Bitcoin’s Role in Portfolio Diversification

Welcome to the US Crypto News Morning Briefing – your important rundown of the most important crypto development for the early days.

Get a coffee as we argue the Bitcoin area with mainstream finance. The pioneer crypto pioneer decaying from traditional equity markets gets significant attention, but is it ready for the next step?

Crypto News of the Day: Bitcoin is still a diversifier, not a reliable fence, says Redstone Exec

The recent -the US crypto news series of Beincrypto in April was explored if the digital gold narrative was damaged as gold climbed into new highs while Bitcoin was caught.

The report came after a wide advocacy for Bitcoin as digital gold, with many presenting it as a safe property against negative market price movements.

“The main case of use for Bitcoin seems to be a store of value, aka 'digital gold' in a decentralized finances (DEFI) world,” the US Treasury Nakasa said Recently.

However, recent findings have asked the question: are you finally here? Beincrypto contacted Redstone To ask: Is Bitcoin a fence for the traditional market?

The response was wise, with major takeaways from Marcin Kazmierczak, co-founder and COO of leading cross-chain data Oracle Provider Redstone. According to Kazmierczak, data supports Bitcoin's role as a portfolio portfolio.

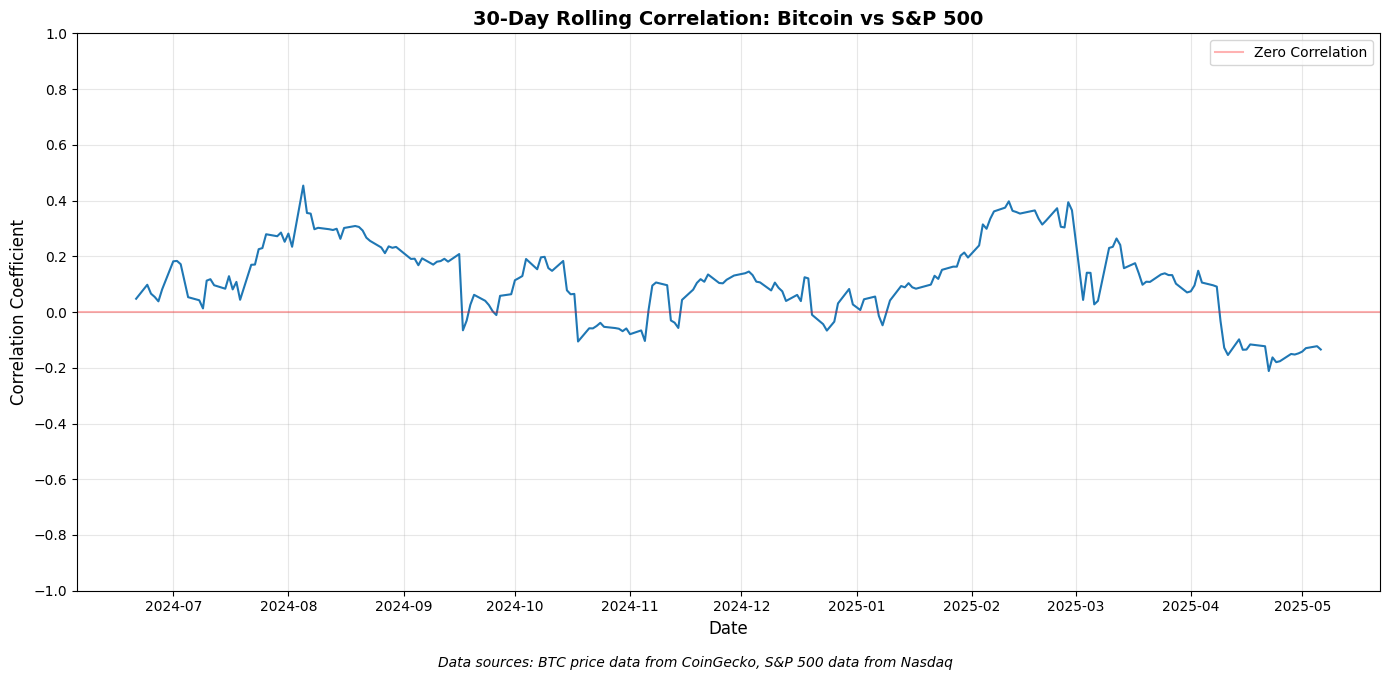

Kazmierczak cited the review of Bitcoin and S&P 500 data from the past 12 months of open American market days. They review weekly and monthly timeframes.

For the 7-day relationship, which provides a more short-term perspective, they noted the F seasons when the BTC showed a strong negative relationship with American stock markets.

“These are the times when many have called for BTC's decay from the broader market,” he explained.

However, the 7-day integration is a short-term measure, which makes it susceptible to influence from market noise. The 30-day chart provides a clearer representation.

This timeframe shows some transfers between moderately positive, close-zero, and slightly negative relationships throughout 12 months.

Bitcoin may not be prepared to replace traditional hedges

He explained that Bitcoin showed a variable relationship with the S&P 500 (SPX) last year.

The difference is that, he said, does not support the positioning of Bitcoin in return for traditional fences such as gold or bond.

“In relationships from -0.2 to 0.4, Bitcoin shows a variable relationship with equal -equivalent rather than providing a consistent negative relationship that is truly necessary for effective portfolio protection,” Kazmierczak told Beincrypto to interview.

He noticed that institutional players are still starting to classify Bitcoin as an asset-on asset. According to Kazmierczak, this range suggests that Bitcoin runs a time -term freedom from the traditional equity market.

He believes that relationships are usually moderate to provide portfolio benefits. However, diversity justifies Bitcoin from functionality as a reliable counter-movement hedge.

