Bitcoin To $2.4 Million? ARK Invest Predicts Massive Surge By 2030

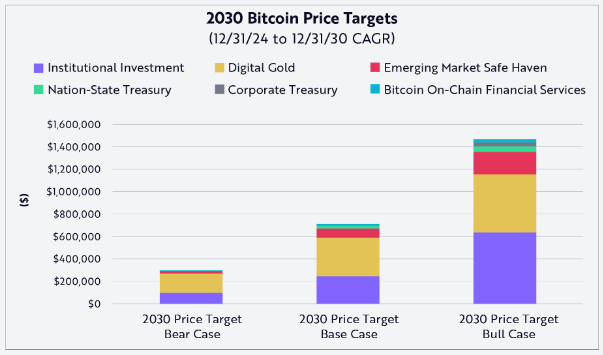

Ark Invest, a fund management company, is sharply raised price forecasts for Bitcoin, predicting the Cryptocurrency It could have reached $ 2.4 million by the end of 2030 in the most Bullish scenario.

The new target, set on an April 24th Report Through research analysts David Puell, is a massive increase from the former firm's previous target of $ 1.5 million firm.

The institution's money set with gasoline growth

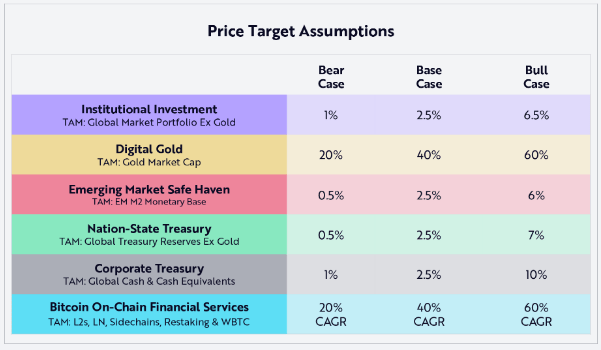

Large financial institutions are the largest price growth driver of Bitcoin's future price growth, as per the Ark report. In the best case, the firm is estimated, Bitcoin can capture 6.5% of $ 200 trillion non -golden global financial markets. The adoption of this institution is the backbone of Ark's positive vision.

The price of bitcoin is currently around $ 93,700, Having bounced back from a 2025 less than $ 75,150. In order for Bitcoin to claim the target case of Bull's Bull, it will need to increase its current value more than 25 times over the next five years.

Source: Ark Invest

Bitcoin can be reached between $ 300,000 and $ 1.5 million by 2030 under the Ark investment scenario, base, and bull case scenario, according to the Big Ideas 2025 report. Projections are based on the expected capital of institutional investment, adoption as digital gold, demand …

– WU BLOCKCHAIN (@wublockchain) April 24, 2025

Digital gold status can boost value

The second main driver in the thesis of the ark price is the increase in Bitcoin's acceptance as “digital gold.” The company expects the potential to capture Bitcoin up to 60% of $ 18 trillion of gold Market Cap by 2030.

This will be a major change in the understanding of cryptocurrency investors, putting it in the competition at the oldest store of the world's value. If this happens, it will make a major contribution to the appreciation of bitcoin prices, as stated in the report.

Source: Ark Invest

Emerging markets offers potential growth

Ark estimates that the appreciation of the price driven by Bitcoin as a “safe shelter” in emerging economies can represent almost 14% of the cost of the cost of the bull case projection.

Puell mentioned this as having the “greatest potential for capital accrual,” which determines the fact that Bitcoin can store wealth safe from inflation and lowering money in the unstable financial regime.

The report also considers the country-state adoption and corporate treasury techniques such as other factors that will contribute to the value of Bitcoin in the future.

BTCUSD trading in the $93,812 region on the 24-hour chart: TradingView.com

Although the bear case detects significant growth

Although the $ 2.4 million bull case produces titles, Ark's more moderate estimates still indicate significant growth. The company has increased the “bear case” from $ 300,000 to $ 500,000 and its “base case” from $ 710,000 to $ 1.2 million.

These targets mean Bitcoin has to rise at the annual rates of 32% to 53% to 2030.

If Bitcoin destroys the $ 2.4 million barrier, then its market capitalization will hit nearly $ 49 trillion based on nearly 20 million supply of Bitcoins until 2030.

This will put Bitcoin's market cap nearly in a par in both the United States and combined by China GDPAs well as the ability to reach gold as the largest type of owner in the world.

Featured image from Alexander Mils/Unsplash, chart from TradingView

Editorial process For Bitcoinist centered on delivering thoroughly researched, accurate, and unbiased content. We promote strict sources of sourcing, and each page undergoes our team's enthusiastic examination of the leading technology experts and timely editors. This process ensures the integrity, relevance, and value of our content for our readers.