Uncertainty amid tariff tensions, data, and earnings

Will actions continue their short-term trend after last week's rally?

The S&P 500 won 0.74% on Friday, reaching its highest level since early April and testing the daily gap from April 3. The market is progressing on pricing fears, potential peace in Ukraine and quarterly versions. Today, however, the term contracts on S&P 500 suggest a 0.2%lower opening, probably consolidating after the impressive rally last week.

The feeling of investors has worsened, as shown in the Saii Senture Survey of last Wednesday, which indicated that only 21.9% of individual investors are optimistic, while 55.6% are lower.

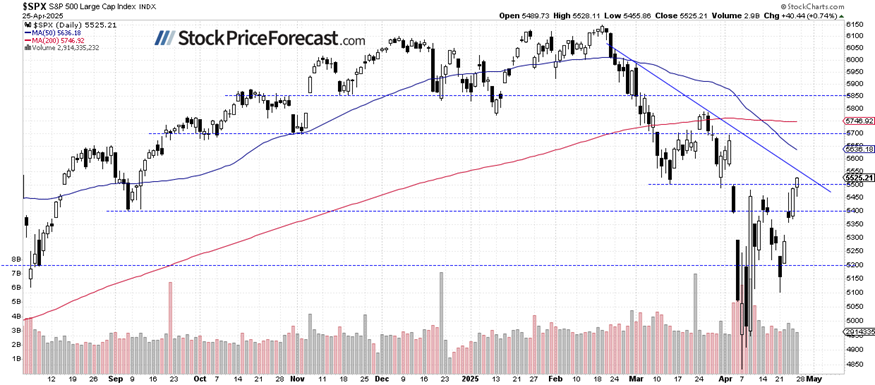

The S&P 500 broke out above the level of 5,500, as we can see on the daily graphic.

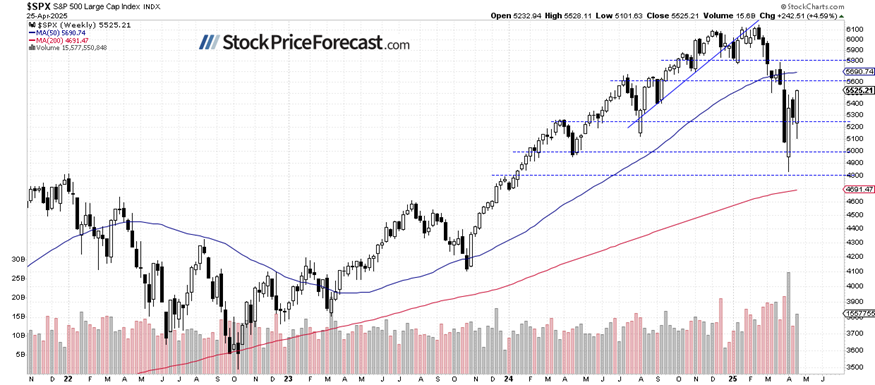

S&P 500: almost 5% higher in one week

Last week, the S&P 500 won 4.59%, retracing its sale more in early April. Despite this high performance, it remains uncertain if we see a new upward trend or a wider drop correction.

