BlackRock adds in-kind redemption to Ethereum ETF in latest S-1 revision

The manager of the BlackRock assets has deposited an S-1 modified to allow the creation and buyout in kind for his stock market fund (ETF) ETF). If it is approved, it will be possible to exchange ETF actions for underlying assets instead of having to use money, as is currently the case.

With movement, Blackrock Joined the ETHE ether issuers who also applied for the same amendment. These include Investco Galaxy, Vaneck, Wisdomtree and 21 shares. There are also pending applications allowing creation in kind and buyouts for Bitcoin ETF.

Until now, the Securities and Exchange Commission (SEC) has delayed decision -making on requests. In April, the decision for requests for creation in kind Vaneck and Wisdomtree for their Bitcoin and Ets Etf spot was more in -depth postponed until June 3.

However, experts believe that the SEC will approve the buyout in kind this year. Bloomberg seniors' analysts, Eric Balchunas and James Seyffart, share this point of view. Seyffart noted that the final deadline for the SEC decision on the first request for buyout in kind for ETHEREUM ETHEREUM is November 10 of this year.

If approval in kind is granted, experts think that this will allow greater efficiency in the Crypto ETF and will improve the liquidity of the sector. Participants will no longer need additional steps and BTC or ETH conversion costs in cash and vice versa.

Seyffart said in January that the ETFs should have been allowed to operate like this from their launch, but it was only a compromise at the time so that the dry approved it. However, authorized participants and institutional investors are the real beneficiaries, because retail investors cannot take advantage of the creation and buyout in kind.

Blackrock highlights IT IT risk for Ibit

Meanwhile, BlackRock also submitted a updated file for its Bitcoin Ibit product. Seyffart stressed that this update included an extended language on the risks of quantum computer science to the Bitcoin network.

According to the cabinet, the progress of this rapidly evolving sector could have an impact on the cryptographic security of Bitcoin.

However, Seyffart has poured cold water on all fears, noting that these disclosure are busiers because issuers should highlight all potential risks with all the products they list or the underlying assets in which they invest.

He said:

“These are only basic risk disclosure. They will highlight everything potential that can go wrong with any product they list or an underlying asset that is invested. It's completely standard. And honestly, it has a total meaning. “

Thus, he thinks that no one should assign maliciousness or an intention to these disclosure because they simply reflect a standard procedure.

More Crypto ETF decisions are waiting for the dry response

The redemption in kind is only one of the many decisions that the dry must make on the FNB Crypto.

Several eTH ETF transmitters, including Blackrock, Fidelity, Grayscale and Vaneck, have already applied to allow the featured, but the regulator always plans to allow it. In April, he postponed a decision at the request of gray levels on June 1.

Many believe that the SEC will ultimately seek despite the delays, especially since other jurisdictions have done so. SEC has shown a desire to authorize changes to cryptographic ETFs while the sector continues to mature by allowing the trading of options.

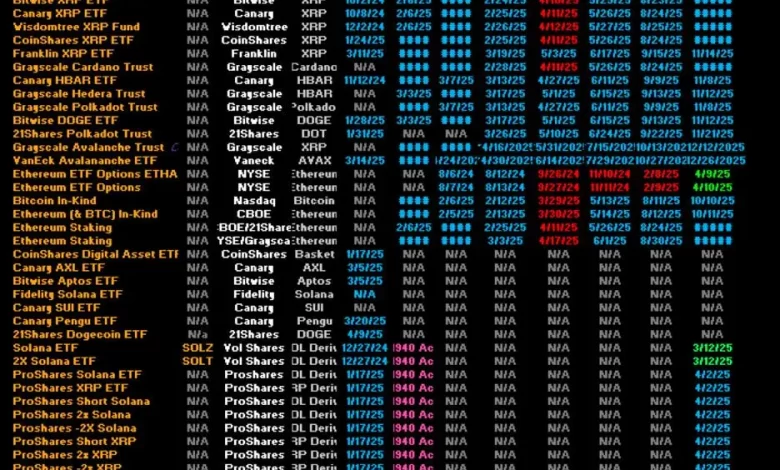

Meanwhile, the regulator must also decide if it will allow Spot ETF for several altcoins and even. There was finished 72 ETF applications related to crypto Before the dry, including popular altcoins such as Solana, XRP, Litecoin and Dogecoin.

Altcoins currently benefiting from a resurgence of value and discussions on the Altcoin season gaining momentum after a recent increase in value, approval of the ETF application could be the perfect catalyst for the long -awaited Altcoin season.

Your news from crypto deserve attention – Thread difference cresure Place you on more than 250 higher sites