Gold Price Drops $180 from Record High as Risk Appetite Returns — Will $3,200 Hold?

- Summary:

- Gold slips below $ 3,300 while US-China Optimism lifted the sentiment at risk. Here's what the driving prices and the basic support levels to watch the next.

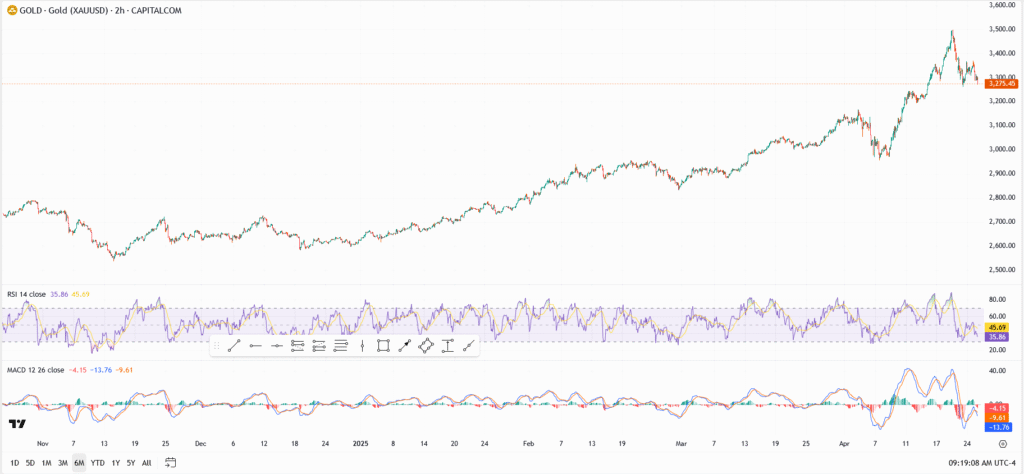

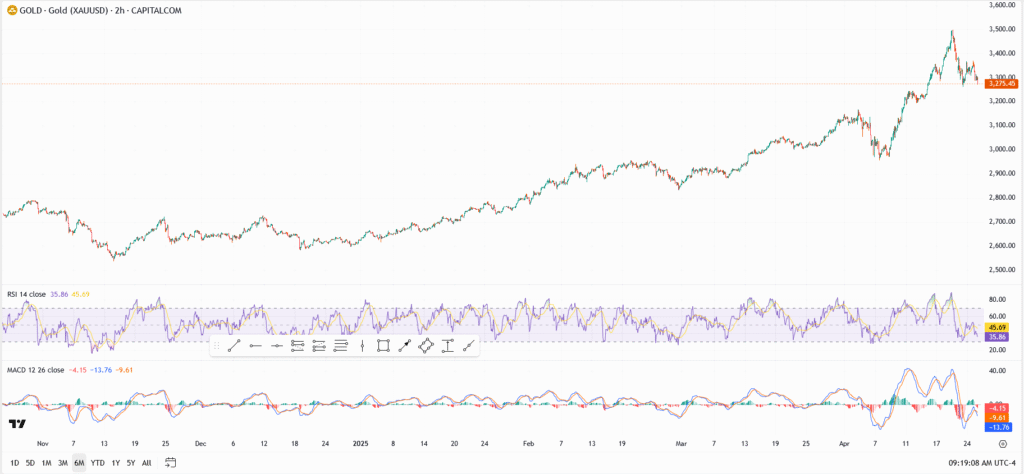

The gold (XAU/USD) returned to the bottom of $ 3,280 on Thursday, its bullish streak while the US dollar was re -granted the dollar and risk of danger saw a short riot following the revised talks between the US and China. The metal is now trading nearly $ 200 from all times high, as entrepreneurs revolve around safe properties and re-evaluate the possibility of rate cuts this summer.

Despite the pullback, gold remains one of the leading performance of the property of 2025, boosted by adhesive inflation, middle bank purchase, and geopolitical hedging. In the markets still on the side of trade risks and tensions in the Middle East, the floor for gold prices appears to be rising – but the reverse momentum clearly breathes.

Gold Technical Analysis: Key Levels To Watch

- Levels of resistance:

- $ 3,320-since high from mid-week rally

- $ 3,385-shortly double top

- $ 3,450-Recent All-Time High (ATH)

- Support in zones:

- $ 3,210 – key fib level and rising demand zone

- $ 3,100 – Base of March integration

- $ 2,970-support of trendline from February-March uptrend

Gold loses steam but is still above critical support. Setup suggests a phase of cooling, not a collapse, unless $ 3,100 is broken specifically.

What's behind the golden price that sinks now?

The pullback came as the US dollar bounced slightly and hoped for a diplomatic victory between the US and China dim in some safe appeal. A stronger greenback is usually weighing gold, which is priced at dollars and becomes less attractive -to foreign consumers when money rallies.

However, the Macro backdrop remains gold-friendly: the middle banks continue to accumulate reserves, real produce returns, and inflations remain above many G20 targets. For long -term bulls, this correction may be a return, not a recurrence.

Did the gold still buy in 2025?

This year's 25% gold rally reigned in the classic debate: Is this the start of something bigger, or is the metal out? Historically, parabolic moves like this do not maintain without pause, and that's exactly what we see today. Today, wise money will appear with caution in the short term, but keeping the long-term exposure.