Bernstein projects $330 billion in corporate Bitcoin buys over the next five years

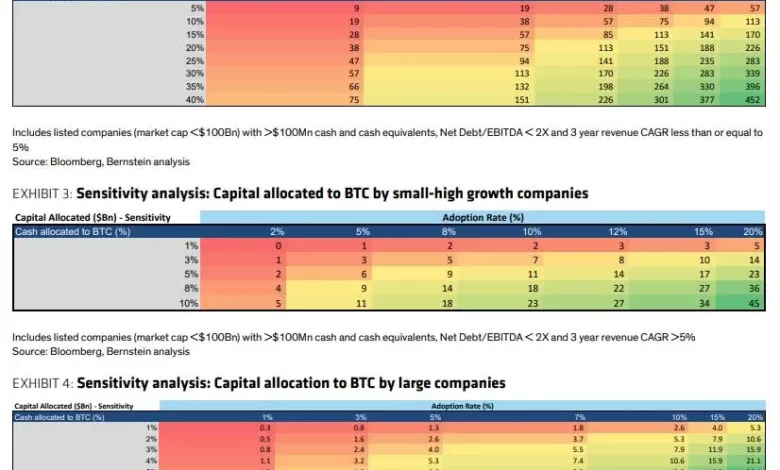

Asset manager Bernstein expects companies to spend $ 330 billion taking Bitcoin for their ark over the next five years. In a research note from the investment firm, analysts expect the approach to lead to the Corporate Treasury's flow to the BTC and expect to follow smaller companies.

According to AnalystThey hope that public companies will allocate nearly $ 205 billion in getting Bitcoin, which is most interest from small, low companies. In their view, these companies are more inclined to copy the playbook of the approach as it offers them a path to growth.

Analysts write:

“Small companies with low growth – High Cash has a better market that fits the MSTR Bitcoin Playbook – no visible road in advance for value creation, and the success of the MSTR model has offered them a rare path of growth.”

Analysts led by Gautam Chhugani have noted that the US Pro-Crypto environment has contributed to increased interest in ownership of corporate bitcoin. Currently, public companies have been sharing around 720,000 BTC, with the strategy of more than 555,450 BTC.

However, analysts added that not all companies that try to copy the playbook will succeed, remember that the approach has achieved the significant size as a first mover that will be difficult to replicate.

Bernstein said the strategy could still buy nearly $ 125 billion BTC

Notably, the firm also hopes that the approach will be responsible for an additional $ 124 billion in Bitcoin. The analysts point to the recent decision of Michael Saylor led by the company to increase the plan of increasing capital for the acquisition of Bitcoin.

The strategy recently increased its plan of increasing its capital to $ 84 billion by the end of 2027 from the preliminary $ 42 billion target, which it announced in 2024. It is surprising that some analysts on Wall Street have accepted its decision to revolt, describing it as ambitious but still strategic.

The company has completed 32% of the initial $ 42 billion target in just six months, and Berstein believes the rapid rate of accumulation and increasing capital is a sign of what comes from the approach.

Small companies leading the accumulation of Bitcoin

While it is impossible to determine the accuracy of Berstein's projection, the opinion of the analysts of small companies that adopted Bitcoin for the corporate treasury was at the point. Today, most corporations who hold BTC are either crypto-related creatures or small companies seeking to use property as a fence against inflation.

The largest public Company with exposure to bitcoin was the Tesla, which captured Bitcoin in 2021 and eventually sold part. Other major companies, such as Jack Dorsey's Block (formerly Square), are also holding on to Bitcoin, but as only in their balance.

However, some small CAP companies, including the Tokyo Exchange listed in metaplanet, semler scientific, Kulr technologies, and much more, have adopted a playbook approach and gradually developing their stash. Others, such as Gamestop and Rumble, have announced that they will accept the Bitcoin standard even if they still have to start accumulating BTC.

However, there is a possibility that even the largest companies in the world, such as Apple, Amazon, Meta, Microsoft, and Nvidia, may begin to invest in Bitcoin in the future, even if they have not adopted a corporate bitcoin treasury.

Some shareholders in these companies began to push for them to provide part of their cash reserve in Bitcoin. Meta and Amazon Shareholders will vote if Bitcoin will be included as a corporate treasury asset on May 21 and 28, respectively.

A similar proposal before Microsoft's shareholders a few months ago failed despite Saylor's appearance before the shareholders raised for the move. It is likely that the upcoming votes will also face the same outcome, especially since the two tech giants board advised shareholders who voted against it.

Key wire difference: Used tool's secret tool projects to get guaranteed media range