AI Agents Lead Crypto Recovery with 39% Price Jump

According to the latest data, tokens of artificial intelligence (AI) have released other crypto sectors over the past 30 days, experiencing a fantastic growth price growth of the double digit.

This progress came in the midst of a broader market recovery, with AI agents emerging as dominant narrative.

AI agents led to the recovery of the crypto market

After enduring significant losses in Q1 2025, the AI agent sector saw a well -known cycle. In early March, Beincrypto reported that its market capitalization dropped $ 4.4 billion, marked a sharp 77.5% decline from high time.

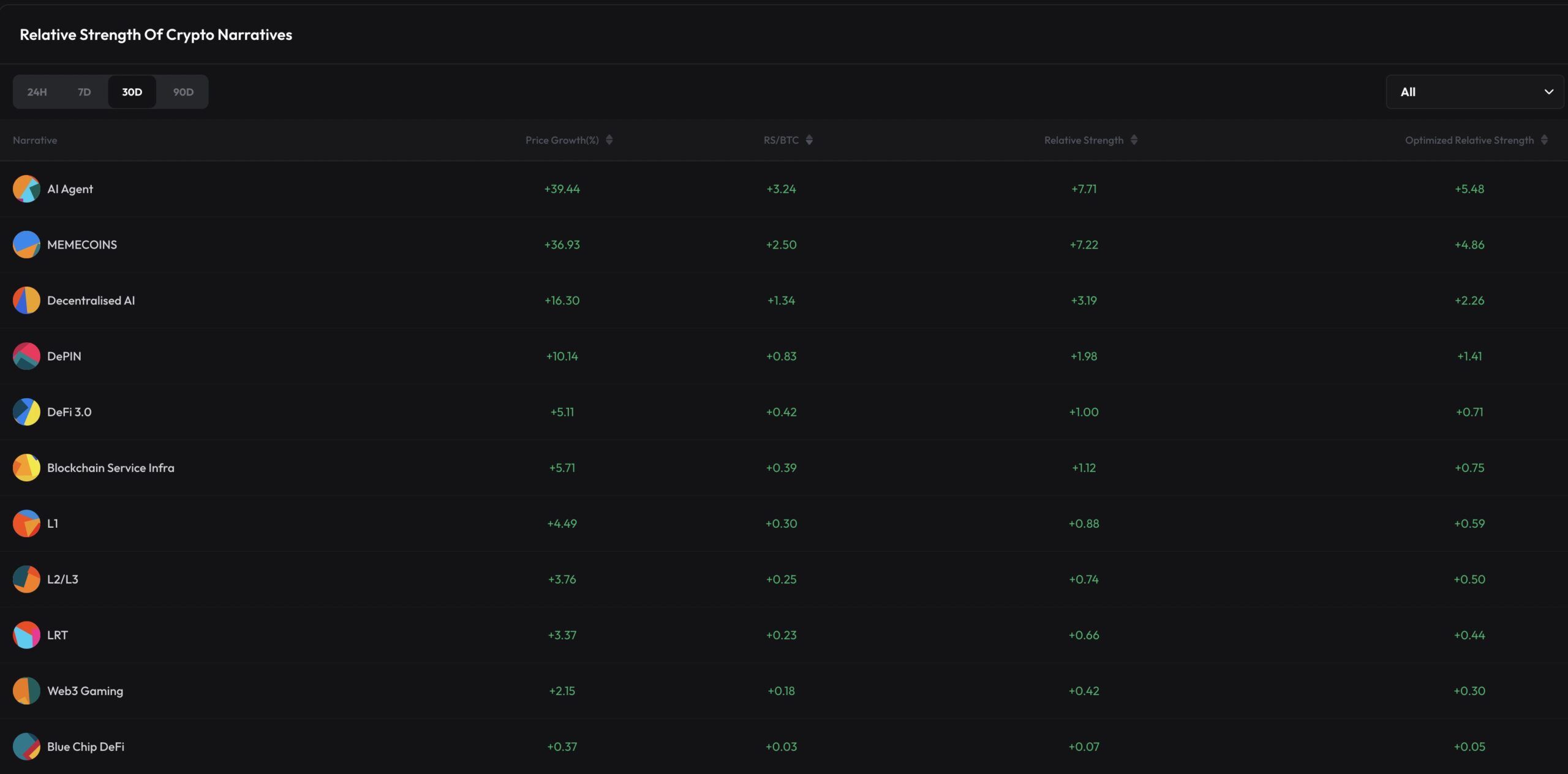

However, the momentum was reversed. Last month, AI agents saw a 39.4% price growth. The sector has released other narratives such as meme coins (+36.9%) and decentralized AI (+16.3%) in the last 30 days.

With the highest -child -child -child score of +7.7, the tokens showed extraordinary momentum, featuring their increase in appeal to investors.

Coingecko data shows that this progress has led to the total capitalization of the AI agent's tokens market for $ 6.4 billion. Among the top ten tokens, the virtual (virtual) protocol saw a rare 142.8% increase in value, whipping a two -month -old. The growth of the token is supported by a well -known revolt with active users, which has signed a strong community and adoption.

Moreover, AI16Z (AI16z) and Aixbt of virtuals (AIXBT) jump 72.1% and 66.1%, respectively.

“AI agents are the hot rotation today-and Santiment supports it a clear surge in social dominance for the” AI agent, “reflecting the sharp sector at full price,” a user mentioned In X.

Greater interest in the sector extends outside the crypto market, as evidence of Google Trends Data. Last week, the search volume for the keyword “AI Agents” sank to 100. At the time of writing, it stood at 94. It reflects the growing public curiosity, both inside and outside the blockchain space.

Does Fomo release the latest climbing AI agents?

However, despite the bullish emotions, some experts remain skeptical. Simon Dedic, CEO of Moonrock Capital, has drawn attention to recent AI and meme coins.

According to him, this trend reflects what he describes as the “last mid-curve trade.” In other words, many investors who have previously stayed on the sides are in a hurry to invest in these sectors. However, they are encouraged to lose (FOMO) with potential benefits as market conditions improve.

Thus, the dedic is extremely critical to this behavior. He suggested that these investors are more focused on chasing trends than making good, long -term investment decisions.

“They deserve to lose everything — and most of them probably claimed.

As the market continues to change, only time will reveal whether these tokens can maintain their momentum or if the speculation hype will eventually disappear.

Refusal

In compliance with the guidelines of the trust project, the beincrypto focuses on unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify the facts independently and consult a professional before making any decisions based on this content. Please note that our terms and conditions, privacy policy, and disclaimers are updated.