Stocks shrug off the tariff cut

Today, we have significant news about potential tariff cuts in China. President Trump suggested that “80% tariff in China seems to be right” in advance of upcoming trade communication with Chinese officials. This represents a huge decrease from the current tariffs, reaching as high as 145%.

What is particularly interesting – and says – the reaction of the stock market to this news.

Despite what is usually considered positive for the economy (lower tariffs), the stock market does not respond with enthusiasm. As of writing, the stocks are slightly decreasing, suggesting one of two things (or both):

1. The market does not believe that these tariff cuts are material that will improve economic outlook, or

2. The market is primed to go down based on technical factors and emotions, extremely what will usually be positive news.

This reaction is aligned with what I have talked about in previous alerts – ghosts do not always respond to news in direct ways, especially if technical and market position conditions point to a particular direction.

The doubt in the bond market in strengthening the trade

The reaction of the bond market to this news provides further context. Treasury's produce has not seen significant movement, suggesting fixed income investors remain skeptical about the long-term economic impact of potential tariff adjustments.

From a technical analysis perspective, the act of today's price further proves what the charts have told us: the market is likely to be positioned for a significant decline regardless of the flow of news. When markets fail to rally at positive news, it is often a sign that the sale of pressure remains dominant. In other words, even though the stocks are moving small, the message is strong: stocks want to come down here.

This is deep, because the performance of stocks along with one of the USD index together provides a basic background for many markets, including goods (such as copper) and precious metals.

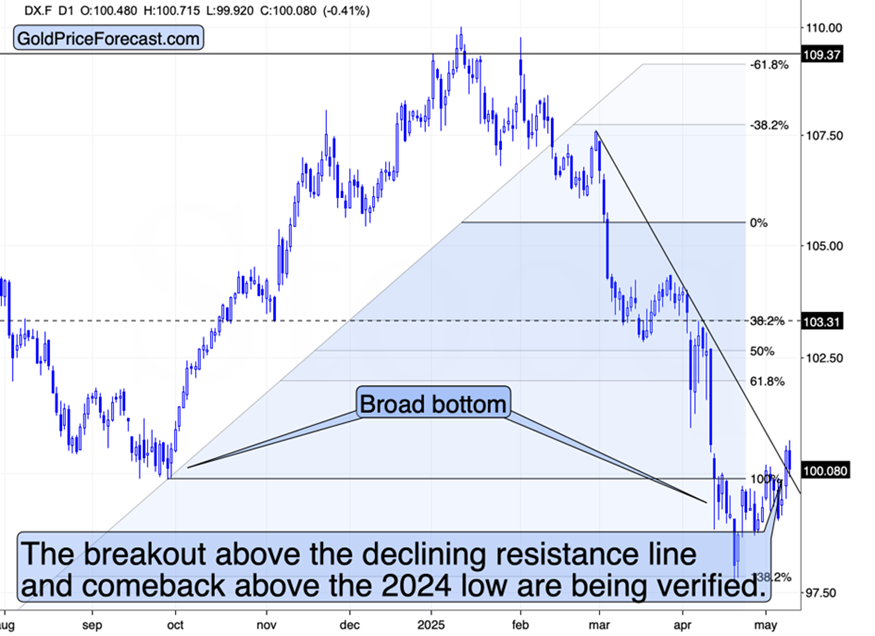

And the latter also did something that was truly noticeable (and in accordance with what I wrote about many days today). Especially, it climbed above 2024 low and the denial of the resistance line.

Yesterday, before the rally, I commented on the above chart in the following way:

“On a short -term basis, we see that the USDX is on the verge of breaking above the steep, declining the resistance line. At the same time, a rally above this line will also return to the USD above the lows this year, thus improper damage.

This is the most likely way forward, and when this happens, it will be clear to many market participants that the trend is reversed.

That is when denial of the important metal market will be greater. “

In fact, the USDX refused, and gold refused. Today, the USD index corrects this rally, while gold is correcting its collapse.

Due to the USD breakout, this is perfectly normal, and because of the denial of the resistance – this is proven as support. This is a bullish set-up for the USD index.

Breakout verification above the short-term resistance line as well as improper movement below 2024 low confirms the very bullish perspective. Especially this is the case, because so many outdoor investors still have a bearish on US money. (Reverse Asian Financial Crisis, Anyone?)

As a result, the transition now higher in gold has little consequences. The same goes for silver and mining stocks.

Bearish momentum builds gold

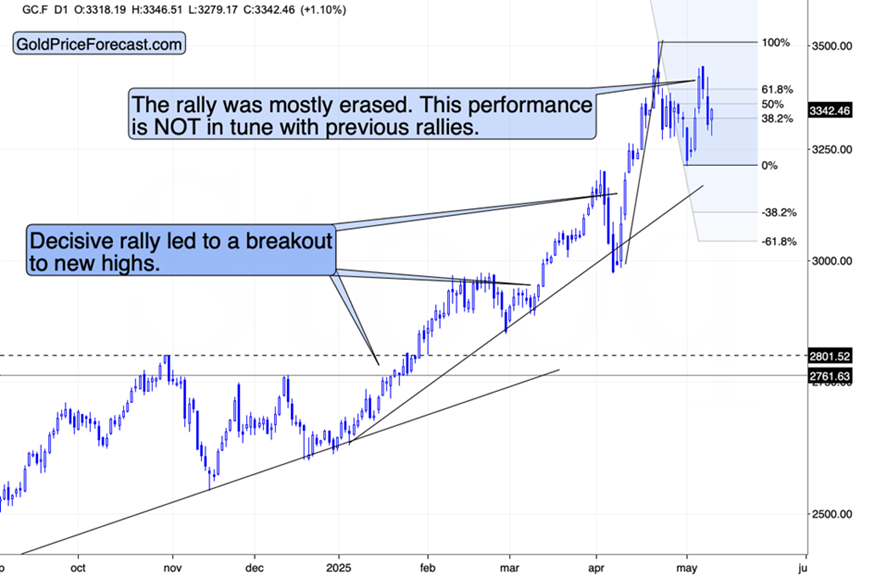

What is the consequence is that the recent Gold price performance is clearly different from what we saw earlier this year, when gold was approaching the previous highs. The rally was temporary, as I warned.

The gold used to move into previous highs in a steady way and then break above them. There is a small pause after the breakout, but there are no corrections before the breakout, let's significantly.

The fact that we saw significant gold decline this week and a move back under 38.2% fibonacci retracement (close yesterday) clearly proving that the previous bullish pattern was broken.

Now, as the USDX proves its breakout, the odds for falling gold in the following days/weeks will continue to increase. This translates to the same views for silver stocks and mining.

And if the stocks are declining – and they are likely to do that – the decline in silver and miners is likely to grow.

Also, since the tariffs are now moving, the gold tariff and the appeal based on uncertainty will decrease. At the same time, tariffs are likely to remain sufficient to cause economic damage to the world's economies, which supports declines in stock markets and commodity prices. Of course, there are ways to earn in this situation.

Do you want free follow-up to the above article and details not available to 99%+ investors? Sign up to our free newsletter today!