Bitcoin trades at ‘40% discount’ as spot BTC ETF buying soars to $3B in one week

Key Takeaways:

-

Data suggests that Bitcoin is currently trading in a 40% discount.

-

More than 36,000 Bitcoins were withdrawn from Coinbase and Binance on April 25.

-

The Bitcoin fracture pattern from Q4 2024 could push prices above $ 100,000 in April.

Bitcoin (BTC) is currently trading in a 40% discount on its intrinsic value, according to Capriole Investments founder Charles Edwards.

In a recent post on X, Edwards Highlighting That since the stop of April 2024, which reduced block rewards to 3.125 BTC, the amount of bitcoin's energy – an estimate based on mining costs and energy consumption – runs at $ 130,000.

Recent data from Cryptoquant It is indicated that more than 8,756 BTCs ($ 830 million) have been withdrawn from Coinbase on April 24. Negative Netflows from Coinbase may teach towards institutional purchase, or ETF -related purchases that reflect the underlying demand.

These development lines along with the Bitcoin ETF inflows area witnessed this week. Bloomberg ETF analyst Eric Balchunas suggests that institutions have been in a $ 3 billion 'Bitcoin Bender' in recent days.

Binance also witnessed the exchange outflows of 27,750 BTC on April 25. Alphractal Founder Joao Wedson said That is “This is the third largest Bitcoin flow in the history of the exchange.” Although large flow and positive price actions suggest bullish tailwinds, Wedson said they do not automatically mean an ongoing rally. Said the analyst,

“In 2021, the massive stream did not prevent the dump from being banned by China's crypto ban (April -may). On the other hand, the ongoing flow within days, such as the fall of the FTX, which signed under and recovery.”

Related: Bitcoin ETFS at $ 3B 'Bender,' Elog First Full Week of Pwing in 5 Weeks

Can it Bitcoin Fractal Push BTC above $ 100k in April?

Bitcoin's weekly performance marked its highest return in 2025 and the most important revolt since November 2024. In addition to the same return, the BTC price also reflects similar price actions.

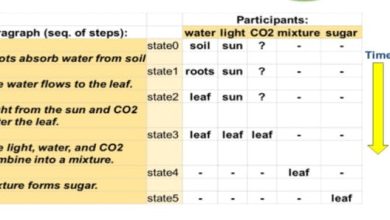

As described in the 1-day chart, Bitcoin is combined with a higher range after its breakout, reflecting its behavior from Q4, 2024. (Circle). After a 13% increase between November 5-9, the BTC posted another 15% increase on November 10-11. Breakout took place on the weekend too.

Similarly, BTC prices rose 11% between April 21-25. With the relative index index (RSI) also shows a similar purchase pressure, a 7-10% jump in the next few days can take BTC above $ 100,000.

While fractal patterns may be repeated, they are not perfectly reliable. Unlike Q4, when Bitcoin entered the price discovery and raw without resistance, the current level of overhead resistance to $ 96,100 could hinder a breakout.

Related: Bitcoin spikes in 7-week high as analyst doubt with $ 100K rebound

This article does not contain investment advice or recommendations. Every transfer of investment and trading involves risk, and readers should conduct their own research when deciding.