Bitcoin All Time High Incoming? Analyst Thinks It’s Likely

The eminent chain analyst Willy Woo said that Bitcoin (BTC) could recover his peaks from all time if the current capital entries persist.

He added that investors should consider price reductions as healthy corrections and purchasing opportunities rather than signals from a market crash.

Will Bitcoin recover its top of all time again?

Woo shared his ideas in a detailed thread on X (formerly Twitter). He thinks that solid fundamentals support the bitcoin bullish trend.

This includes an influx of growing capital in the Bitcoin network, with total and speculative capital flows recently at the end. The alignment of these flows creates a solid and bullish environment for the active.

“The fundamentals of the BTC have become bruise, not a bad configuration to break the heights of all time”, he declared.

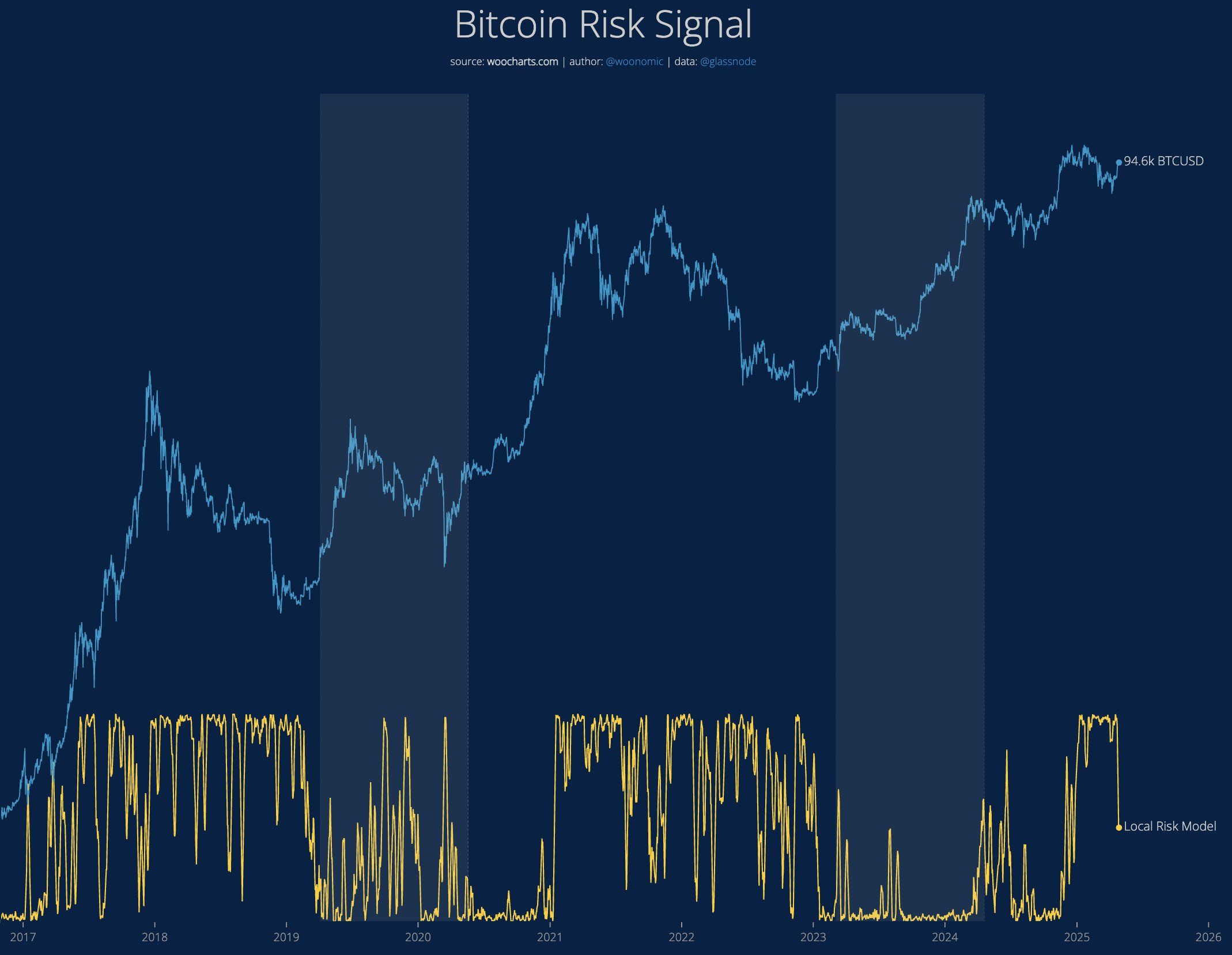

In addition, Woo stressed that Bitcoin's liquidity is deepened, as evidenced by its lower risk model. This downward trend suggests that market liquidity has returned. Consequently, the cuts of future prices will probably be smaller and less serious, which reduces the risk of net sales.

“All the hollows are intended to buy under the current diet. In the very short term, there is a good chance of hollow,” said Woo.

The analyst also noted that Bitcoin had already recovered medium -term price targets of $ 90,000 and $ 93,000. In addition, a new provisional target at $ 103,000 has formed, which suggests that Bitcoin will likely reach this level before pushing $ 108,000.

He specified that these objectives are supported by supported capital entries rather than by simple speculative negotiation, strengthening the case for a sustainable ascending trajectory.

