Bitcoin ETFs and the $56M Outflow: Is Market Momentum Slowing?

On Wednesday, the Bitcoin Spot ETFS recorded their first net flow since April 16, stopping an eight-day verse of constant flow.

The flow was marked by a well -known return after the funds that together attracted more than $ 2 billion in net inflows during the previous eight sessions of trading.

Bitcoin ETF faces $ 56 million exit amidst price action

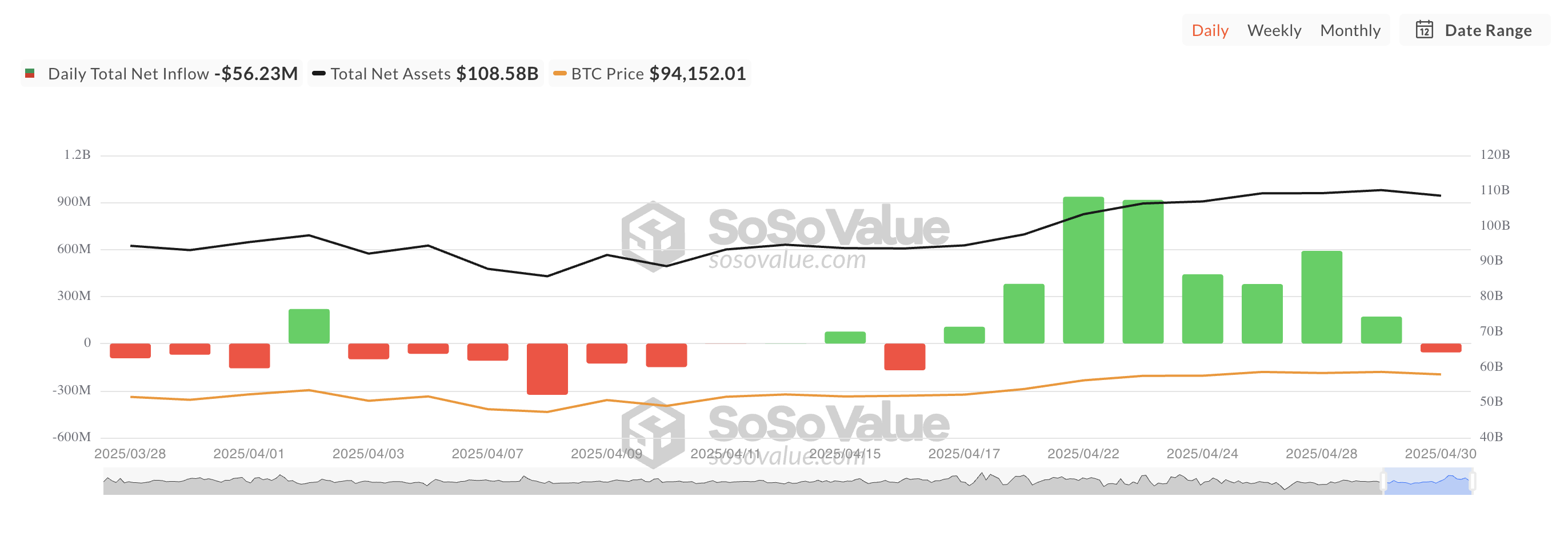

Yesterday, the total net flow from the BTC spot ETFS arrived at $ 56.23 million. The sudden transfer of fund flow suggests a potential cooldown on institution's demand following a prolonged period of accumulation.

Including BTC prices since April 25 can motivate this pullback. A BTC/USD chart analysis one day shows that the leading coin has been exchanged within a narrow range ever since, faced with a resistance to $ 95,427 and finding support for $ 93,749.

With the BTC being combined with strict and failing to break the basic levels, some major investors choose to risk their positions by temporarily removing capital from funds supported by the BTC. An extended period of price action has uncertainty around short-term momentum, making it more difficult to maintain aggressive flow to BTC ETFs.

On Wednesday, Blackrock's Ishhares Bitcoin Trust (IBIT) was the only fund to curl up, which recorded a net inflow of $ 267.02 million, which brings a total historical net flow to $ 42.65 billion.

Fidelity's FBTC has seen a $ 137.49 million exit from the fund on a single day. Despite the drawdown, FBTC's total historical net stands for $ 11.63 billion.

