Bitcoin Whales Back in Profit as BTC Signals Bullish Q2

The price of Bitcoin jumped over 12% last week to reach $ 96,500, exceeding the average purchase price of “short-term whales”-holder who bought Bitcoin for the last six months.

Cryptoquant analyst Ja Maartunn Beincrypto said that these whales reclaimed their break-even level of $ 90,890. This means that they are in income now and are more likely to sell, which adds stability to the market.

Bitcoin's short -term whales are back in revenue

Short -term whales are addresses that will hold Bitcoin under six months. These whales are now sitting in combined -with the BTC outpaces their average realized price.

Historically, when these participants cross the profitability, they tend to pause or reduce sales pressure.

Cryptoquant's The short/long -term whale realized that the price chart shows the orange line (short -term whale cost) rising towards the white market curve in recent weeks.

This confirms that most short -term holders will get net acquisitions if they sell at current levels.

On-chain data reinforces significance. Eternal funding rates remain deeply negative, indicating heavy short positions prepared for a potential squeeze if the purchase continues.

Meanwhile, long-term holders continue to rebuild their accumulation. Also, the network hash rate led a note at 1.04 ZH/s this month.

These metrics of miners and patient investors are confident in maintaining a rally trajectory.

Pan -Time and Macro Dynamics Bolster Outlook

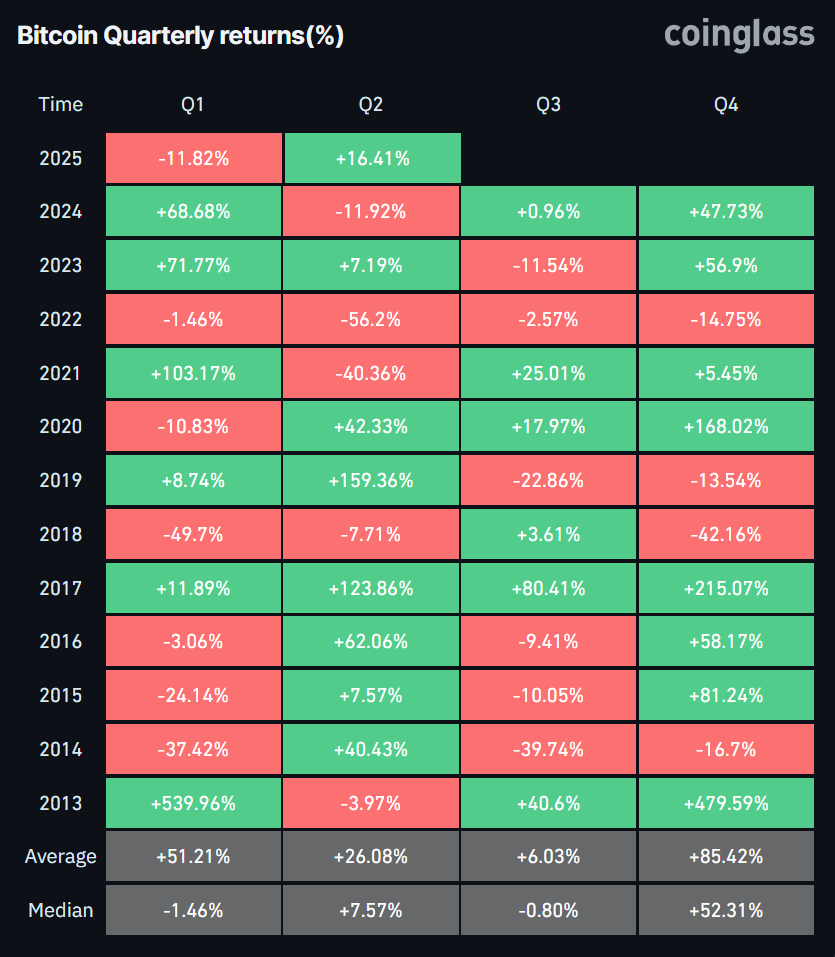

Timely trends are often cool rallies in the tag -heat. Historically, Bitcoin has gained 26% in Q2 on average, but the median has only been 7.6% since 2013. Sudden falls – like 56.2% stab in Q2 2022 – occurred.

Q3 is usually weak, which averages 6% return and a slightly negative median. Like May near May, there are many braces for “sell in May” effects on the same -equal, where the S&P 500 returns only 1.8% from May to October since 1950.

Macro factors are also important. US inflation is eased at 2.4%, and markets are now expecting fed rate cuts later in 2025.

A weaker dollar raises risk assets such as Bitcoin. Bitcoin ETF spots have seen $ 3 billion in net inflows in late April, showing strong institutional demand.

In general, whale revenues, healthy on-chain signals, and support MacRO trends undergo the Bitcoin rally.

But headwind and derivative imbalances will remain. Entrepreneurs should set clear risk limits and watch funding rates and economic news this time.

Refusal

In compliance with the guidelines of the trust project, the beincrypto focuses on unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify the facts independently and consult a professional before making any decisions based on this content. Please note that our terms and conditions, privacy policy, and disclaimers are updated.