Bitcoin's open interest will be left behind despite price actions over $ 100,000 – Analytical company recommends caution

Bitcoin's price was largely redeeming over the past week, as the Prime Minister restored his place from the psychological 100,000 dollar border. This recent bullish impulse reflects a healthy demonstration among investors.

On Friday, May 15, the price of Bitcoin reached as much as $ 103,800 – its highest level from January. However, the latest circuit data shows the lack of investors' activity in the derivatives market, which is usually seen when the BTC value reaches that level.

BTC Price Rally who will stop?

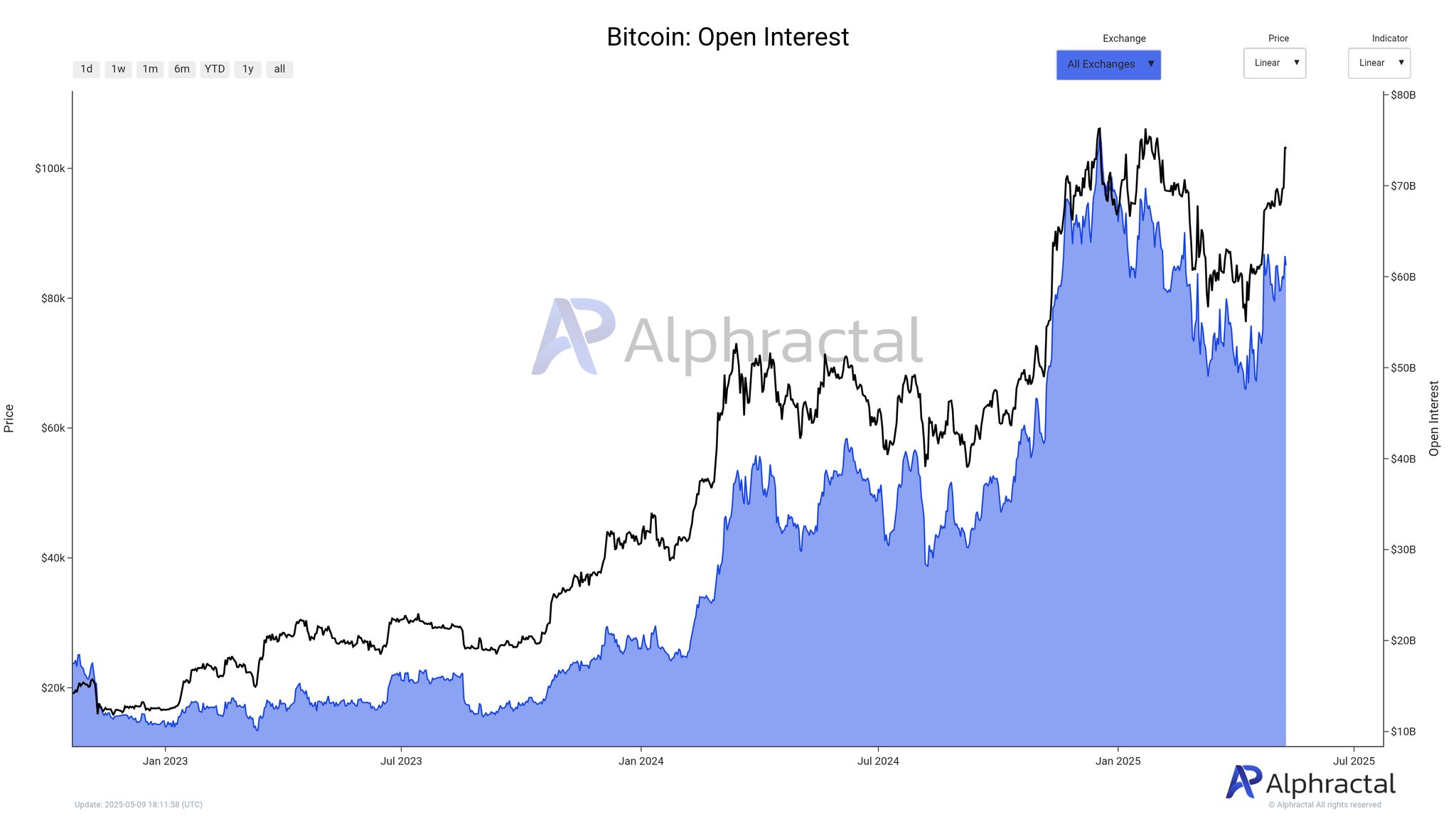

In a recent post on the Social Media Platform X on the Alfractal of the Crypto Analytics platform shared That the open interest (oh) has not moved quite a lot in recent days at the price of Bitcoin. Open interest metric measures the total amount of money flowing into the BTC derivatives at any time.

The growing open interest is often considered a bullish signal for the prime minister's cryptocurrency, especially since it refers to fresh capital inflow into the market. Ultimately, this trend recommends improving the feelings of investors and the growing trader confidence.

According to Alfractal data, Bitcoin's current redundant Oi (worth about $ 103,000) is estimated at $ 61.3 billion. The last time the BTC was at this monumental price, with more than $ 68 billion, was open.

Source: @Alphractal on X

Since the current Bitcoin open interest is less than OH, the last price was $ 103,000, alphractal noted that this trend recommends lower leverage and reduced activity in Crypto's largest market. The analytical company also explained that this phenomenon may be due to either recent waves of liquidation or the closure of the position.

In the XI post, the alfractal revealed other reasons why the price of the flagship cryptocurrency may be the risk of a short -term repair movement. The whale position is appropriate for this bearing of this bear projection.

The whaling meter monitors both the trend of large owners and the trading behavior. It usually reflects the net position of the whales, their market sense and changes in open positions.

Chart showing a decline in the Whale Position Sentiment from 1 to around 0.7 | Source: @Alphractal on X

Alphractal came to the conclusion that the decline in whale position reflects the interest of large investors in the closure of long positions, thereby moving the market sense. If the metric continues to fall, the chain analytics company concluded that it can cause price stagnation or worse, correction.

Bitcoin price briefly

As of this article, the price of BTC is $ 103,035, which reflects significant movement within 24 hours. If the recent bullish momentum suggests that the Prime Minister Cryptocurrency can achieve a new all -time in the near future, investors could wish to be careful given the recent chain observations

The price of BTC on the daily timeframe | Source: BTCUSDT chart on TradingView

Picture from Istock, graph of TradingView

Editorial For bitcoinists, the focus of the provision of precise and impartial content has been focused. We support strict procurement standards and each page passes a careful overview of our top technology experts and experienced editors. This process ensures the integrity, relevance and value of the content of our readers.