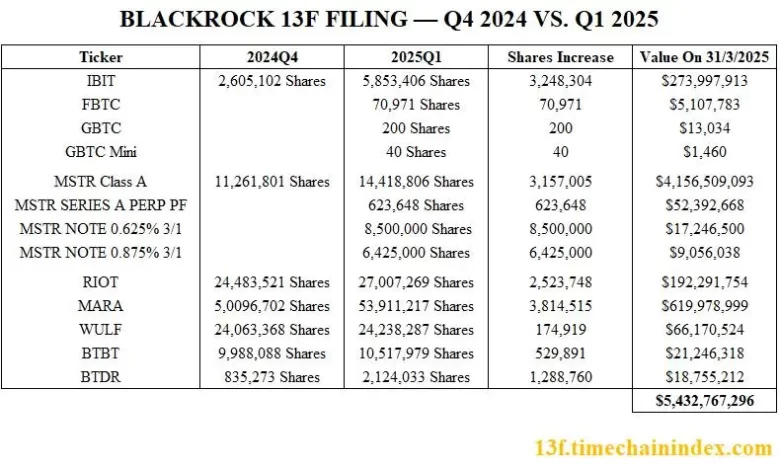

According to offering, Blackrock's position in Ibit grew 124.7% between the Q4 of 2024 and Q1 by 2025, as it bought an additional 3,248,304 Ibit shares. It increased its total handling to more than 5.8 million shares worth $ 273.99 million.

Beyond the purchase of more than its own ETF, the company also obtained 70,971 shares at Fidelity's FBTC, 200 sharing on Grayscale's GBTC, and 40 shares with the GBTC Mini. It was marked for the first time that Blackrock would invest in competing bitcoin ETFs, showing an evolution of its approach.

Noteworthy, the investment firm has also doubled in obtaining security and bonds of companies with exposure to bitcoin. It is translated with increasing Class A strategy of sharing 28% to 14.42 million shares. Blackrock only now holds more than $ 4 billion worth of approach shares.

It is also on the track of the owner, given that it has also obtained more than 620,000 MSTR series A which is eternal sharing, has purchased nearly 15 million sharing two notes with the commercial MSTR. Overall, the company's exposure to MSTR costs more than $ 4.23 billion, providing most of this $ 5.43 billion in investment in Bitcoin.

Meanwhile, Blackrock also increased its investment in Bitcoin miners in the first quarter. It bought an additional 2.5 million distribution on riot platforms and 3.8 million shares with Mara Holdings. The two are the most held miners, with 27 million and 53.9 million shares respectively.

However, it also increased exposure to terawulf, bitdeer, and bitdigital, showing that it was allocated in the sector despite the challenges faced by most bitcoin miners.

Blackrock exposure to increasing ibit by more than 13,000% yoy

Increasing Blackrock allocation to bitcoin -focused products and companies is not entirely surprising, as it aligns with the decision to integrate these products into some of its portfolio portfolio offerings.

The firm announced a few months ago that it would allocate 1% to 2% of its citizens at the selected model portfolios. It said at the time that the addition was part of its move to vary -these portfolios, focusing on investors who were less dangerous and had higher growth targets.

In the past year, the firm Exposure to its own sharing of ibit increased by more than 13,500%, from just 43,000 shares at the end of the Q1 2024 to 5,853,406 shares by closing Q1 2025. It shows how much Ibit demands from the house.

Despite increasing investment in Bitcoin products, only BTC provides a small portion of the company's possessions under Management (AUM). Blackrock has more than $ 11 trillion in AUM, which means BTC exposure of $ 5.43 billion is less than 0.05% of its general portfolio.

9% of BTC supply held by public companies and ETF

However, the allocation of Blackrock to Bitcoin only indicates the overall trend of exposure to corporate entities in the BTC. According to the data from Ecoometrics, ETFs and public companies now control 9% of all Bitcoin supplies.

The Bitcoin ETF spot currently holds 5.5% of the total supply, while public companies hold the remaining 3.5%. However, they are likely to increase their percentage of handles in the coming months, given that they are the largest accumulator in the last 18 months.

In the approach that expresses plans to expand the target of Bitcoin's acquisition to $ 84 billion, BTC accumulation of corporate entities will likely increase over the next few years. The rate of accumulation of ETF spots exceeds BTC's average rewards mined, and many stakeholders believe that the owners will only be scarcer because more institutions increase exposure.

Meanwhile, the BTC currently costs about $ 94,000 after falling 1.10% in the past 24 hours. It has been trading within the scope for the past two weeks. As one The user noted, Investors should be focused on BTC's annual lows that have been rising since 2015, except 2022 and 2023, rather than all this time.

Your crypto news deserves attention – Key wire difference You are placed in 250+ Top Sites