Allotment Status, Grey Market Price And Listing Price

- Summary:

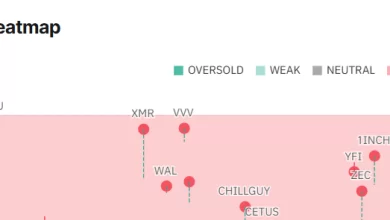

- Investors are conducting careful optimization at the Ather energy sharing price while the gray market price (GMP) indicates an underlying weakness.

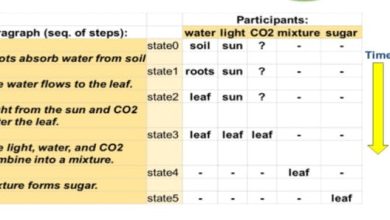

The Ather Energy IPO list will take place on May 6 following the allotment confirmation on May 2. The IPO bidding period is open between April 28-30, with subscribing investors 1.78 times and institution subscription 1.70 times. Ather's energy sharing price will go to 2% premium above the IPO price. The Stock's IPO price is between Rs 304 and Rs 321, in the color -the -colored market, which signed a potential price list of Rs 328.

The Company's electric scooter IPO raises $ 352 million to its IPO, with qualified institutional buyers taking full 54% of shares allocated, with bids worth Rs 15.6 billion. On the other hand, investor bids enter Rs 5.31 billion. A large portion of the IPO fund, which equates to nearly $ 111 million will go setting up a new e-scooter manufacturing plant in Maharashtra.

Halo -Come on insights for Ather's energy sharing price

India is moving towards green energy, with 50% of energy needs that are expected to come from changeable resources by 2030. It provides a large market for Ather Energy's two-wheeler scooter. The company's IPO attracts bids from stunning institutions, including the Tamek and Abu Dhabi Investment Authority, and boasts the presence of hero motorcorp as one of its largest shareholders.

See also

Some analysts have interpreted the Ather Energy Ipo of somewhat underwhelming performance and marginal Gray Market Price (GMP) premium as a sign of a weak debut in the stock market. In addition, the company was not useful because it started operations twelve years ago, presenting a weak proposal. Noteworthy, despite being a pioneer in the EV industry, Ather has been -outmuscled by relatives of newcomers such as Bajaj, Ola Electric and TVs.

However, newly raised funds, some of which will go into debt repair, marketing and R&D can injection fresh impetus to the company and help it develop traction. That said, the close performance of the ather energy sharing price can be severely affected by the existing geopolitical tension between India and Pakistan triggered by Kashmir attacks.