BlackRock Warns Quantum Advances Could Undermine Bitcoin

Blackrock has updated its S-1 recording declaration for the Ishares Bitcoin Trust (IBIT), introducing a new language that describes the potential risks posed by quantum computer science.

This revision, deposited on May 9, reflects an increasing awareness of industry to the way in which advanced IT technologies could have an impact on the cryptographic systems used in digital assets.

Blackrock flags quantum risks theoretical to bitcoin safety

In the depositThe asset manager has warned that future progress in quantum IT could undermine the security framework that underpins bitcoin.

If quantum technology evolves far beyond its current state, it could make cryptographic algorithms used by obsolete Bitcoin.

This could allow malicious actors to exploit vulnerabilities, in particular to access unauthorized access to portfolios that store Bitcoin for trust or investors.

While quantum computing is still developing, Blackrock stressed that the complete technology capacities remain uncertain.

However, the company considers that it is important to disclose any theoretical threat which could affect the performance or safety of its cryptographic investment products.

Bloomberg ETF analyst James Seyffart said that update is a key factor that is standard in ETF deposits. He explained that issuers regularly list all potential, so distant threats.

“To be clear. These are only basic risk disclosure. They will highlight everything potential that can be mistaken with any product that they list or underlying investment. It is completely standard. And honestly a meaning,” added Seyffart.

In particular, the BlackRock deposit also covers concerns about regulatory actions, energy consumption, mining concentration in China, network ranges and previous market events such as the collapse of the FTX.

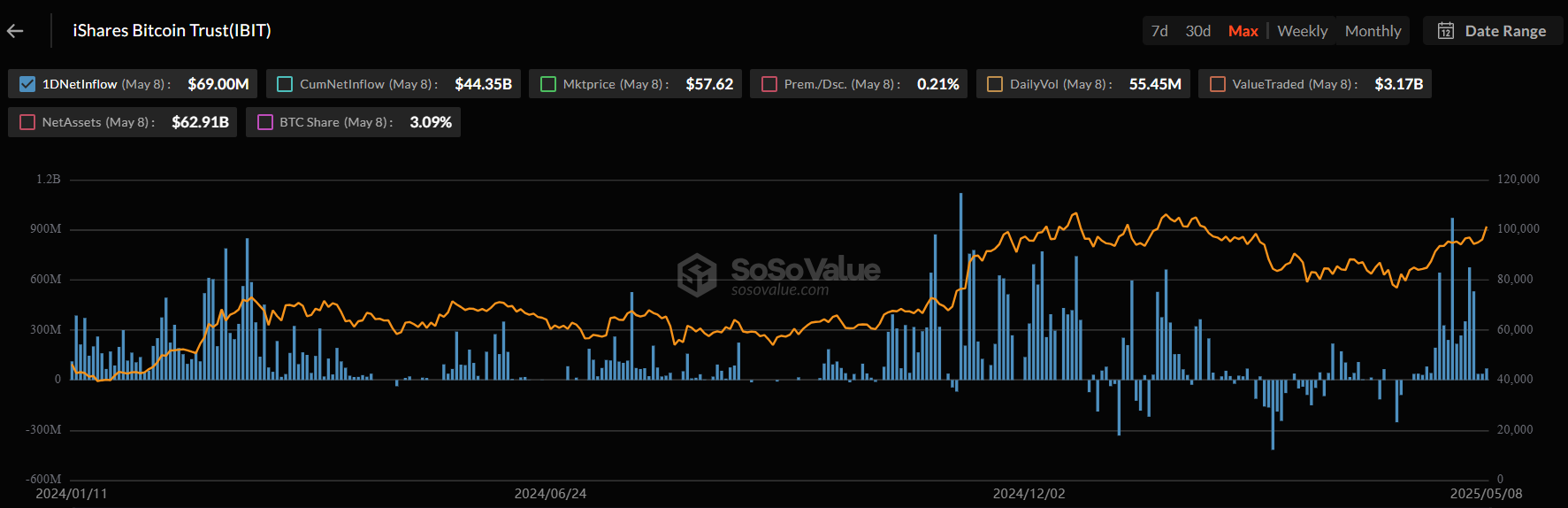

Despite these warnings, Ibit remains the largest ETF Bitcoin on the market. He recorded 19 consecutive days of entries, attracting more than $ 5.1 billion during the reference period.

The ETHE ETHEUM file adds a buyout structure in kind

In a separate file, Seyffart revealed that Blackrock has also changed its S-1 application for Son ETF.

The new version includes plans to take charge of creation and buy -in in kind – a model allowing investors to exchange ETF shares against Ethereum, instead of using money.

This structure could reduce transaction costs and reduce market friction. It also avoids the conversion of crypto to fiduciary currency, which is currently required in the model -based model. The approach can help issuers minimize price shift and save on negotiation costs.

The dry has not yet approved models of redemption in kind for FNB Crypto, but analysts expect progress this year.

“Eric Balchunas and I expect the approval of the dry for in kind at a given time this year … In particular, the first application for one of the ETHEREUM ETHERE made it possible to create/buy back in kind to a final deadline around ~ 10/11/25”, Seyffart note.

The BlackRock file follows the meeting of the cabinet with the American Securities and Exchange (SEC) commission to discuss the tokenization of ETF Crypto Etf and titles.

Non-liability clause

In membership of the Trust project guidelines, Beincrypto has embarked on transparent impartial reports. This press article aims to provide precise and timely information. However, readers are invited to check the facts independently and consult a professional before making decisions according to this content. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.