AI agent platform Virtuals Protocol is now mostly controlled by whales

Virtuals protocol (virtual) is one of the hottest recovers of tokens, which strengthens many other AI agents. However, on-chain data shows the virtual switching to whale wallets, controlling most of the supply.

The Virtuals Protocol (Virtual) has seen a lot of funds from whales, which have signed accumulation in recent weeks. Virtual recovered along with other AI agent's tokens and is now about 63% down from its climax after weeks of wise money.

Buying Virtual interest leads to a Concentration of token in the hands of leading merchants and whales. Based on Solana On-chain data, around 93% of virtual tokens are held in the top 100 purses.

On-chain data from bubblemaps also shows increase activity At the gate.io exchange, with a cluster of dompets linked to the centralized market for high-frequency transfers.

Open interest grows for virtual protocol

The protocol of virtuals is drawn in smart money purse, which further strengthens the positioning of whales. A sum of 63.7% of virtual tokens has been locked, leaving a significant portion of large wallets, prepared for long-term unlocking and community rewards. In recent weeks, the new accumulation of whale has changed the distribution of the token toward larger wallets.

The Virtuals protocol raised $ 16.6m with various funding, with the largest part of the fundraising in the form of an Ido in the Fjord Foundry. The protocol will also be held by many smaller VC-funded cycles, with no significant team allocation or contributor.

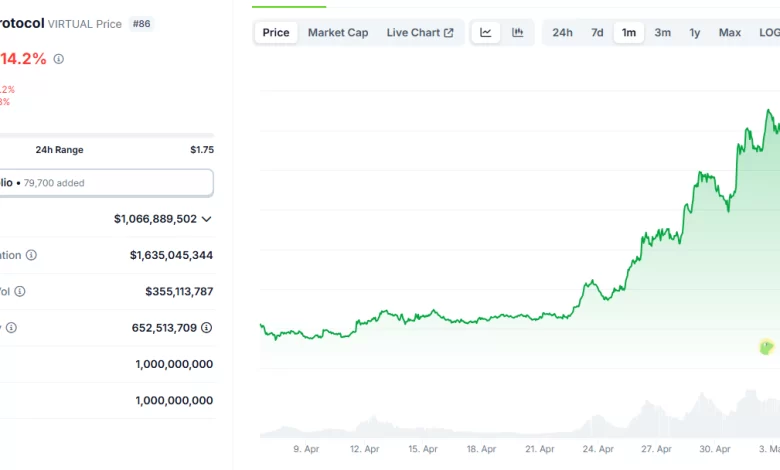

Virtual has passed a period of increasing interest in purchase, pushing the price to a month of over $ 1.80. The token returned to $ 1.66, which is still leading the general recovery of the AI agent's narrative.

Derivative trading for virtual rose last month from recent lows of $ 15m. The derivative positions now cost more than $ 111m, showing the modified token performance bets.

Currently, long positions are slightly dominant, although there are attempts to be briefly owned. Derivative trading is independent of virtual accumulation. Businessmen are still making a speculation that the platform will recover and trade on a higher range.

Virtual Rose with increasing activity in April

Last month, the activity in the protocol of virtuals was taken after two months of excessive low activity.

Solana activity remained almost unchanged, but base users were taken again. In April, the active purse that creates and interacts with agent tokens reach 10k days again.

The AI Agent Ecosystem is also concentrated on some leading projects, including Aixbt, Game, Sam, Vader, and Luna. AVA is another trending token, even with a smaller market capitalization. In total, the value of AI agent tokens returns to the top $ 570m.

The AI agent agents are also quite concentrated in a small community. Despite the resemblance of the memes, a smaller circle of owners is purchased in these possessions.

On-chain data shows only 9,792 individual wallets holding AI agent tokens, suggesting the accumulation of whale and insider. The Virtuals Protocol aims to expand the ability to create agents, however the ecosystem seems to have been made by large projects and also controlled by whales.

Cryptopolitan Academy: closely – a new way to earn passive income with the defi in 2025. Learn more