ETH, and SOL After Bitcoin Halving

- Summary:

- Is the Bitcoin market spinning – to lead Ethereum and Solana to the next rally? Basic prices and predictions for BTC, ETH, and Sol.

Bitcoin will be held above $ 94,000 after a highly expected division, but exploding Breakout entrepreneurs have not yet raised. Instead, the market feels coiling – a calm before the next wave direction.

The Ethereum shows mixed signals, which walks below $ 1,800, while Solana continues to attract capital to the meme coin, driving a market cap closer to the $ 80 billion mark. Throughout the board, the crypto sentiment remains carefully optimistic.

Bitcoin combines those who got after dividing – Is a breakout coming?

Bitcoin trades at $ 94,603, holding close to high-halving highs with signs of stability but not yet breakout energy. The RSI in the 2-hour chart drives above 65, and the MACD momentum remains tilted upside down. But the bulls clearly stopped fighting near the psychological $ 95,000-96,000 zone.

This sideways chop is not uncommon after dividing. Historically, Bitcoin is combined before making a long run, often months later. The supply shock narrative remains intact, but today's price action depends excessively on greater liquidity, ETF flow, and whether macro risk assets remain pleasant.

Bitcoin chart analysis

- Levels of Support: $ 91,200 / $ 88,000

- Levels of resistance: $ 96,400 / $ 100,000

A clean move above $ 96k can unlock a running towards six numbers. But so far, the BTC is covering, not angry.

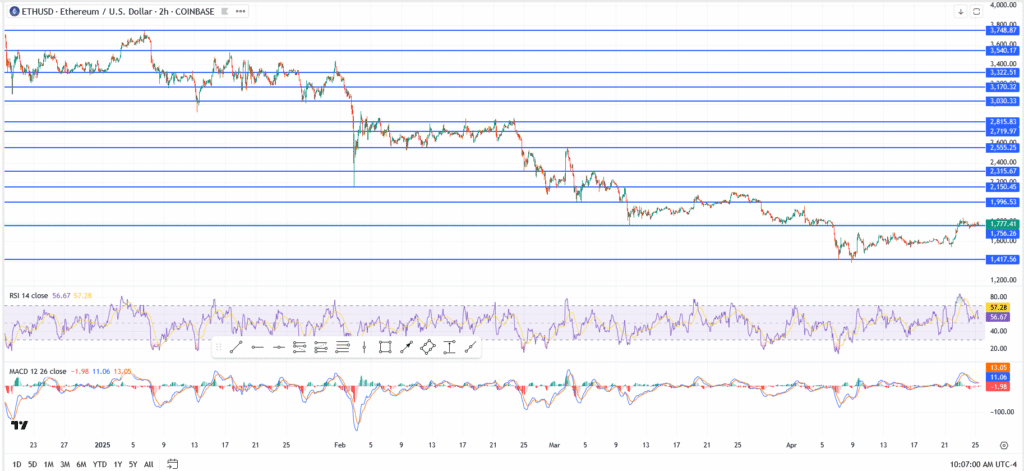

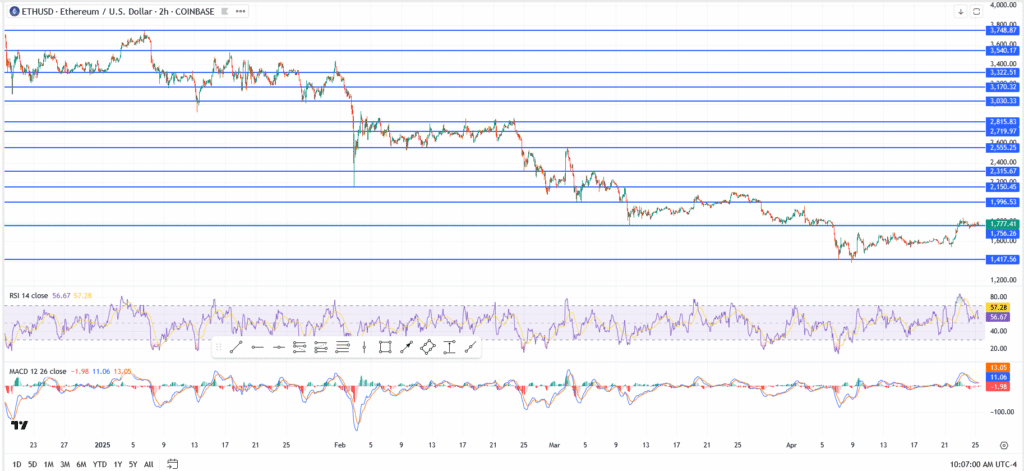

Ethereum price struggles near $ 1,800 as bulls and bears tug war

Ethereum opened Friday under pressure, the trade below the key $ 1,800 level despite posting a moderately sunny benefit. Momentum is surprising to a critical pivot, with the RSI walking near 56 and the MacD that is raising, signing an indecision instead of driving. For bulls to recover control, ETH requires a clean recovery of $ 1,800 – not just a wick above it, but a firm close and handle.

