Top 3 AI Coins For May: IP, VIRTUAL, GRASS

The AI pieces continue to draw great attention before the first week of May, with history (IP), virtual (virtual) protocol and the grass standing up for various reasons.

The story has shown modest gains but remains below the explosive pace established by other AI projects. Conversely, Virtual jumped almost 90% in just seven days, benefiting from the beaten renewed around the agents of Crypto AI.

History (IP)

History (IP) has increased by almost 5% in the last seven days, but has been underperforming compared to the other main parts focused on AI during the same period.

While many AI tokens have seen explosive gains recently, the more modest decision of Story suggests a slower construction.

Despite the discrepancy, history remains a project with fundamental solids and increasing relevance in the space of decentralized content, which makes its pricing behavior to watch closely.

Its market capitalization is now just greater than $ 1 billion, a psychologically important threshold that could influence the future feeling of investors.

Technically, IP is currently negotiated very close to a key support at $ 3.82; If this support fails, the next main drop in decline is $ 2.97.

However, if the support is maintained and the momentum improves, IP could reach $ 4.49, and with higher purchase pressure, extend the gains to $ 5.04, or even $ 6.61.

Virtual (virtual) virtual protocol

Virtual has jumped almost 90% in the last seven days, fueled by a renewed excitement around the accounts of artificial intelligence and Crypto AI agents.

While AI's accounts find traction through the market, Virtual has positioned itself as one of the main beneficiaries, quickly recovering attention after months of quieter negotiation.

The solid rally highlights market appetite for AI and Virtual AI projects in a strong position before the next major technical levels.

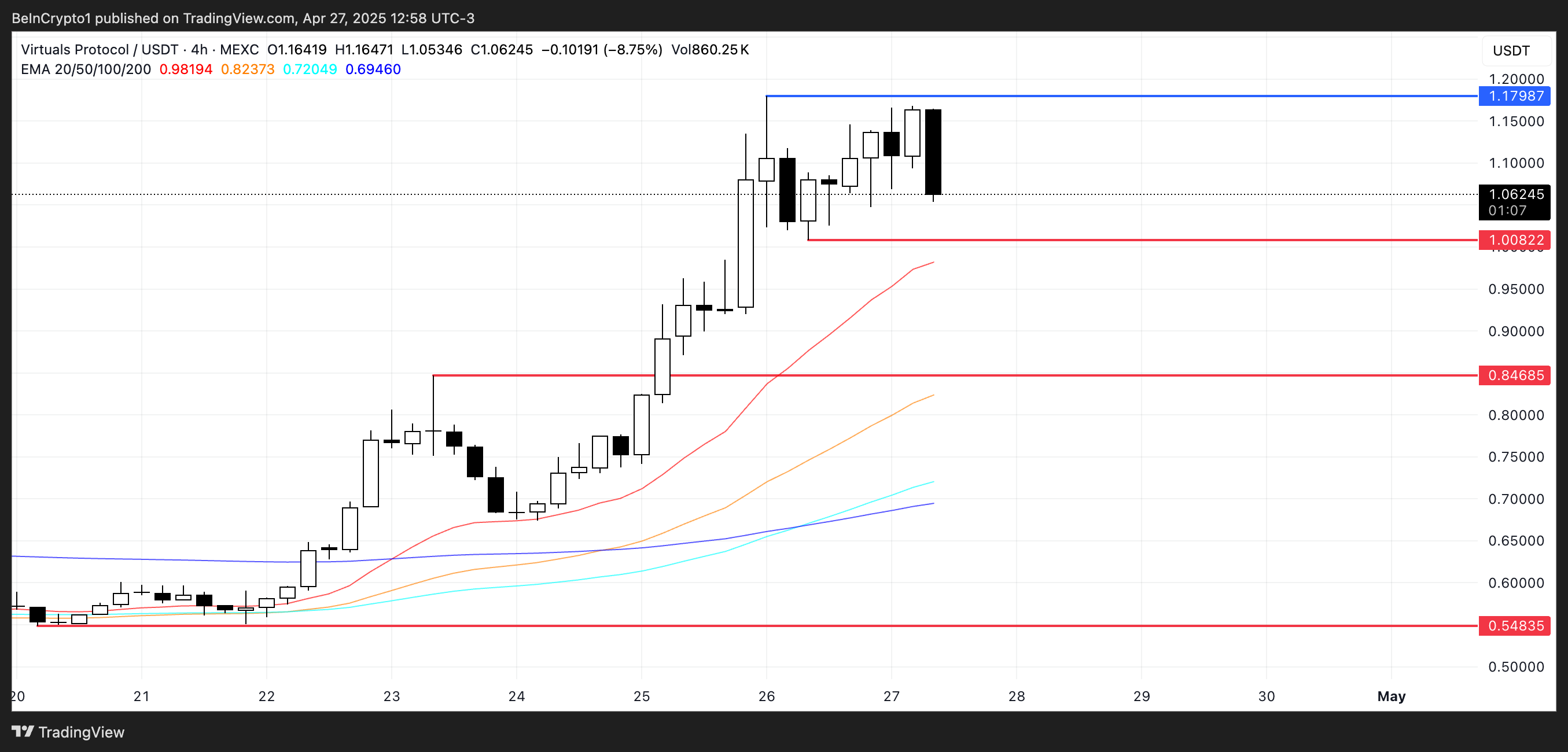

Currently, Virtual approaches a key support at $ 1.008; If this level is lost, targets to the following decrease would be $ 0.84 and potentially $ 0.54 if the sales pressure is intensifying.

However, if Virtual can maintain his positive impetus, he could reach resistance at $ 1.17.

A successful break above this resistance could open the way to a move to $ 1.30, and if the purchase of interest remains strong, even $ 1.50 – a level level of level has not seen since February 5 – could be at hand.

GRASS

The grass has been disappointing compared to other major parts of AI, its price moving by 0.4% in the last seven days.

While many AI tokens have published strong gatherings recently, the grass has remained relatively stagnant, which suggests that the bullish momentum has cooled.

Despite the mute performance, the grass still shows signs of underlying force, but it remains uncertain if it can capitalize on the wider story of the AI.

Technically, the EMA de Grass lines are always optimistic, with the short-term averages positioned above the long-term averages, but the gap between them is narrow, alluding that the trend could soon change.

If the pressure sale resumes, the grass could test support at $ 1.63; The loss of this level could lead to new drops to $ 1.56 and even $ 1.45.

However, if the grass can bring together enough strength to test and exceed the resistance of $ 1.74, it could open the door for a higher movement at $ 1.82 and potentially $ 1.90.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.