Despite the long -term optimistic prospects, Woo has warned that short -term challenges can occur. The average weighted price of the Bitcoin chain (VWAP) is currently at +3 standard deviations.

This implies that the current price of the room is much higher than its typical beach. When an asset moves as well above its average, it is considered too extensive.

“It will be difficult to move upwards with a decent momentum due to the overexxation,” said Woo.

According to Woo, this metric indicates that the upper momentum can be limited in the short term. Instead, the most likely results move laterally or a slow and progressive increase rather than a fast rally.

Previously, Beincrypto described three major signals which strengthen the case of Bitcoin recovery. In April, Bitcoin restored its opposite relationship with the drop in the US dollar index (DXY) and decoupled from Nasdaq.

Meanwhile, long -term investors actively accumulate coins. Together, these three differences report growing market confidence and refer to a potential major Bitcoin rally. In fact, the recent BTC market performance also strengthens these perspectives.

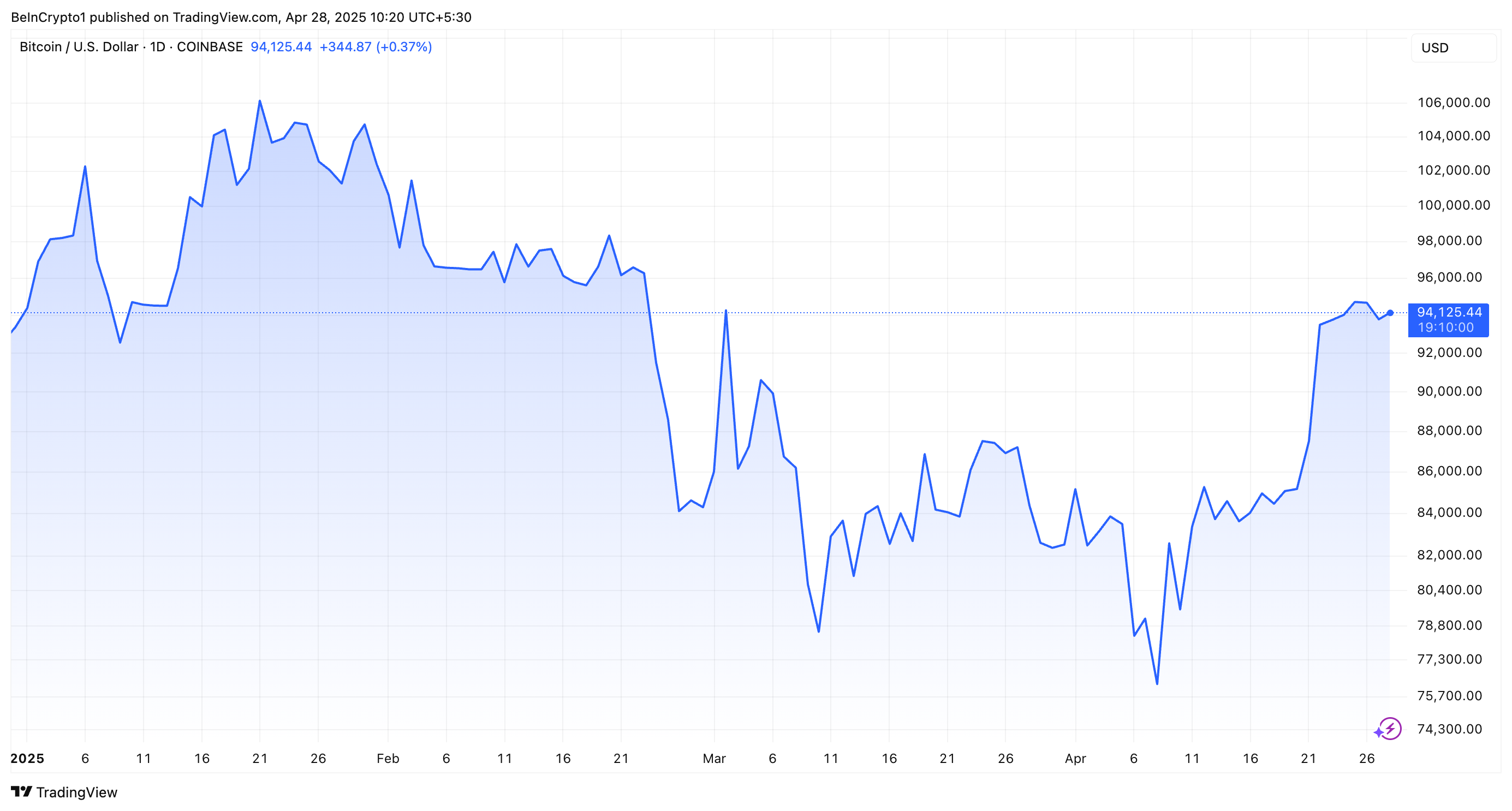

Beincrypto data showed that the value of the part recovered 7.7% in last week. At the time of writing this document, Bitcoin exchanged $ 94,125, representing a minor drop of 0.07% in the last day.

Non-liability clause

In membership of the Trust project guidelines, Beincrypto has embarked on transparent impartial reports. This press article aims to provide precise and timely information. However, readers are invited to check the facts independently and consult a professional before making decisions according to this content. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.