Arbitrum Dao allocates $ 11 million to Tocenized US Treasury Investment

The Arbitrum Foundation was earlier today on Twitter XI to announce that Dao is moving to the next phase of its stable Treasury Endowment Program (Step) after the vote of the chain.

As part of the new stage of the Dao initiative, it allocates 35 million ARBs to diversify its Treasury with real-time assets (RWAS), which is worth about $ 11.6 million at current prices to tokenize the US Treasury, Franklin Templeton, Spiko and Wismtrine.

This is a huge day for RWA!

Arbitramdao just approved the 35m ARB through Stages 2. To accelerate the institutional acceptance of RWA @Fti_us @Spiko_finance and @Wismontreefunds

Only on arbitrate, here is what it means 👇 👇 pic.twitter.com/atnyof4qsh

– Arbitram (@arbitrum) May 8, 2025

The money is distributed between three issuers

According to Dao's post, after more than 50 submissions, the evaluated proposal stage committee recommended that 35% of Franklin Temple be allocated to Fobxx (labeled as Benju), 35% Spiko Ustbl and 30% to Wisdomtree's WTGXX.

The Commission, consisting of members of the community, made a desire to achieve a choice between fees, existing TVL, risk-tailored settings and community involvement.

Nearly 89% of the participants voted in favor of allocations, with many expressed satisfaction by decision as they believe in reflect Proper balance between costs, risks and revenue without compromising the wider purpose of supporting RWA growth arbitrum.

Only 0.01% voted against and about 11% decided to refrain. The vote lasted several days, from May 1, before ending on Thursday at 9am to. Applicants who were not selected proposal On behalf of the Commission, Arbitrum Dao strategic consultants entropy advisers.

“We are delighted to be elected the 2nd step program manager, deepening our already strong connection to the Arbitrate user base,” said Roger Bayston, Digital Assets at Franklin Temple. “Using Arbitrum's leading 2nd layer technology, we are able to provide our customers with faster, more large -scale and cost -effective solutions. This collaboration not only strengthens our commitment to innovation, but also positions us at the forefront of next generation financial services infrastructure.”

Step -algatus is crucial for Dao

Step initiative is a strategic step in increasing institutional participation in the arbitrum ecosystem and expanding its impact in the wider chip circuit and the financial sector.

Entropy's co -founder Matthew Fiebach shared his thoughts on development in a recent interview. According to him, organizations such as Blackrock, Franklin Templeton, Spiko and Wisdom Tree are publicly interacting with the DAO forum, “an incredible achievement for the entire crypto room”.

“From the first day, Arbitrum is strategically placed at the center of the Crypto approach with Tradf, and Step is a great example of Dao's steady push to continue introducing the institutions,” he added.

All three organizations that participated in the initiative of the field have decades of experience in managing assets and involving them in phase 2 may indicate that the network is a reliable and secure platform for RWAS to be used and managed.

His partnership with these well -established Tradf companies can help with arbitration that it has a ripe ecosystem that is safe and capable of handling institutional quality financial transactions.

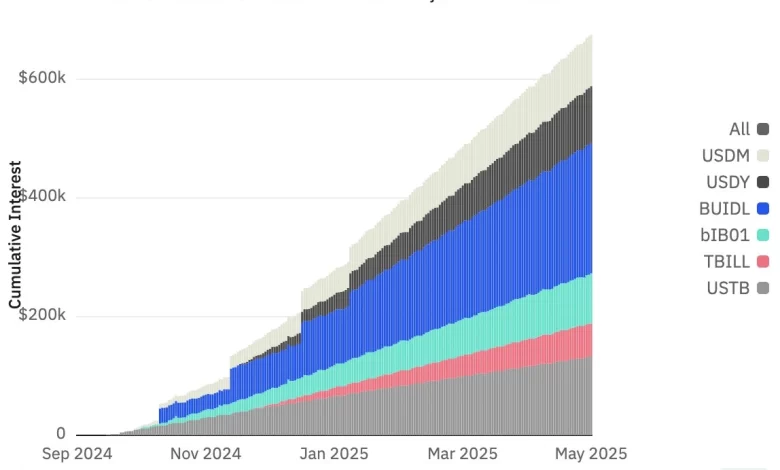

According to post From the fact that he was launched more than 6 months ago, DAO has been created for over $ 650,000.

Cryptopolitan Academy: Are you tired of market changes? Here's how Defi helps you build a permanently passive income. Sign up right now