Bitcoin Targets $96,000 Ahead of US FOMC Meeting

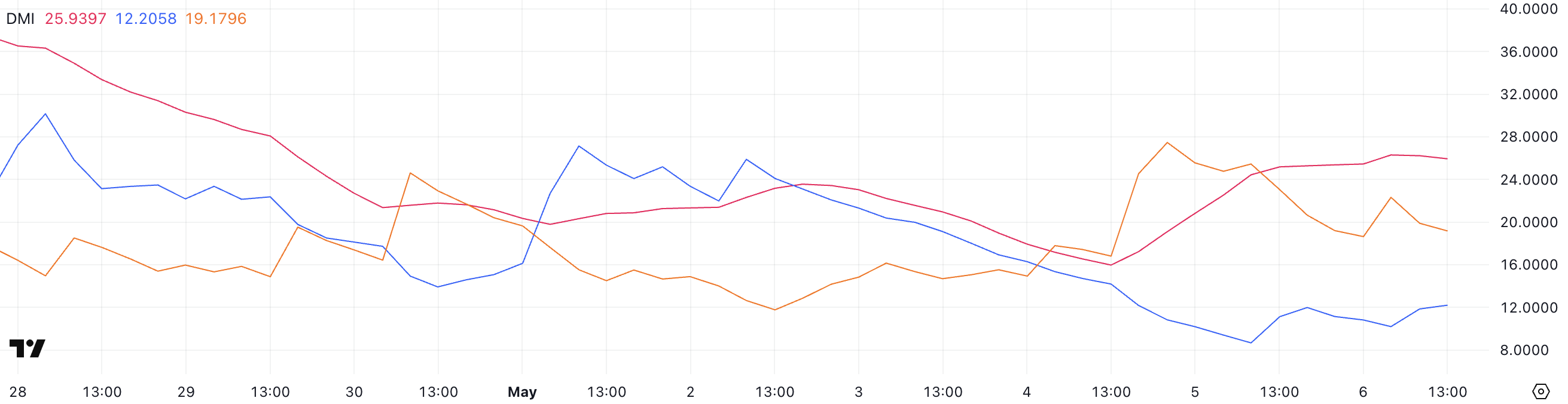

Bitcoin (BTC) enters the second week of May Trading in a fragile but critical zone, with conflicting technical signals and growing macro uncertainty that shapes short -term expectations. As the ADX from the directional movement index rises, the bearish pressure is still dominant, and the momentum remains vulnerable to many indicators.

Although the price continues to hold above the $ 92,900 support level, the weakening of the EMA and the floating FOMC assembly has left the $ 100,000 path of Bitcoin recovery, but cannot be reached.

BTC trend strength is rising, but still with control

The Directional Movement Index (DMI) of Bitcoin (DMI) shows a known shift.

The ADX, which measures the strength of a trend regardless of the direction, rises sharply to 25.93, from just 15.97 two days ago – riding the key 25 threshold that signed a trend begins to gain traction.

This rising ADX suggests that volatility is back and a new direction may form, even if the direction itself is unclear.

Looking at the DMI components, +di (bullish strength) bounced at 12.2, which was slightly from yesterday 8.67 but still dropped from 21.31 three days ago.

Meanwhile, -di (bearish strength) is 19.17, slightly at 25.44 but higher than three days ago. This indicates that even though the recent bearish momentum is somewhat cool, the sellers still have the upper hand.

With the ADX rising and -di -top, Bitcoin can remain under pressure unless +not recovering in the coming days.

Bitcoin trapped under clouds as momentum stalls

The current ichimoku cloud chart for Bitcoin reflects a integration market, with a slightly bearish undertone. The price action is seated near the blue kijun-sen (baseline), which usually represents the medium-term trend momentum.

Trading under this line suggests that the BTC has no strength to recover the bullish momentum in the short term. White candles walking near the lower border of the cloud indicate anesthesia among entrepreneurs, with no clear breakout.

The green kumo (cloud) itself is relatively thin at this stage, indicating a fragile support zone that can easily break down if the bearish pressure returns.

At the forefront, the red Senkou Span B – the top of the expected cloud – acts as a dynamic resistance, which attaches any upward attempt. For a stronger bullish signal, BTC will need to close definitely more than kijun-sen and the whole cloud.

Complex things, Tenkan-Sen (conversion line) are flat and overlay with Kijun-Sen, a sign of weak momentum and lack of direction. Lines of flat tenkan and kijun are often preceded by movement or delays of progress.

Until the Bitcoin convinces the top of the cloud with a rising volume, the current setup relies on the neutral bearish, with a price trapped in a low convincing zone and limited momentum.