The institution's flows are selective, with spots ETF ETF recording $ 63.5 million in net inflows on Thursday, the highest in three weeks. The open interest has risen to $ 9.8 billion, suggesting positioning is the development of the long side.

This is not a complete return, but it is far from a breakout. The Ethereum sits in a delicate spot, and the next 48 hours are likely to dictate whether the bulls are pushing by resistance or folding under pressure.

Ethereum chart analysis

- Resistance: $ 1,800 → $ 1,836 → $ 1,876

- Support: $ 1,745 → $ 1,700

Institutions buy dips, but on-chain weaknesses are above.

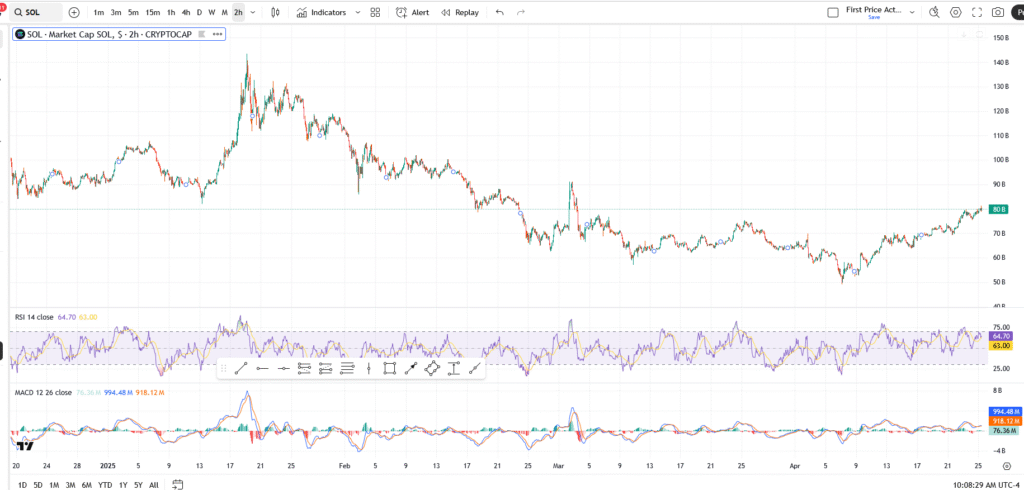

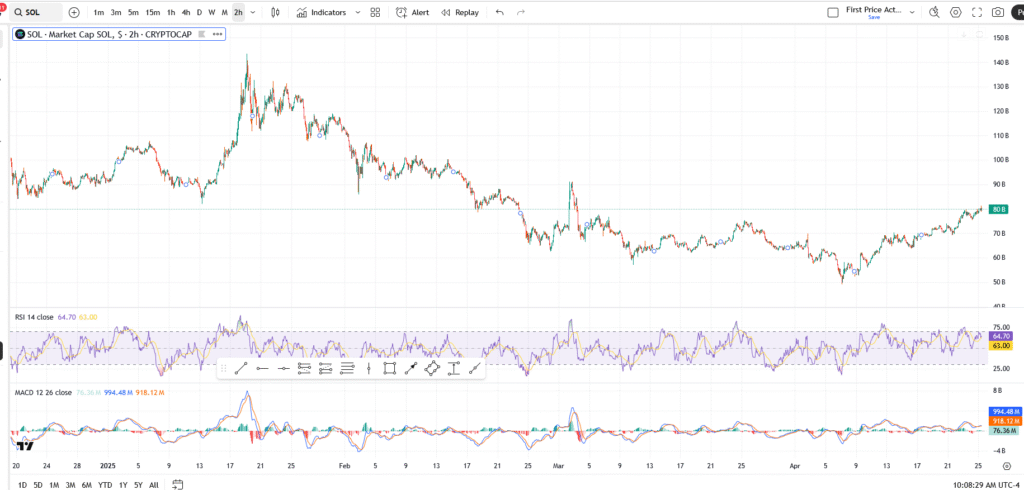

Solana captures $ 80b market cap – meme mania or wise money spin?

Solana's total market cap has been walking around $ 80 billion, and the price action has been higher over the last week. Businessmen revolve around the launch of the Sol Amid Meme Coin and growing developer activity in the chain.

Solana's strength stands primarily as Ethereum struggles to maintain utility metrics. Coin memes such as WIF and Bonk attract massive volume to Solana-based DEXs, which contributes to increased transaction count and income revenue.

Solana chart analysis

- Levels of resistance: $ 85b → $ 91b

- Levels of Support: $ 74B → $ 70b

If Solana breaks above $ 85B with volume, it can run-run the next Altcoin cycle.

Finishing take: twist, patience, and the waiting game

Bitcoin stops may be completed, but the effect is just beginning. While combined with BTC, ETH and Sol are fighting for dominance in the market under the surface. The Ethereum has institutional tails but are weak on-chain metrics, while Solana succeeds in retail and alt-season hype energy.

It's not an euphoric melt-up-it's a calculated rotation. And when one of these three breaks is decisive, the rest is likely to follow.