America’s seniors lost billions in crypto scams; here’s how we can stem the tide

We have spent decades creating regulations to protect older adults from lending predators and abusers. But don't we pay attention to the digital threats they are facing today while transaction online? This fierce fact is evident when reviewing the latest Crime Crime report (IC3) of the FBI.

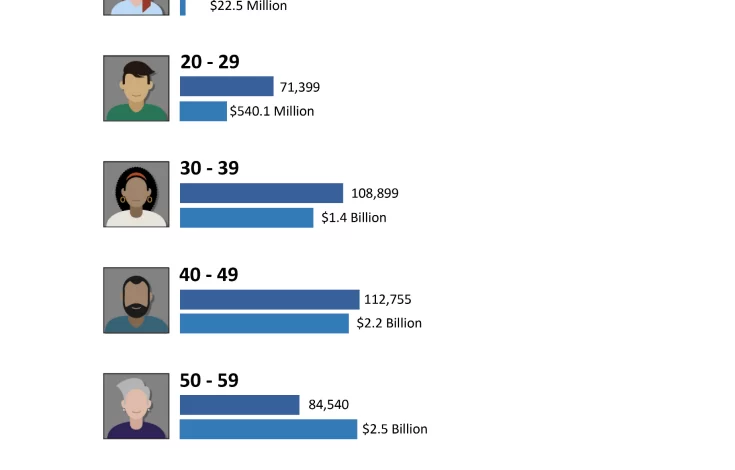

According to Studying IC3Americans aged 60 and older lost $ 4.8 billion in Cybercrime in 2024, a 43% Jump Yoy. The findings also revealed another restless fact. The findings also revealed another restless fact: they filed 147,127 complaints, of which 7,500 lost $ 100,000 or more. That is more than any other age group.

This is not just a financial crisis. It paints a picture of a systematic failure to protect a generation who has built the wealth of this country but remains dangerous to be prepared for digital threats.

What does it say about us if we allow our parents and grandparents to catch online? If we were shrugged when the most trusted generation became the most exploited? Beyond cybersecurity issues, this is a national character test. And now, we failed it.

Why are Cybercrime seniors more susceptible?

Cybercriminals target seniors for a variety of reasons. First, retirees often control the lifelong savings, are clearly home -owned, and institutions of trust such as banks or government agencies -brand scammers are lacking.

Moreover, digital literacy gaps have left a lot of navigating on online financial platforms without the necessary care. That is combined with advancing today's scams that are nothing like clunky, typo-ridden emails of yesteryear. Instead, they are gentle, personalized, and engineered by global crime syndicates, as shown in the screenshot below.

Another factor that increases the weakness of our seniors in online financial crimes is their separation. About 1 in 3 adults over 65 live alone, and sadness prepares them with the targets of romance and pretending scams.

We should re -imagine our systems

Overall, the IC3 report is a statements of our institutions to keep up with the emerging crime trends. Financial service providers, for example, lack real-time scam detection tools. True, our banks are not unusual to remove cash. But they can miss the shift of the wire to the shore Crypto exchangeEven the retireds have been able to do the IRAs overnight.

Compare it to Europe, where commercial French banks are blocking the suspicious transactions in real-time, and the “digital compass” German program trains seniors to see online fraud. The US is caught because it puts the burden of prevention of elders' fraud on most individuals rather than treating it as a systematic risk.

Again, we invested billions of cybersecurity infrastructure. But it has not been done to empower internet users at least use to navigate its risks. Today, there are few states that mandate the fraud education as part of aging services, leaving many seniors in the transition to digital finances.

Finally, the government's response to this plague remains fragment and underfunded. While the SEC is aggressive Police Wall Street, older Cybercrime is running the FBI, FTC, and local agencies without centralized responsibility. This creates gaps, leading to inconsistencies in protection and implementation of the constituents.

Elders in America lose more money in crypto scams than any other procedure

Another disturbing stat from the FBI report is this: Americans over 60 lost $ 2.8 billion up to cryptocurrency -related scams last year. That is what makes them the only affected age group.

Most of these losses come from investment scams ($ 1,8 billion), including “Big butchering. “

This funny accurate nickname refers to long-con schemes that attract victims to fake online relationships with crypto wealth promises. After winning their trust, the offender then their victim was bleeding.

But crypto is not just a threat. Call center scams – especially masqueradings in support of tech or government agencies – have become wild profitable. Only in 2024, older Americans reported that they lost $ 982 million in tech support fraud. That's more than some Fortune 500 companies in the annual income.

In the midst of darkness and disaster, one of the agency's initiatives – level level – commands a rare bright spot. Through the program, the Bureau identified and the secret service of the secret 4,323 potential victims of crypto fraud and intervening, saving them nearly $ 286 million in combined losses.

Although commendable, such reactive steps are only band-AIDS in a bleeding: we need a stronger, long-term intervention to nip the vice to its bud.

So, how can we try to divide?

Here's what we should do to defend our seniors and ourselves from falling into cyber -related crimes. First, we must invest in target education for our older population. That is possible by developing awareness campaigns that are in accordance with their needs and delivering them through accessible channels such as community centers, libraries, and health care providers.

Besides, America should expand the victims of the victim's support services such as psychological and financial advice. That should coincide with the public's teaching about the need to be victimized. In this way, we can encourage the targets of web -based fraud to open about their difficulties, which potentially release their scammers for action.

The financial and tech industry should also rebuild efforts to implement senior-friendly security measures and fraud detection protocols. In addition, they should strengthen their reporting of abnormal wire transfers, especially those involving cryptocurrency or overseas accounts. So, they can help with law enforcement track trends and help potential online fraud targets.

Families and communities should lead the role in teaching and protecting old relatives and neighbors. They should have open conversations about scams and teach seniors how to verify requests through offline channels, not a link to an email.

Protecting seniors is more than a moral obligation

IC3 data shows a stressful pattern of fraud that is faster than faster institutions. This makes protecting the seniors not only morally but also the economical pragmatic. Americans aged 60+ are an important demographic, so keeping their wealth is critical to maintaining consumer spending, health care systems, and intergenerational trust.

The alternative? A future where retirement is not a reward for decades of work but a gold ticket for faceless predators.

Cryptopolitan Academy: Wanna grow your money in 2025? Learn how to do this with Defi on our upcoming webclass. I -save your place