Bitcoin Set To Soar? Top Analyst Ties BTC Surge To Global Money Supply Boom

Bitcoin crossed the level of $ 100,000 this week, reaching $ 104,000 before moderating at around $ 103,000. This decision was made after the US and Chinese officials sit in Switzerland to speak of a possible trade agreement. The markets responded quickly. Optimism has returned, and Bitcoin Pink accordingly. But analysts see beyond the headlines. Global liquidity is the real story.

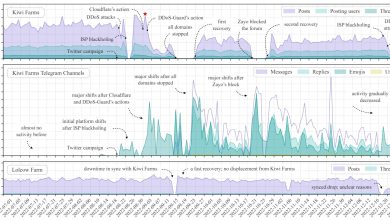

Global M2 reaches 111 billions of dollars

Julien Bittel, a macro researcher at Global Macro Investor, is of the opinion that the global money supply of M2 is a good lead indicator from the place where Bitcoin Va. He presented a graphus illustrating a 12 -week offset between the increase in the M2 and the price of the upper crypto. In terms briefly, when M2 increases, Bitcoin follows about three months later.

Many of you have asked for the Global M2 VS Bitcoin Chart. Well, here it is …

And yes – he always tells the same story:

We go above … pic.twitter.com/kv7qse9ign

– Julien Bittel, CFA (@bitteljuen) May 9, 2025

Between the beginning of 2023 and the beginning of 2024, the world M2 went from 98 billions to just over 108 billions of dollars. Bitcoin has arrived, finally exceeding $ 100,000. But mid-2014, M2 ceased its ascent for a period.

Bitcoin also decreased, falling below $ 80,000 during this period. Bittel called this range as a consolidation phase. Today, M2 Move again – especially. He managed 111 billions of dollars. If this trend continues, BTC could continue to climb in mid-201.

Bittel said: “We are going above”, stressing the strong increase in world M2 as a signal.

Others think Bitcoin is the best dog

Not everyone agrees with the Bittel calendar. Analyst Benjamin Cohen raised doubts about the idea that cryptographic asset is still lagging behind compared to liquidity changes. He stressed that Bitcoin reached his heights in 2017 and 2021 before M2 culminated. This does not correspond to the theory of M2 leading BTC of 12 weeks.

Cohen has provided an alternative perspective. He thinks that Bitcoin could very well lead, with modifications made to M2 later. If this is the case, then the recent ascent of the medal may concern us that global liquidity could decrease in the coming months.

And if #Bitcoin Liquidity leads, rather than winning it?

Many people show this graph, where they compensate Global M2 from 3 to 4 months old and show that BTC follows it.

The problem is that in 2021, this discrepancy shows that M2 increases 6 months after the removal of BTC. pic.twitter.com/gpkbw9jbog

– Benjamin Cowen (@intocryptverse) May 8, 2025

FTX collapse still resonates

Cohen also referred to what happened in 2022, when Bitcoin fell hard. This drop coincided with the bottom of M2- but the drop has persisted longer due to the debacle of the FTX. He argued that Bitcoin price movements do not always adhere to the same chronology as M2. Exchange failures like the one we experiment can disrupt the pace.

This perspective reveals another type of forecast. If BTC is lagging behind, rather than directing, the current rally can indicate a danger on the horizon – not resilience.

PEXELS star image, tradingView graphic

Editorial process Because the bitcoinist is centered on the supply of in -depth, precise and impartial content. We confirm strict supply standards, and each page undergoes a diligent review by our team of high -level technology experts and experienced editors. This process guarantees the integrity, relevance and value of our content for our readers.