The BTC Derivatives Market shows mix -a feeling

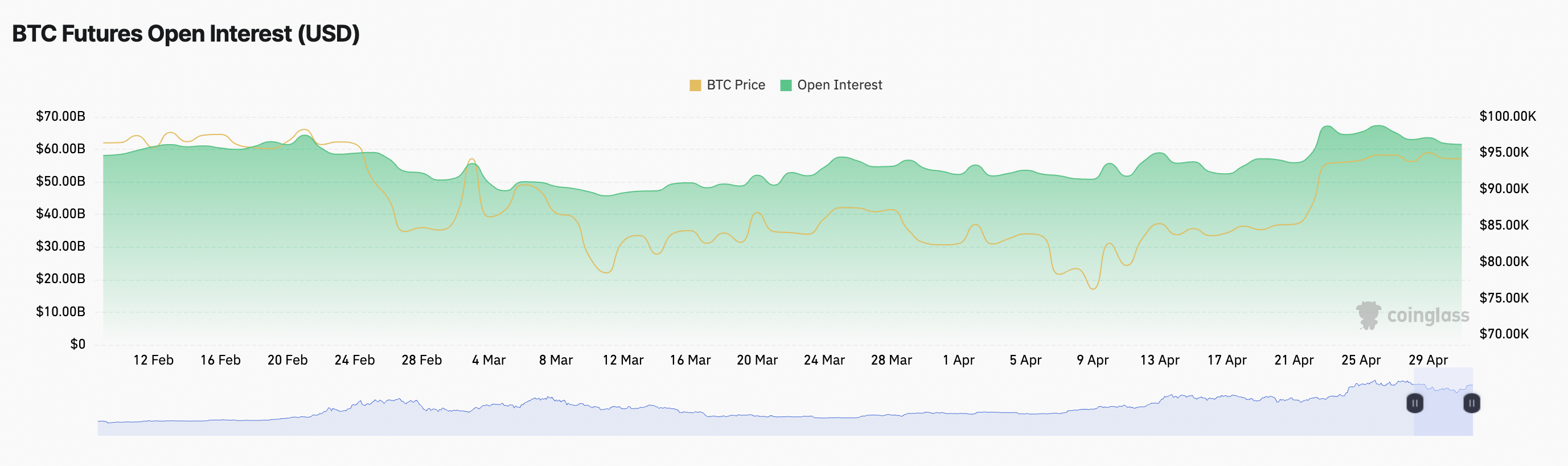

Meanwhile, despite the recent incorporation of the price, the derivatives market data reflects a mix of emotion to merchants. Open interest in BTC futures refused slightly the previous day, the signing of decreased activity.

At the time of the press, it stood at $ 61.50 billion, noting a 1% sinking the previous day. A collapse in open interest like this suggests that traders are closing positions instead of opening new ones. This trend reflects the uncertainty or lost convincing in the short -term BTC price direction.

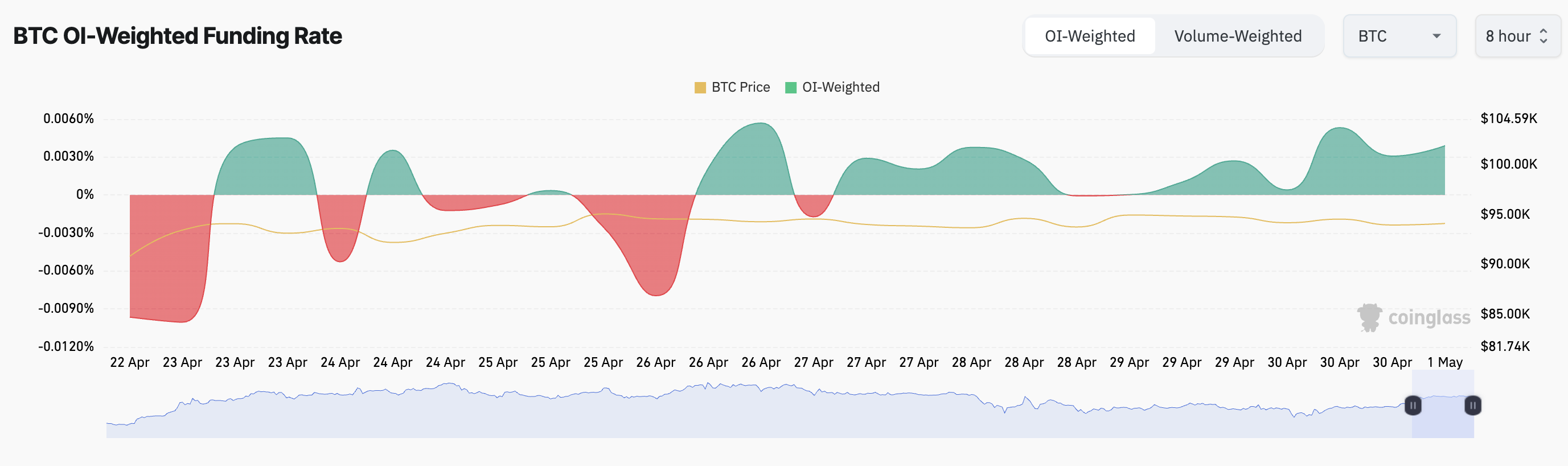

However, the rate of coin funding remains positive, indicating that long entrepreneurs are still dominant. Like this writing, it stands at 0.0039%, confirming the preference for long positions in short ones.