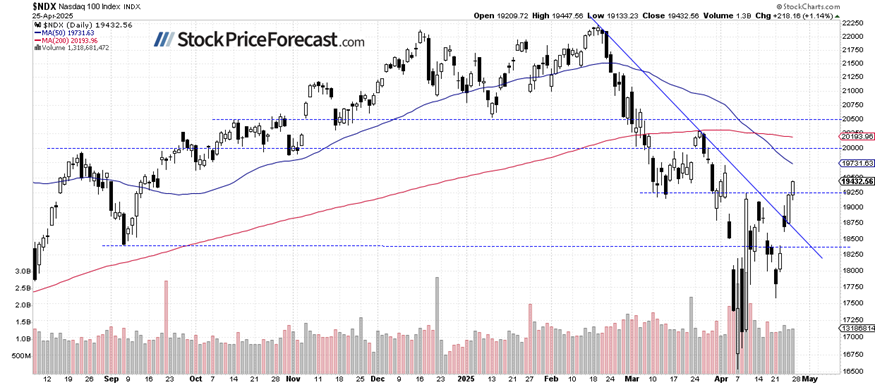

Nasdaq 100 extends her rally

Friday, the Nasdaq 100 1.14% higher, extending its advance after exceeding the level of 19,000 Thursday. The positive feeling was supported by better than expected quarterly results of alphabet (Goog) which attracted new optimism on artificial intelligence.

The potential resistance for the Nasdaq 100 is around 19,700, marked by the previous local summit, while a support is from 19,000 to 19200.

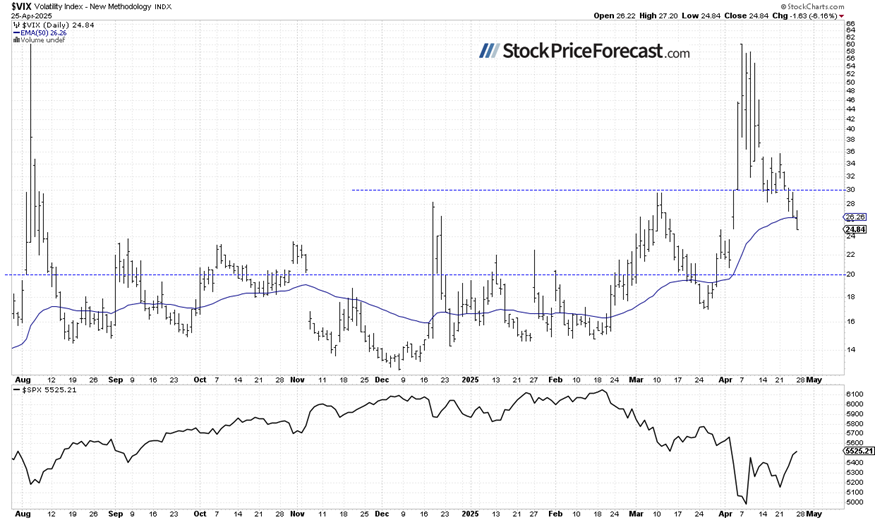

Vix Lower Setling

The drop in volatility suggests growing investors. Friday, Vix was as low as 24.84, taking more than 30 earlier in the week.

Historically, a downward VIX indicates less fear on the market, and the increase in VIX supports stock market slowdowns. However, the lower the VIX, the higher the probability of the market decrease in the market. Conversely, the higher the VIX, the higher the probability of the market increase in the market.

T lights S&P 500: oscillating below 5,550

This morning, the long-term contract S&P 500 is slightly negotiated below Friday's fence. This represents a modest withdrawal after the high performance last week.

The market continues to fluctuate along its previous local summit of approximately 5,530. A higher escape could push it to 5,700-5 800 zones.

Conclusion

The S&P 500 has reached its highest level since the beginning of April Friday, showing a continuous rise. However, the openings expected today lower today suggest that a certain consolidation is probably following the high rally of 4.59% last week.

The market continues to progress in several positive catalysts, in particular the softening of tariff fears, potential peace developments in Ukraine and the planned quarterly press releases (this week's major results reports include Visa, Microsoft, Meta, Amazon and Apple). That said, it remains uncertain if it is a new upward trend or simply a correction in the downward trend.

Here is the ventilation:

-

S&P 500 won 0.74% on Friday, reaching its highest level since early April.

-

Last week, the index won 4.59%, retraced more from its sale in early April.

-

There remains a market -oriented market, with pricing developments to the point; The mixed signals on American-Chinese-Chinese trade negotiations continue to influence the feeling of the market.

Do you want free monitoring of the above article and details not available for 99% + investors? Register for our free newsletter today!