“This relationship puts bitcoin in one category of others rather than a shelter asset … Bitcoin can add a difference to a portfolio but it is not reliable to protect against stock market crashing as it does not constantly move in the opposite direction, ”he added.

However, the Redstone Executive has stated that if Bitcoin is truly moving to be regarded as a safe property, in danger, it will mark the deepest transformation of property in modern financial history.

“I believe it is possible. But not in such a short time as crypto believers want,” Kazmierczak concluded.

Chart of the day

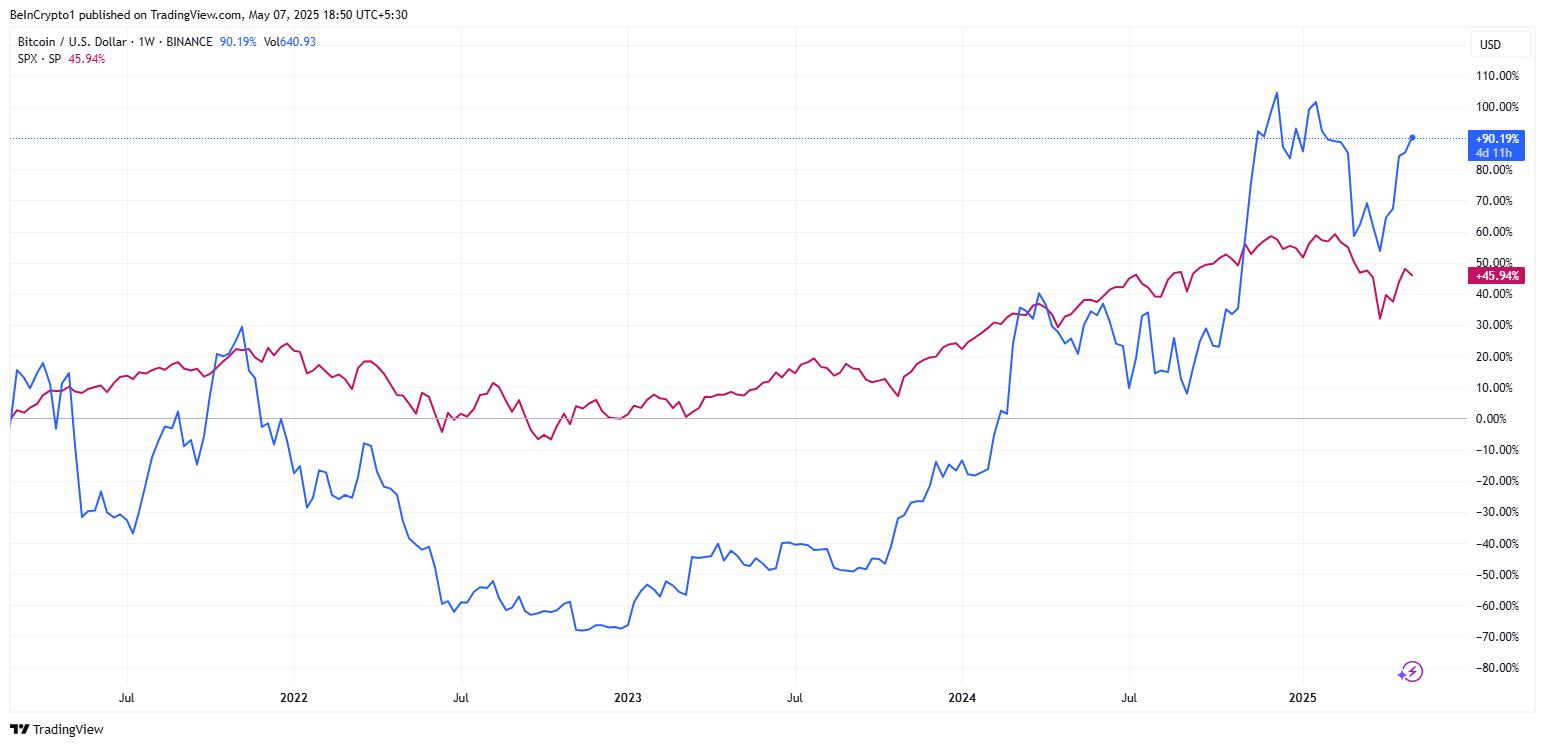

The chart suggests the performance of bitcoin is often different from the traditional equity market, especially in 2024-2025.

However, this does not certainly indicate a permanent degeneration or the same negative relationship with equality.

While Bitcoin is ruined at times, it still shows relationships with the S&P 500, which indicates its role in portfolio protection remains unsure and relies on context.

A recent US Crypto News publication indicates what could be passed as a context for differences. Beincrypto cited politics and concerns over the Federal Reserve (FED) independence.

Byte-sized alpha

Here's a summary of more news of Crypto to follow today:

Crypto pre-market overview

| Company | By the end of May 6 | Pre-market overview |

| Approach (mstr) | $ 385.60 | $ 396.94 (+2.94%) |

| Coinbase Global (coin) | $ 196.89 | $ 200.79 (+1.98%) |

| Galaxy digital holdings (glxy.to) | $ 25.90 | $ 25.30 (-2.3%) |

| Mara Holdings (Mara) | $ 13.15 | $ 13.60 (+3.42%) |

| Riot Platform (Riot) | $ 7.86 | $ 8.10 (+3.05%) |

| Core Scientific (Corz) | $ 8.99 | $ 9.19 (+2.22%) |

Refusal

In compliance with the guidelines of the trust project, the beincrypto focuses on unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify the facts independently and consult a professional before making any decisions based on this content. Please note that our terms and conditions, privacy policy, and disclaimers are updated.