Bitcoin Upside Pressure Now Brewing As BTC Decouples From US Stock Market, Says Swissblock

An crypto analysis company believes that Bitcoin (BTC) is preparing for a new upward upwards while it begins to surpass the stock market.

In a new thread on the X social media platform, Swissblock said This bitcoin “plays now in his own league” after BTC held land in the midst of a serious sale of stock markets this month.

According to Swissblock, Bitcoin seems to play the role of an asset with a safe package in the middle of the market uncertainty resulting from President Trump's trade war.

“The decoupling Bitcoin actions is confirmed:

Even if the feeling around the trade war changes, Bitcoin will not be strongly affected.

In fact – like gold – it could strengthen.

The upward pressure is brewing. »»

Bitcoin increased by more than 15% this month while the S&P 500 is down approximately 1.42%.

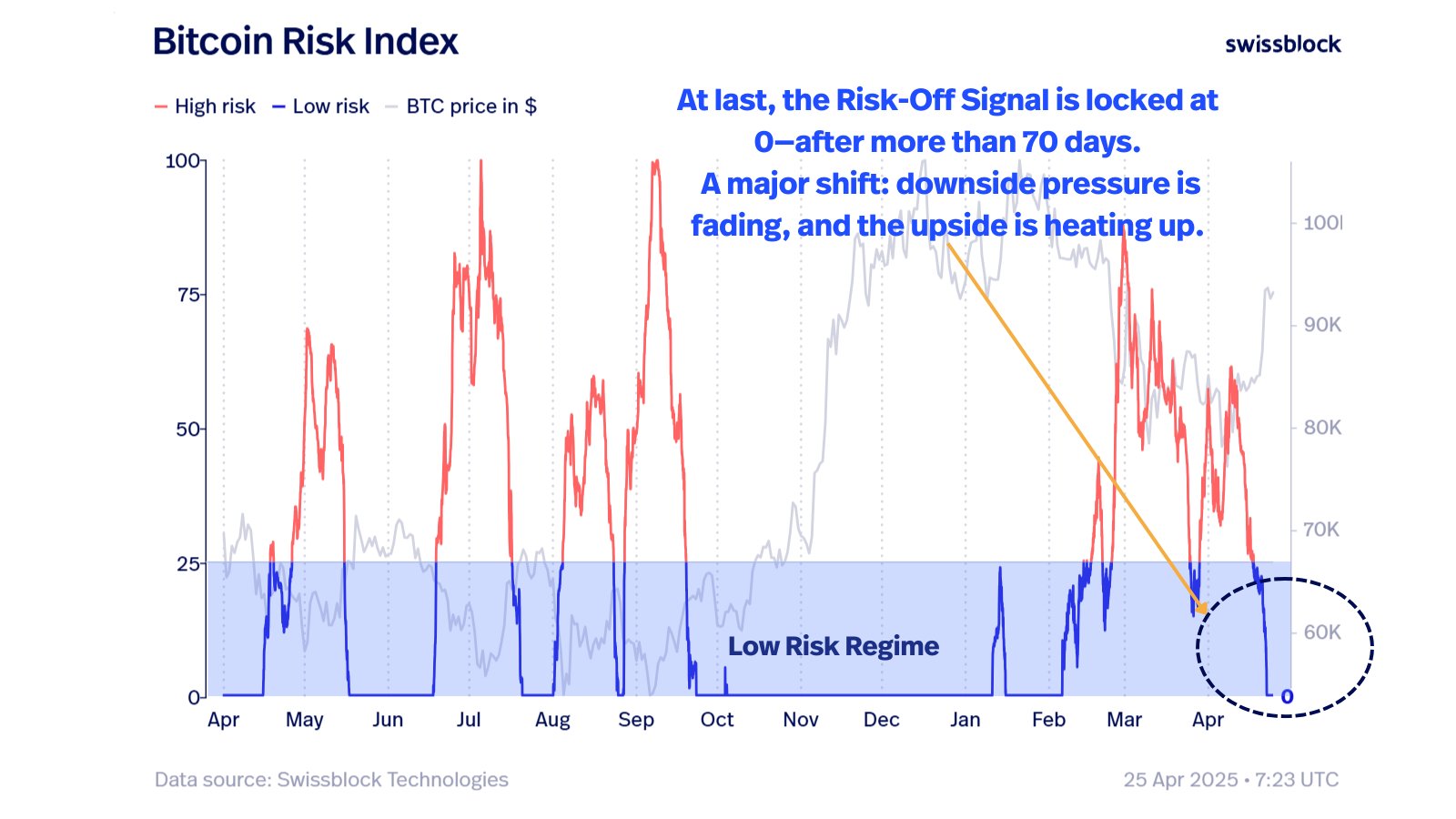

Swissblock too said that the Bitcoin risk index flashes Haussier for BTC. Metric aims at assess The current risk environment of Bitcoin by aggregating various data points, in particular the evaluation on the chain and basic costs of costs.

According to the analytical company, metrics suggest that the sales pressure of Bitcoin fades while the upward potential heats up.

“Beware of the Bears!”

Risk signal at 0 for days: clear proof that downward pressure is disappearing.

We are in Haussier stabilization – withdrawals are now launch cobblestones for more increases. »»

Last week, Swissblock said that the BTC had to break its immediate resistance to around $ 95,000 to trigger new rallies. But the company also said that the BTC could first attend a retrace to the $ 89,000 area to bring together a bullish momentum before triggering a new leg.

At the time of the editorial staff, Bitcoin is negotiated at $ 94,826.

Follow us X,, Facebook And Telegram

Do not miss a beat-Subscribe to obtain alerts by e-mail delivered directly in your reception box

Check price action

Surf the daily Hodl mixture

& nbsp

Warning: Opinions expressed at Daily Hodl are not investment advice. Investors should make their reasonable diligence before making high-risk investments in bitcoin, cryptocurrency or digital assets. Please note that your transfers and trades are at your own risk and that all the losses you may undergo are your responsibility. The Daily Hodl does not recommend the purchase or sale of cryptocurrencies or digital assets, and the Daily Hodl is an investment advisor. Please note that the Daily Hodl is participating in affiliation marketing.

Image generated: Midjourney