Bank of America says stock market rally is over

Bank of America does not think that this year's stock market rally increases. Michael Hartnett, one of the best strategists in the company, said the rebound had already taken place, and now it's just flat.

Hartnett wrote in a note on May 8 that the rally was “correct”, based on optimism around prices reductions earlier in the second quarter, but that the game is fundamentally finished. He said that the merchants followed the usual game book: “Buy the wait, sell the fact.” And now they sell.

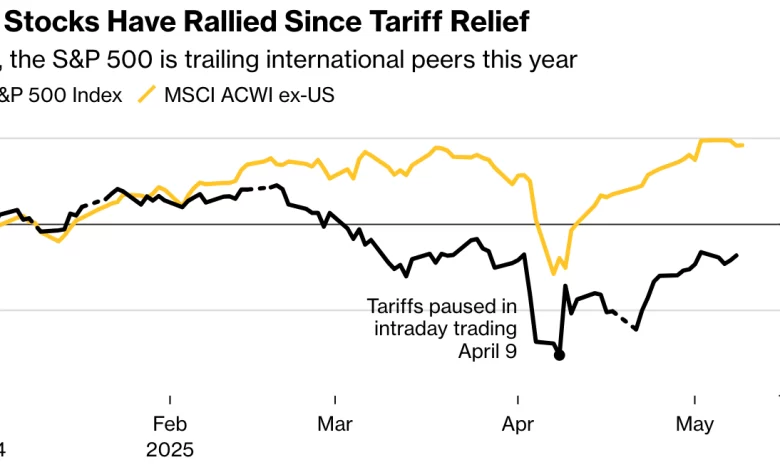

The strategist underlined the S&P 500, which increased by 14% after President Donald Trump announced a break in certain prices on April 9. But even after this increase, the index is still down 3.7% for the year.

This puts him behind foreign markets, that Hartnett said Look better. It now promotes obligations on actions and prefers international actions instead of those American, claiming that American assets are stuck in a “market for structural bear at an advanced stage”.

Investors withdraw money while Trump signs an agreement in the United Kingdom

Bank of America saved Hartnett's call with real money flow numbers. Over the past four weeks, investors have pulled $ 24.8 billion from American shares, the biggest release in two years. The data came from EPFR Global, and this shows that people do not stay to see what will happen next. They came out. And this exodus is directly part of Hartnett's warning that this is not the time to chase the actions.

At the same time, the White House began to cool off on the language of the trade war. Officials are considering serious price discounts during weekend discussions with China. Trump also abandoned a commercial framework with the United Kingdom on Thursday, calling it a “breakthrough”.

This is the first agreement that the United States has concluded with any country since Trump began to push the idea of ”reciprocal” prices. But even this one is delivered with strings. Trump said the United Kingdom would always face a basic price of 10%, and that other countries with major trade surpluses would pay even more.

Chris Zaccarelli, director of investments at Northlight Asset Management, said that the British agreement was more important as a test than a great economic victory.

“While trade with the United Kingdom turns out to trade with our neighbors in the north and south, and especially compared to China, it is an important test case and a model for what could be accomplished,” said Chris.

Traders remain cautious despite the rebound in the market

Even if Hartnett is lower, the market has always moved after Trump made his comments. When he said he expects American officials to have a “good weekend” in commercial negotiations in China, the three main clues climbed.

The Dow Jones increased by 0.6%, the S&P 500 added almost 0.6%and the composite Nasdaq jumped 1.1%. But the excitement did not last. Friday morning, the future moves barely.

DOW -related term contracts fell by 16 points, or 0.04%. The term contracts on the NASDAQ 100 increased by 0.12% and the S&P 500 term contracts increased by 0.04%. The merchants did not place big bets. Everyone is waiting to see if Trump's optimism on China turns into real progress, or if it is only another weekend of conversation.

The figures for the week show how careful the market is. The S&P 500 is directed to a loss of 0.4%. The NASDAQ seems to be settled to drop by 0.3%, and only the DOW is hung with a tiny gain of 0.1%, which would do its third consecutive third week.

Your news from crypto deserve attention – Thread difference cresure Place you on more than 250 higher sites