Stablecoins can expand to $1.6T by 2030, says Citigroup

Citigroup considered a key role for Stablecoins, with the potential for a total supply of $ 1.6T by 2030. A new Citi Institute role monitored the positive development scenario for the blockchain space by the end of the decade.

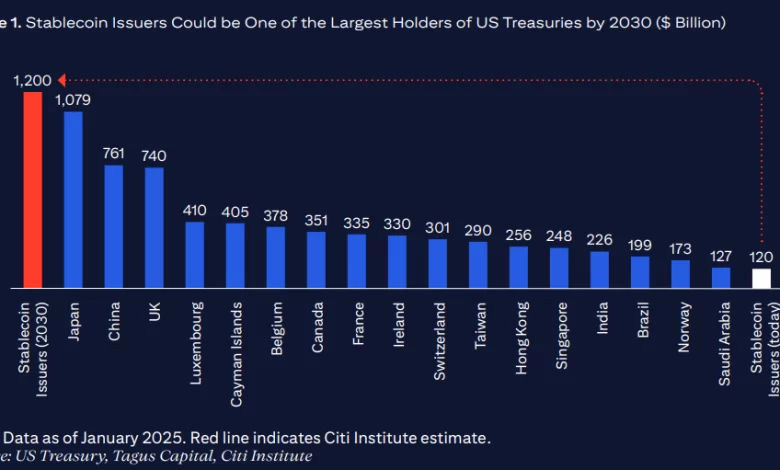

Citi Institute Guess The total supply of stablecoins will increase by a high $ 1.6T by 2030 in the base case scenario. With a more development, the market can see up to $ 3.7T in Stablecoins. Givers could be some of the largest holders of US wealth, a convenient and liquid collateral.

Research also suggests that blockchain technologies and stablecoins may have a 'chatgpt' moment by the end of 2025, as improved regulations can lead to greater adoption in the financial sector. Stablecoins have already seen regulation in the region, while the USA has passed a new Stablecoin Bill To differ between different types of assets supported by assets.

Citigroup believes the crypto market will remain dolarized, with up to 90% of issued stablecoins based on the US dollar. Other countries may begin to experiment with centralized CBDCs, which denominations with other currencies.

Dolarization will lead to demand for US wealth, which is already supporting the USDT and other stablecoins. Even in 2024, Tether's rank in Top 7 Holders of US treasures, competing with other large corporate and state entities.

The Citi Institute predicts demand for $ 1T in US wealth by 2030 in the Base Case scenario. The report based the figure on the estimated demand in the case of favorable regulation and transparent providers based in the US.

Stablecoins still posing a risk to contagion

Citi Research counts 1,900 events when stablecoins deviate from their $ 1 value in 2025. Even asset-supported tokens can change, while coin algorithms may have more dramatic de-pegging events.

Even regulated coins like the USDC felt pressure from a sudden demand for redemption. In 2023, the Silicon Valley Bank's failure led to a temporary crisis in the USDC.

Despite this, Citi Research believes that stablecoins can serve as a source of global liquidity and serve as dollar -based standards for the development of markets. Stablecoins can serve as a replacement for the US dollars hold on cash and replace some of the finisch apps.

If localized by the local, some stablecoins may also carry yield, which serves the area of bank -based products. Stablecoins can also replace payment accounts and other US dollars reserves, due to 24/7 uptime and comfort.

Citigroup still believes that Stablecoins puts some threats to the banking sector, with a technical risk increase due to hacks and scam.

In addition to private payments, Citigroup predicts the use of blockchain for public spending and cost monitoring. So far, governments have only tested blockchains and have implemented some on-chain solutions for transparent reporting. Citi believes that smart contracts can replace several procedures for public tenders and play a role in automatic tax collection.

On-chain tokens can also be used to issue and sell digital bonds and other fractional ownership. On-chain automation can also be used to disburse and monitor public grants, the report suggests.

Cryptopolitan Academy: Wanna grow your money in 2025? Learn how to do this with Defi on our upcoming webclass. I -save your place