Asian stocks advance over the possibility of easing US-China trade wars

Asian actions and US stock contracts climbed Friday after Beijing reported that he was willing to discuss the prices. This attenuated investor is concerned about the impact of prices after dull income from Apple and Amazon.

The Chinese trade ministry said that the United States had “expressed several times its desire to negotiate on prices” and that the Beijing door is open to talks. “The remark has contributed to transforming the term contracts on Wall Street: the future linked to the S&P 500 increased by 0.6% and those related to the Nasdaq added 0.3% despite the session from the red when Apple warned that the prices could increase its costs this quarter by around 900 million dollars.

Advanced Asian actions

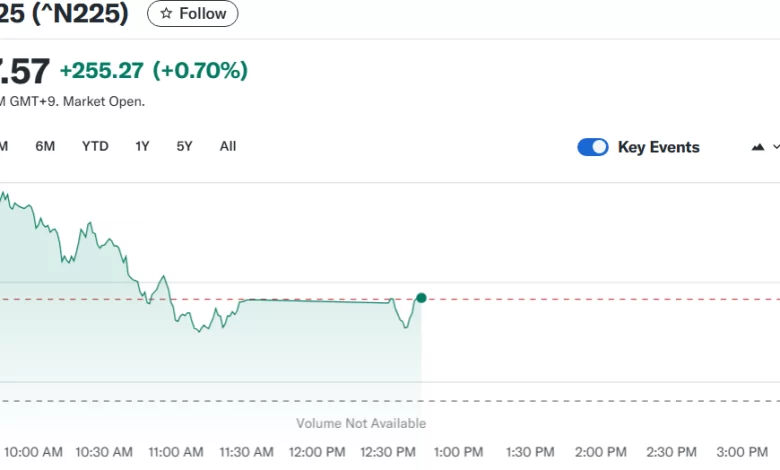

Japan Nikkei increased by 0.70% and Taiwan's reference jumped by 2%. The MSCI index which follows actions in Asia-Pacific outside Japan respected 0.4%.

Despite this, the commercial offices remained suspicious because the investors continued to juggle with the changing tariff strategy of the White House and the risk that higher import costs can eliminate the global economy. This week's government data showed that the US economy has decreased in the first quarter for the first time in three years, while a private survey revealed Chinese factory production in April contracted at the fastest monthly rate.

Several companies have recently reduced or withdrawn profile forecasts, and Apple and Amazon Thursday updates have deepened anxiety. Their weak projections partly compensated for the figures stronger earlier in the week of the Microsoft and Meta platforms, which had fed the hope that large technological groups could leave the price storm.

The Japanese yen has slipped to its lowest level since April 10

In the currency trade, the Japanese yen slipped to 145.62 for a dollar, its lowest level since April 10, one day after the Bank of Japan left the interest rates unchanged and reduces its growth prospects due to American rates.

The milder yen has helped the American currency newspaper its best week since the end of February. The dollar index, which measures the greenback against six peers, was last time at 100.14 while the merchants awaited the non -agricultural pay data in April. Economists interviewed by Reuters Expect that payroll increased by 130,000 after the 228,000 March increase.

Japanese officials were also under the spotlight. Finance Minister Katsunobu Kato told journalists that more than $ 1 dollars in the country in the US Treasury assets were one of the levers Tokyo could use in business negotiations with Washington. His comments came while Japan's first commercial negotiator Ryosei Akazawa met the US Treasury Secretary Scott Bessent in Washington for a second cycle of bilateral tariff talks.

The raw materials markets have given mixed signals. Spot Gold released $ 3,234.9 $ $, putting the metal on the right track for its lowest week in two months as an asppet for coolant. Oil was directed in the other direction after President Donald Trump warned against secondary sanctions against Iran. Brent crude turns on crude BRT increased by 0.56%, while US West Texas Intermediate won 0.6%.

Cryptopolitan Academy: to come soon – a new way of winning a passive income with DEFI in 2025. Find out more