Banking giant sets Nvidia stock price target

⚈ Estimate of the worst case sees Nvidia falling at $ 76.25, a drop of 32.72% compared to today.

⚈ Despite the concerns, Piper Sandler maintains an overweight note and a long -term bullish view.

Banking giant Piper Sandler has revised his prospects on Nvidia's actions (Nasdaq: NVDA) for the next 12 months.

In a difference compared to what Wall Street companies usually do, business analysts have published a range instead of a single price goal.

After having carried out a sensitivity analysis of income from the chip manufacturer's data center to determine the potential impacts Capital expenditure slowdown (CAPEX) could have, Piper Sandler analyst Harsh Kumar, estimates that $ 9.8 billion on an annual basis – approximately 6.45% of income from the company's data center could be in danger.

In addition, this analysis already completely excludes the income from China. According to the Multinational Investment Bank, the worst case could see a blow of $ 0.40 for action per share (BPA) – and a multiple of 25 times several that Piper Sandler applies to achieve its price objectives, this leads to a price target of only $ 76.25 for NVIDIA shares.

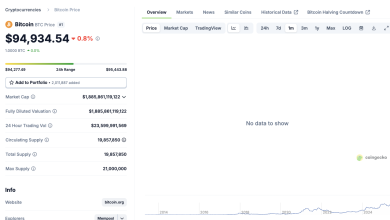

For reference, at the time of the press on May 5, NVDA shares changed hands at $ 113.34, having marked a drop of 15.6% since the start of the year. Consequently, the worst case by Piper Sandler would have a 32.72% drop in current prices.

However, it is important to remember that we always discuss a specific scenario here – on the whole, the banking giant remains optimistic about the actions of Nvidia.

Piper Sandler reiterates the objective of optimistic prize on Nvidia's actions

With the risks noted, the banking giant reiterated a note “overweight” on the NVDA action, equivalent to a strong purchase. Depending on the best case of the company, and once again using an NVIDIA stock of 25x, NVIDIA could reach a price of $ 126.75.

If such an upward move was to materialize, it would represent an increase of 11.83% of current prices. Although the fact that Piper Sandler has remained optimistic should not be reduced, readers should note the great disparity in the advantages / disadvantages between the best case and the worst case that the company has presented.

In addition, it was the drop in price objective – the previous coverage of Piper Sandler came with a price forecast of $ 150 to 12 months, which would be equivalent to a gathering of 32.34% compared to current prices

Although analysts have maintained optimistic perspectives, there is a significant tendency to reduce price objectives. The change of feeling is not limited to Wall Street – because the Ratio runs Nvidia's actions recently reached a 2 week high.

Star image via Shutterstock