This bullish signing suggests that despite BTC's price avoidance, many futures entrepreneurs are still opening bets in favor of a price rally.

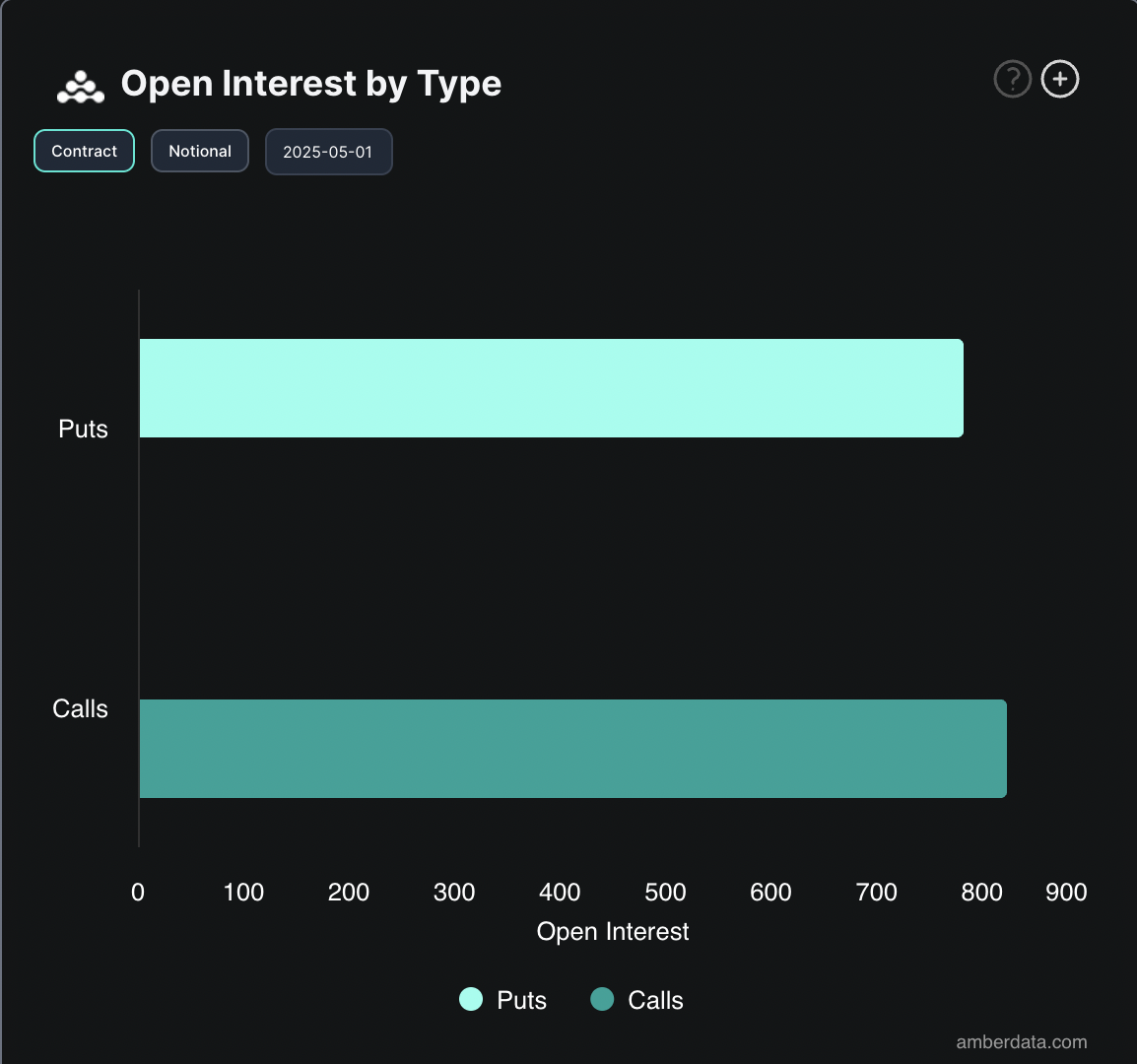

In addition, the options market shows a higher volume of call contracts than is placed, a sign that some market participants will continue to bet on an upward breakout in the near term.

The pullback on ETF Inflows may reflect earning income after a strong April performance, but data from both futures and market options suggest investors have not been bearish yet.

Refusal

In accordance with the guidelines of the trust project, this price assessment article is for information purposes only and should not consider financial or investment advice. Beincrypto is focused on accurate, unparalleled reporting, but market conditions are subject to change without notice. Always do your own research and consult a professional before making any financial decisions. Please note that our terms and conditions, privacy policy, and disclaimers are updated.