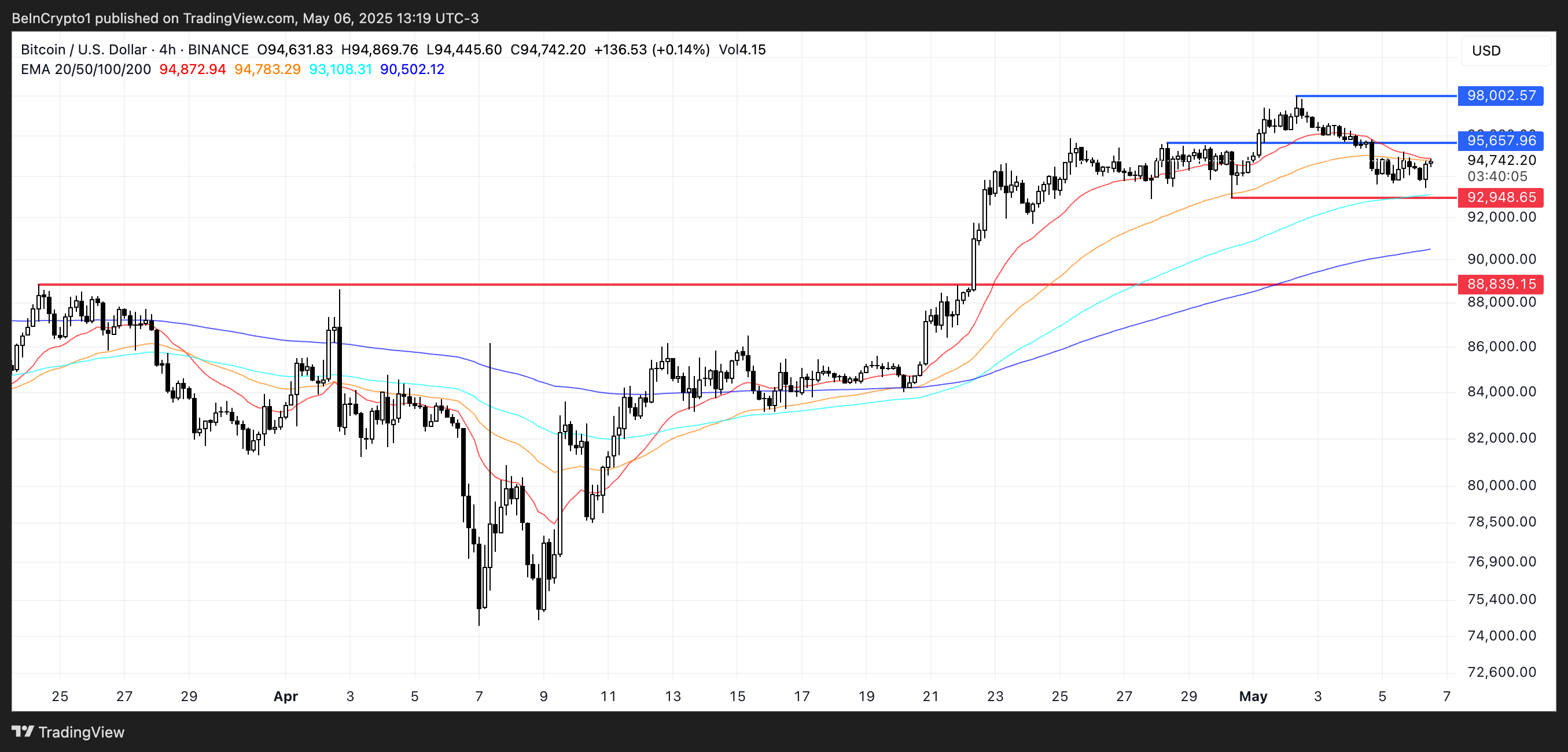

Bitcoin holds the main support because the $ 100,000 reclaiming is hanging on the balance

The price of Bitcoin has remained resilient above the $ 90,000 level since April 22, repeatedly holding support near $ 92,945 despite the broader uncertainty in the market. The exponential transition of averages (EMA) still reflects a bullish structure, with short -term averages positioned above the long -term.

However, there are early signs of momentum weakening, as short-term emma began to descend down-an indication that consumers could lose their strength soon.

If the BTC fails to handle its basic support, a collapse can be followed to $ 88,839, which will break the structure held for more than two weeks.

However, some analysts remain confident. Nick Purin, founder of the Bureau of Coin, believes that Bitcoin is well positioned to recover the $ 100,000 mark, even though the markets are guarding for volatility surrounding the upcoming FOMC meeting:

“It's going to be a volatile week. First, we have a FOMC meeting tomorrow. While pretty clearly there are no rates on rate, this is what Chair Powell said that could move the markets. At the top of that, the amount of trade is low and the long/short ratio is seated in 50/50, which means, again, the BTC can swing in either direction from here. Bounce back.

Nick says how next decisions can influence the market in the coming months:

“If the Fed is a surprise with some dovish tones as well as guides for rate cuts in June, there is a room for Bitcoin to rally all the way up to $ 100,000 levels, which remains a magnet of liquidity. But even the powell fits a positive momentum -the BTC spots are hoovering up Forming BTCs that form BTC assets, corporations form BTCs that form corporations, corporations form BTCs that form corporations, corporations are the BTCs that make up BTCs, the corporations form BTCs, the corporations form BTC Forming corporations, corporates form BTCs that make up corporates.

A momentum recovery can first drive to BTC to retest a resistance to $ 95,657, with a breakout that potentially leads to $ 98,002 and ultimately a challenge of psychological $ 100,000 levels.

Through Macro Headwinds and technical crossroads converting this week, the next move is likely to be hinge how BTC responds to its zone support and how widespread the market sentiment in the Fed Commentary.

Refusal

In accordance with the guidelines of the trust project, this price assessment article is for information purposes only and should not consider financial or investment advice. Beincrypto is focused on accurate, unparalleled reporting, but market conditions are subject to change without notice. Always do your own research and consult a professional before making any financial decisions. Please note that our terms and conditions, privacy policy, and disclaimers are updated.