Bitcoin Rally May Face Headwinds as Stablecoin Minting Lags

Bitcoin (BTC) Price is negotiated with a bias bias, faced with the resistance at $ 94,000 with prospects of more gains. However, a renowned analyst said to temper the hopes of the Bitcoin rally, citing a crucial indicator.

For a sustained rally, the capital must enter the market in a coherent manner, as this provides the liquidity necessary to increase.

The late Stablecoin indicator threatens the goal of $ 100,000 in Bitcoin

Bitcoin prices were optimistic on Wednesday during the first hours of the Asian session. Housing technical training, including the ditch model, referred to the increase in the pioneering crypto.

When writing these lines, Bitcoin was negotiated at $ 93,714, with up to 9% of a potential rally of 20% in the cards. The target objective of the falling corner model is the rise of 20%, determined by measuring the longest height in the area and overlapping it at the break.

This bullish reversal is already in action after the price of Bitcoin overthrew the critical resistance at $ 85,000 in support and converted the support area into a bull circuit breaker.

Based on the daily graphic above for the BTC / USDT trading pair, a daily candlestick nearly $ 91,575 could set the tone for Bitcoin prices to increase.

The increase in purchase pressure beyond immediate resistance to $ 94,000 could see the Bitcoin Eye price $ 100,000. BTC could extend to the target target of $ 102,239 in a very optimistic case.

Technical indicators align with this perspective. The relative resistance index (RSI) increases, recording higher peaks, suggesting an increasing dynamic. Its position less than 70 indicates that there was even more space up before the BTC was exaggerated and at risk of correction.

Similarly, the histograms of the impressive oscillator (AO) have flashed green, indicating bullish control. Their position above the midline (in positive territory) adds credibility to the upward thesis.

However, the search manager of 10x Research, Markus Thielen, urges prudence, citing the latecoin strike indicator.

“Since our stable painful liaison indicator has not yet taken up at high activity levels, we remain cautious about the sustainability of the current bitcoin rally”, Thielen wrote In the last search 10x.

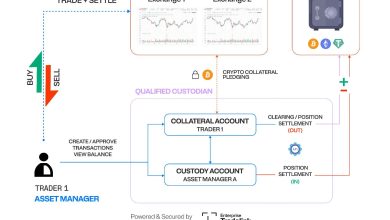

The Stablecoin striking indicator refers to the delivery or the creation of new stalls, such as Tether (USDT) or USD Coin (USDC). Stablecoin's strike often indicates that capital is entering the cryptography market, and it can have several implications for the Bitcoin price.

Among them, there is increased liquidity and confidence in the market, investors provide profitable opportunities. Both are signs of potential optimistic pressure.

According to the analyst, the absence of strong stablecoin entries “raises questions about follow -up”. The Bitcoin rally at the psychological level of $ 100,000 remains threatened.

It should be noted that stablecoins are less significant as a leading indicator for the Bitcoin price. Analysts cite other factors such as institutional entries via ETF (Stock Exchange Fund) or Purchasing Strategy (MSTR).

Nevertheless, if the use begins, a candlestick near the midline of the Haussier circuit breaker at $ 86,562 could reverse the trend. This could reimburse Bitcoin in the consolidation below the crucial level of $ 85,000.

Non-liability clause

In membership of the Trust project guidelines, Beincrypto has embarked on transparent impartial reports. This press article aims to provide precise and timely information. However, readers are invited to check the facts independently and consult a professional before making decisions according to this content. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.