Bitcoin Primed To Hit $180,000 Amid Rapid Economic Slowdown Ahead, Says Investor Dan Tapiero – Here’s How

Macro Investor and Fund Manager Dan Tapiero believes that Bitcoin (BTC) is preparing for fireworks rallies as macroeconomic conditions deteriorate.

In a new post, TAPATERO Says His 129,100 followers on the social media X platform that Bitcoin could sink more than 90% of its current value due to a likely reduction in the Fed rate to boost the economy.

Tapiero believes the increase in liquidity is the catalyst to send Bitcoin to a new full time of $ 180,000.

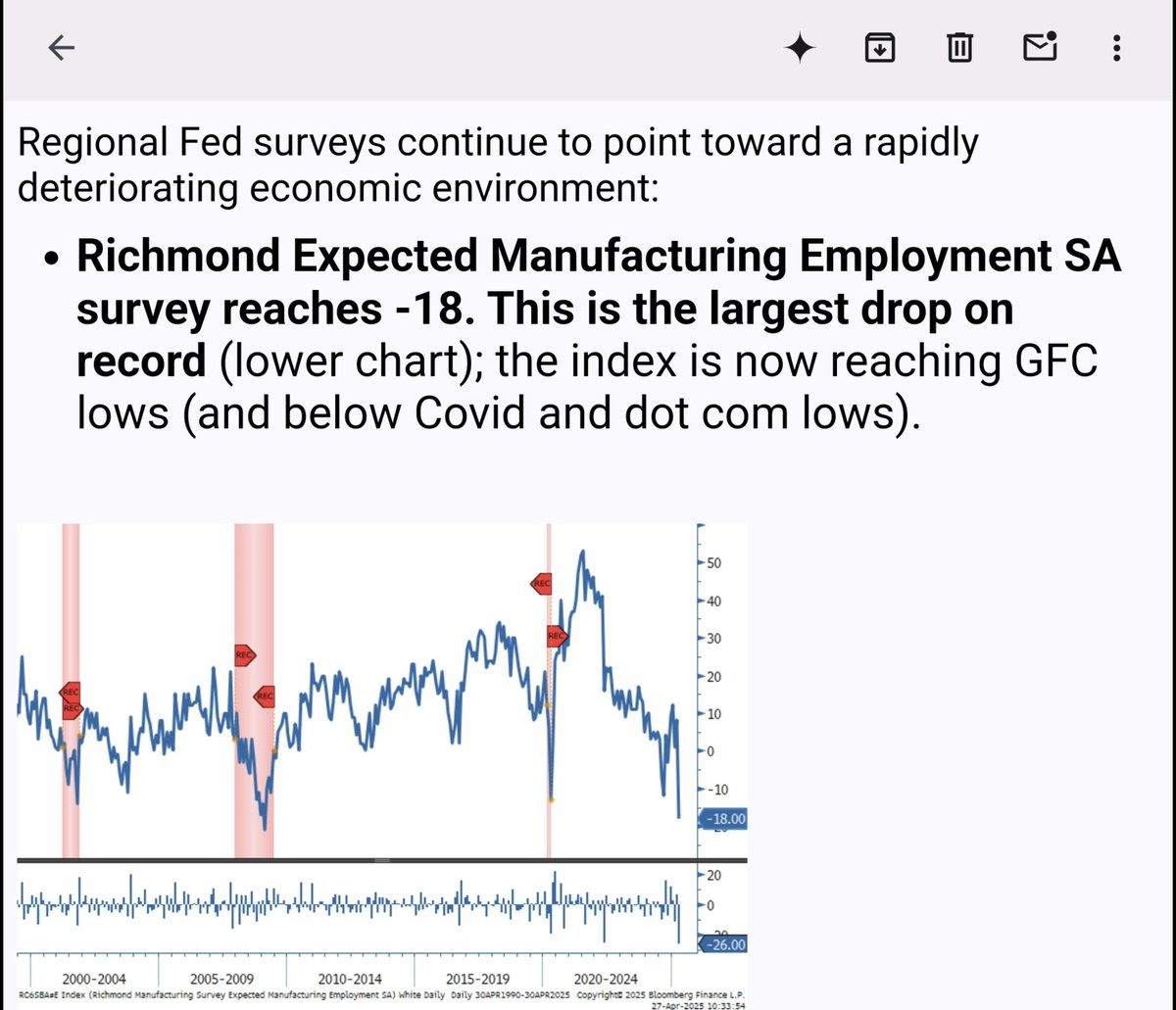

Among the economic metrics he is looking at is Richmond's Federal Reserve work index, which has fallen to levels that are only seen in economic crises.

“We're here again. More second-tier Macro data signed a speedy slowing down early. The biggest falling ever-back to '08 lows. It's a Fed survey, so it's hard for them to ignore. Short rates at 4% are too high.

Both themes: More liquidity will come. BTC up to $ 180,000 before Tag -in '26…

[The Richmond Expected Manufacturing Employment index is] Only an indicator showing that we are in extreme rare when it comes to. I'm looking for these intense outliers as they raise the odds that slowing down is more severe than the current. “

TAPATERO din Says Worsening economic conditions are likely to lead to more money printing, which will reduce the US dollar. He believes that money debasement will cause Bitcoin investors to be pouring out as a fence.

“The Fed is playing fire. A massive collapse of consumer expectations for the economy over the next six months (hits 54.4). Back in March 2009 lows, which is less than covid panic lows. It's intense data. Most lower rates and USDs need to offset the fiscal austerity. Fiat Debasement Equals +BTC.”

Bitcoin trades $ 94,277 at the time of writing, flat in the sun.

Follow us at X, Facebook and Telegram

Do not miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check price action

Surf with the sun -day hodl mix

& nbsp

Denial: Opinions expressed in Daily Hodl are not investment advice. Investors should do their appropriate hard work before making any investments at high risk to bitcoin, cryptocurrency or digital assets. Please advise that your transfers and trading are at your own risk, and any losses you can achieve is your responsibility. Daily Hodl does not recommend buying or selling any cryptocurrencies or digital assets, or the sun -day hodl an investment advisor. Please note that the day -to -day hodl participates in affiliate marketing.

Formed image: midjourney