Bitcoin and US stock markets see modest profits after Fed kept interest rates unchanged

Bitcoin Rose and US shares rose on Wednesday after Fed kept his interest rate untouched, warning both jobs and prices for increasing dangers.

The S&P 500 was closed at 0.1% higher after a messy session. Dow Jones added 237 points or 0.6%, Disney shared the shares.

Nasdaq, hit by technical losses, slipped 0.3%. The Federal Open Market Commission announced that it will keep a loan of 4.25-4.5%overnight, the same place as it has been since December.

Fed accuses tariffs, Trump doubles

Fed leader Jerome Powell told reporters that if the tariffs are currently on the table, the state may face slower growth, longer -term inflation and the loss of a growing job. “They can cause economic growth, long -term increased inflation and unemployment,” Powell said. His comment was not subtle.

The answer of the White House was also not subtle either. President Donald Trump, on the same day, said with journalists that he would not take back the tariffs in China, even if the talks are planned in Switzerland for the weekend. His trade team is set to meet Chinese officials, but no compromise promises are zero.

JPMorgan Asset Management Global Global Strategist David Kelly During CNBC During CNBC Energy lunch“This is a somewhat barking statement.

It says, “We are not in a hurry to reduce tariffs, because frankly, there is a risk of both sides of our mandate here, and we are not sure what way we should play it.” “Kelly also Kelly said Fed's message was clearly aimed at the Trump administration.

“If you read between lines,” your policy causes higher inflation, greater unemployment. “” ”

While the DC played a political drama in the DC, the technical shares dragged the market. The alphabet fell by about 8% and Apple lost 1.5% after the Bloomberg report showed Apple's plans to add AI-controlled search tools to the safari, replacing as a default search partner of Google.

Bitcoin rises when traders take a profit

Outside Wall Street, Bitcoin traded about $ 96,500 just after the Fed announcement. This is a 1.7% growth in just one hour. Coingecko data He showed that the BTC has risen 22%over the past week. But this is not just a new flood of money – investors make a profit aggressively.

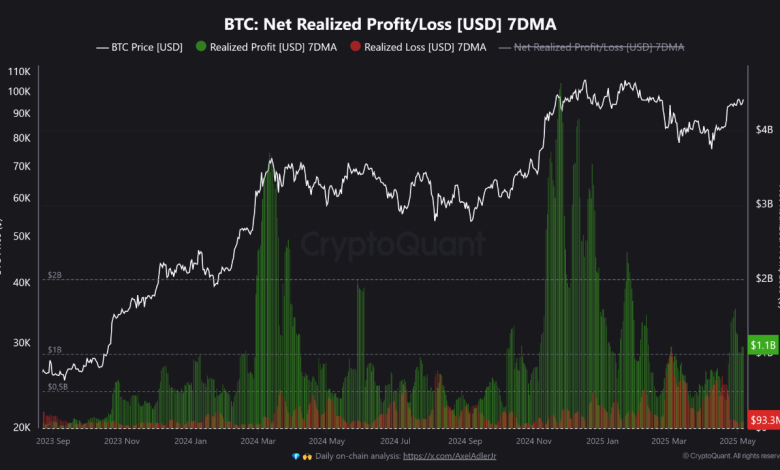

On May 8, the Cryptoquant post said that Bitcoin's 7-day average net profit/loss has been strongly positive since the beginning of 2024. This is now over a billion dollars a day, which they called “still high” even after the market setback from March-April 2025. It's not as wild as in November – December 2024, but it is enough to raise eyebrows.

Cryptoquant associated the trend with the market behavior of the late-stage bulls-traders will benefit until prices continue. They pointed to previous cycles, for example 2021, where this exact pattern happened before local tops or sudden corrections. This time they said the market would look the same, just much larger.

As the Spot ETF was introduced in January 2024, the structure of the crypto market has shifted. But behavior has not done so. Cryptocurrency wrote Although the tools are new, the mindset is exactly what it was before: “the same behavior, greater extent”.

They warned that as long as the realized profits remain so high, the chance of a rebound will increase. If the profit is slowing down, this may be a sign that the market enters the new stage.

Cryptopolitan Academy: Are you tired of market changes? Here's how Defi helps you build a permanently passive income. Sign up right now