Bitrace Cypto Crime Report: Over 5% of Stablecoin's transfers went to high -risk addresses

The increased use of the Stablecoins has also reached crypto crime markets. In 2024, about 5.14% of all stable trading activities could be associated with high -risk addresses.

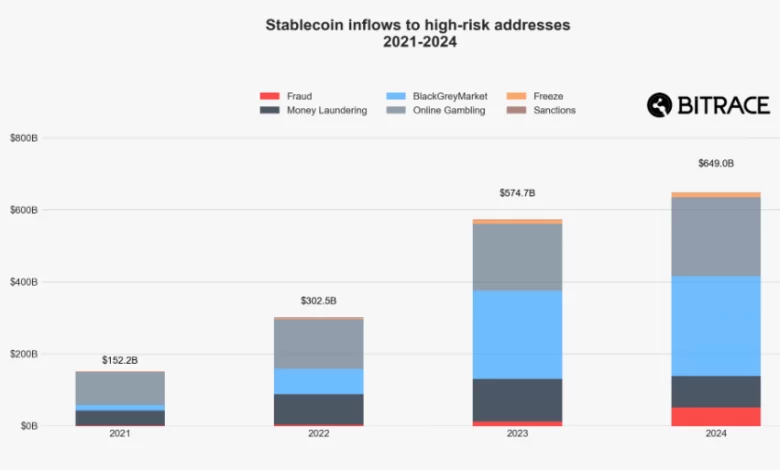

In 2025, Stablecoin's activity as a whole increased with high -risk addresses. The Bitrace Crypto Crime report of the 2024 year showed high -risk addresses to $ 649 billion around the world. In 2024, in general Stablein's volumes expanded to over $ 450 billion a month, processing an estimated $ 14t All year.

The use of Stablecoin increased as an intuitive tool instead of BTC or ETH payments. It also called for more fraudsters or hackers to use dollar-decor chips. According to Bitrace, up to 5.14% of the total cryptocurrency activities were associated with high -risk addresses.

Stablein addresses were also closely monitored for exploitation or fraud. Since most very active USDT chips are located in Ethereem, they are particularly suitable for hacker habits, who usually quickly exchange and wash ETH-based signs.

However, USDT-based USD also captured a significant part of the risky addresses. TRC-20 chips were often used in P2P markets, some of which still hide illegal operations or are used for washing.

Crypto hackers as a whole slowed down but various forms washing Accelerated in 2024. T3 Financial Crime Unit In cooperation with Tether.

Bitrace monitors a number of illegal activities stable

Stablecoins flow into several legally gray areas or by direct illegal activities. Most of the labeled addresses belonged to gray or black markets.

Fraud and web -based gambling were new growth categories in 2024, exceeding the activities of 2023. Website games grew by 17.5%over the last year, with a part of $ 217 billion. Although USDT was still a leading coin, USDC also increased its role in online games.

A total of $ 86.3 billion in Stablecoin flowed into various money laundering destinations. Part of the possibility of washing funds was related to the growth of Web3 facilities including DEX, loan protocols and privacy networks, such as ThorchainTo. The trend of washing 2024 was 2025 when the hacking activities continue.

Even with a stable record offer, the proportion of these illegal activities as part of the total turnover was relatively high. In 2023, up to 5.49% of stability went to suspicious addresses, totaling $ 574.4 billion.

Bitrace's assessment shows that stability ideas are now used for more widely high -risk activities compared to 2021 and 2022. Traders also shifted the choice of currencies, with the TRC-20 USDT the largest part of the gray area. Ethereum -based USDC also increased its use, despite Circle's attempts to position Stablecoin fully regulated and transparent.

Despite regular monitoring, only a small part of these addresses have been exposed and frozen. Tesfrow platforms like Huione Guarantee are one of the main elements of washing, which expands their volume to 2.64 billion in 2024. The increased activity of Tesfroud services coincided with the increase in fraud. During the 2024 years, personal frauds pulled $ 52.5 billion in stability traffic, exceeding the entire year's activity from 2021.

Cryptopolitan Academy: Do you want to raise your money in 2025? Here's how to do this in our upcoming web class. Save your place