Pi Network Struggles as Mixed Momentum Stalls $1 Push

The PI Network (PI) enters May with a mix of technical signals. Momentum indicators point to a strong downtrend, while currency flows indicate potential accumulation. The ADX advanced above 50, which signed a strong bearish trend.

At the same time, the Chaikin Money Flow (CMF) has been positive for the first time in the weeks, suggesting early signs of amended purchase interest. However, in short-term emma trending below the long-term, PI should hold the main support of $ 0.547 to prevent deeper losses.

The PI network enters strong downtrend as adx spike above 50

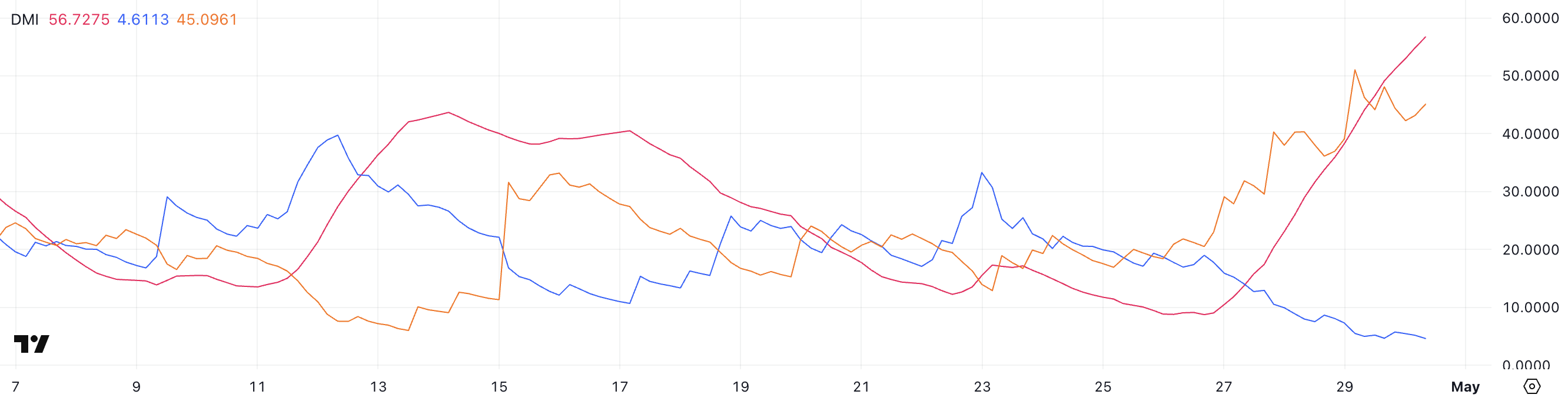

The DMI's (Directional Movement Index) chart for the PI network shows a significant transition to the treasure force, along with the ADX (average index direction) that falls to 56.72 from just 10.48 three days ago.

ADX measures the strength of a trend regardless of its direction, with readings above 25 that usually indicate a strong trend.

Reading above 50, as seen today, reflects a powerful gaming trend – the one that entrepreneurs often look at dominant and repeated in a short time.

At the same time, the collapse of the direction indicators suggests that the dominant trend is bearish.

The +di, which measures upward motion, drops sharply from 15.88 to 4.61, while -di, which monitors the downward motion, rises significantly from 23 to 45.

This broad gap between +Di and -di reinforces the view that the PI network is in a strong and speedy collapse. Unless the purchase of pressure is back soon, the technical indicators suggest an additional downside may be early.

Pi CMF has hit the highest level since mid -April

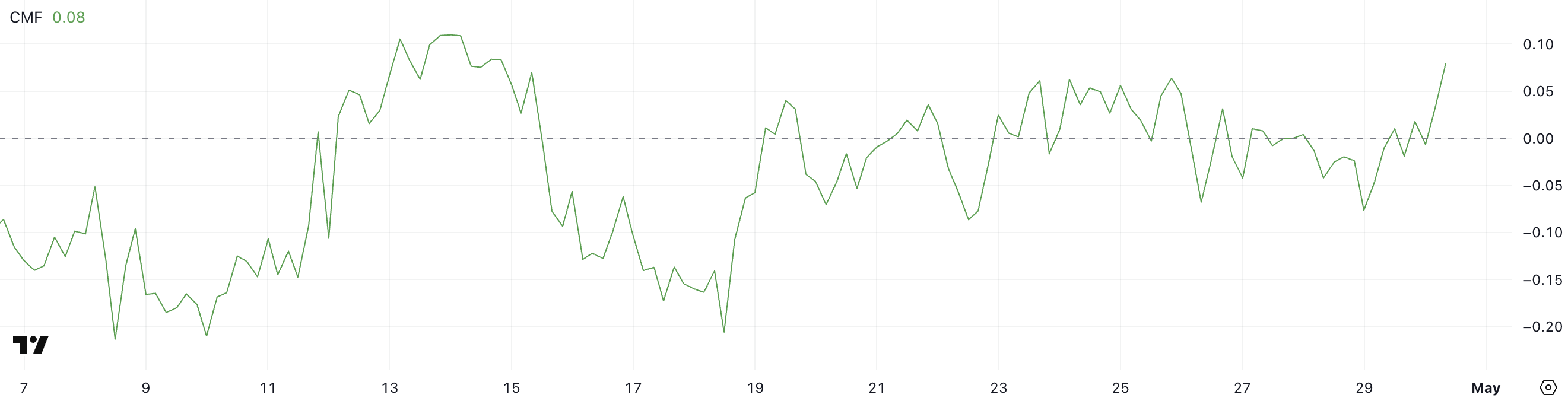

The Chaikin Money Flow (CMF) of the PI network climbed to 0.06, from -0.08 just a day ago, marked the highest level since April 14th.

CMF is an indicator based on the volume that measures the flow of money on or out of a property at a specified period. It covers between -1 and +1, with values above 0 indicating the purchase of pressure (accumulation) and values below 0 signaling pressure sale (distribution).

Sustainable reading in positive territory often suggests that market participants are beginning to accumulate ownership.

In the CMF of PI today at 0.06, this change indicates a potential change in emotion, showing that more capital flows into the token after a flow period.

While the level is still low, the transition to positive territory and the multi-week high may suggest that the bearish momentum has weakened.

If this trend continues and is confirmed by a stronger action or price volume, the likelihood of a short-term recovery or stabilization of the PI price may increase.

However, further confirmation will be needed before identifying a clear bullish trend.

The PI network network is facing key support test while EMA structure remains bearish

The PI network is currently in a bearish technical setup, along with short-term exponential moving averages (EMA) sitting under the long-term eme-a structure that usually indicates a continuous descending momentum.

The token dropped more than 12% in the last seven days, reflecting the sale pressure increase. If the correction continues, PI can test the immediate support level at $ 0.547.

A breakdown below that can open the door to a deeper decline towards the range of $ 0.40.

However, if the trend is upside down and the consumers are redesigned, the PI price can re -evaluate the resistance level to $ 0.665.

A breakout above this threshold can lead to further reversal, which potentially push the price toward the next major resistance to $ 0.789.

The current EMA alignment still favors the bears, but a momentum transfer-confirmed by the volume and price action-can change a short-term perspective.

Refusal

In accordance with the guidelines of the trust project, this price assessment article is for information purposes only and should not consider financial or investment advice. Beincrypto is focused on accurate, unparalleled reporting, but market conditions are subject to change without notice. Always do your own research and consult a professional before making any financial decisions. Please note that our terms and conditions, privacy policy, and disclaimers are updated.