ALPACA Price Soars 1,000% After Binance Delisting: Here’s Why

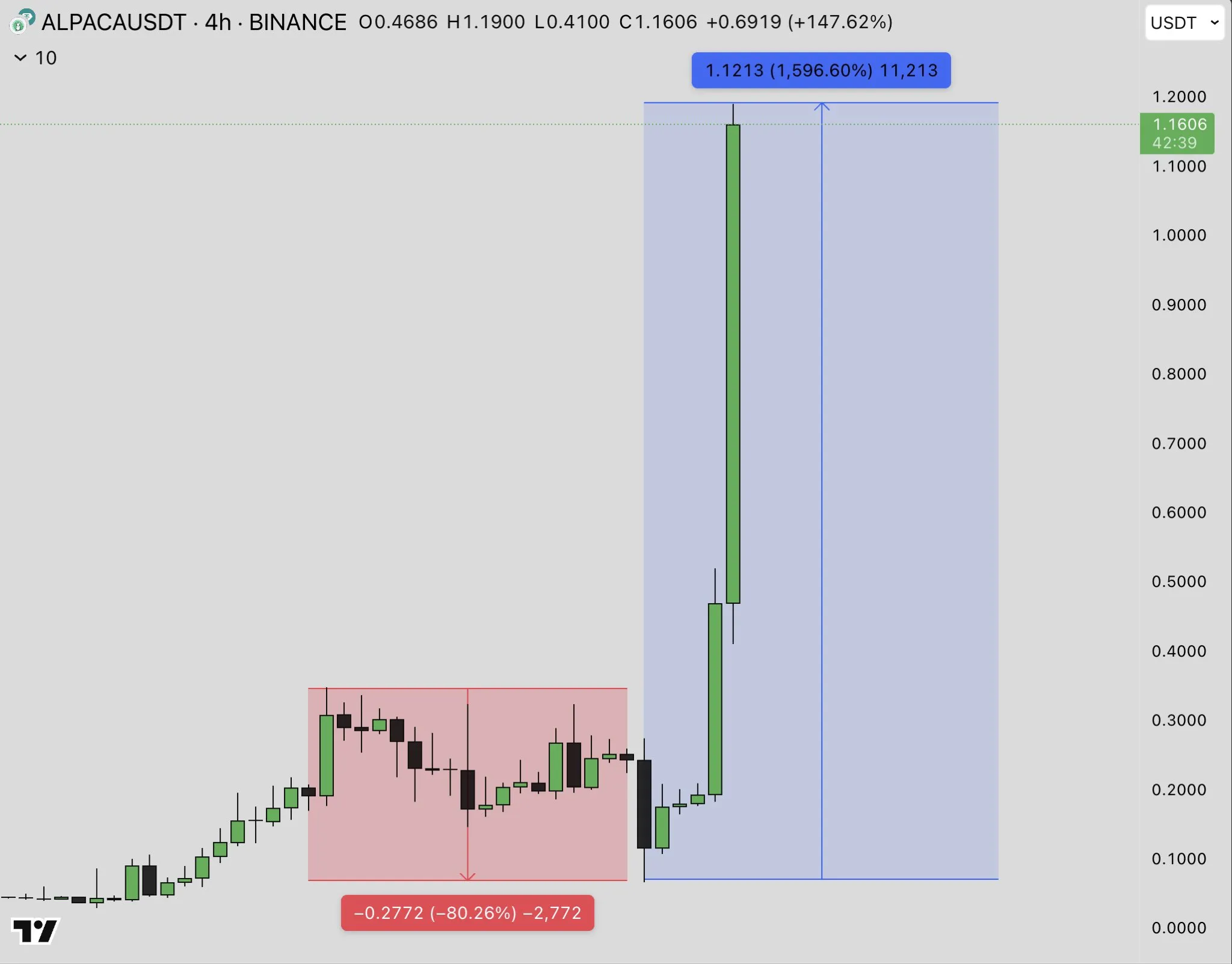

Following Binance's announcement, Alpaca Finance (Alpaca) experienced a terrifying quadruple-digit price rally last week.

The behavior of this counterintuitive market has caused a great discussion with analysts and merchants. Many experts suggest that this may be a case of market manipulation.

Why is Alpaca's price bomb despite Binance's dedication?

Usually, a Binance list is a bullish signal for tokens, often driving prices up because of increased visibility and liquidity. However, recent trends indicate a return to this pattern.

On April 24, Binance announced the removal of four tokens, including the Alpaca. While the value of all the other tokens refused, Alpaca's price shot. Beincrypto data showed that the token was appreciated by more than 1,000% in the past seven days.

However, the momentum appears to slow down somewhat while the alpaca is about to remove it on May 2. The previous day, its value sank 34.5%. At the time of writing, it trades at $ 0.55.

However, the unusual increase of alpaca has drawn the attention of the market observers.

“Alpaca is the worst crypto manipulation I've seen in recent times. How do you pump a token from 0.02 to 0.3 then sell it back to 0.07 and bomb it from 0.07 to 1.27 then back to 0.3,” a user write.

Analyst Budhil Vyas called it as a “hunting book.” He explained that large players in the market, or whales, initially expel the price by 80%, which contributed to panic and prevention. Then, before the 2-hour delisting deadline, they quickly pumped the price of 15x.

Vyas believes it is a strategic move to extract liquidity from the market, as these whales are desperate to secure positions before removal from the exchange. He further emphasized that no real accumulation is taking place.

The analyst said the price of the price was purely tactical. It is designed to drain any liquidity left in the market.

“It was crypto in 2025. Stay alert,” Vyas warned.

Meanwhile, Johannes too provided A detailed deterioration of mechanics behind price -like manipulations. In the latest Post of X (formerly Twitter), he explained that sophisticated parties exploited low liquidity following the announced announcements.

The approach involves dominant in a large part of the token supply. Traders take large positions to eternal futures, betting on the price increase, as these contracts are more liquid than the area markets.

Then they buy a token in the area market, increasing demand and price. In most controlled supply, there is little pressure sale, which allows the price to spike.

When removal occurs, the eternal positions in the futures are forced to close a slight slippage. This allows entrepreneurs to lock large income.

Defi's analyst Ignas also weighed the situation. According to Ignas, this pattern has been observed before, especially during the removal of announcements at South Korea Exchange Upbit.

In fact, he noted that delistings used to receive similar, if not more, attention from speculators as new lists in the country.

“A delisting window requires closing deposits, so with a stream of new tokens restricted, Degens will pump the price to get the last hooray before an inevitable dump,” he write.

Ignas referenced bitcoin gold (BTG) as an example. The price of altcoin increased by 112% after Upbit announced its removal, showing that this behavior was still happening.

These cases have caused a debate about whether the “Pump → Delist” pattern is becoming a new trend. As the crypto market grows, these manipulation skills feature urgent need for research, vigilance, and stronger regulation management to protect investors from predators.

Refusal

In compliance with the guidelines of the trust project, the beincrypto focuses on unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify the facts independently and consult a professional before making any decisions based on this content. Please note that our terms and conditions, privacy policy, and disclaimers are updated.