Bitcoin Holds $100,000 Support, Eyes $110,000 Breakout

Bitcoin (BTC) has reached 3.6% in the last 24 hours, which has fallen above $ 100,000 for the first time since February 3. This progress reigned bullish momentum throughout the market and pushed the institutional interest back to attention.

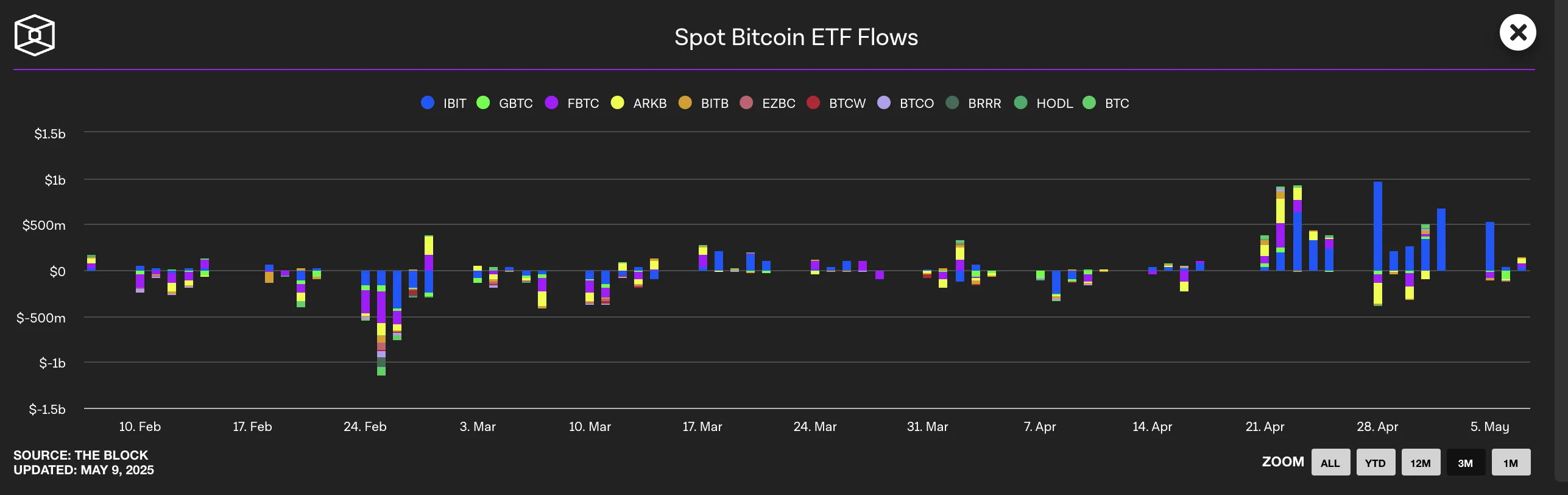

From the ETF streams to the massive handling of the corporation, traditional finances are now driving in the narrative around the next bitcoin transfer. Like BTC's new highs, analysts are also watching basic technical levels and a possible transition to dominance towards the altcoins.

Institutions are leading as Bitcoin's eyes are new highs and altcoins who wake up

The Bitcoin rally above the $ 100,000 challenges that has long been held in frameworks and fuels widely debated about what's next.

According to cryptoquant CEO Ki Young Ju, the traditional theory of Bitcoin cycle is outdated as institutional players and the ETF has seized the reshape of the ecosystem.

In companies such as strategy that holds more than $ 53.9 billion in BTC and ETFs carrying billions of net inflows, on-chain analysts are repairing a new regime led by Transulo's liquidity.

Meanwhile, the mixed emotions in the options market and increasing interest in futures reflects a dedicated property, which is increasingly driven by the macro forces and capital flow.

At the same time, the momentum moves toward the altcoins. Raoul Pal suggests that bitcoin's dominance is sinking, motivating the “banana zone” – a stage of the growth of parabolic altcoin. CoinMarketCap's Altcoin Season index moved to the territory of the “Bitcoin Season” territory for the first time in the months, now sitting at 41.

Institutional participation remains strong, with ETFs of blackrock and fidelity that continue to absorb capital.

The standard chartered doubled its bullish view, predicting a new BTC throughout the time in Q2, fueled by ETF demand, adoption of sovereign funds, and the approach plan to raise $ 84 billion, which potentially push Bitcoin handles to more than 6% of the total supply.

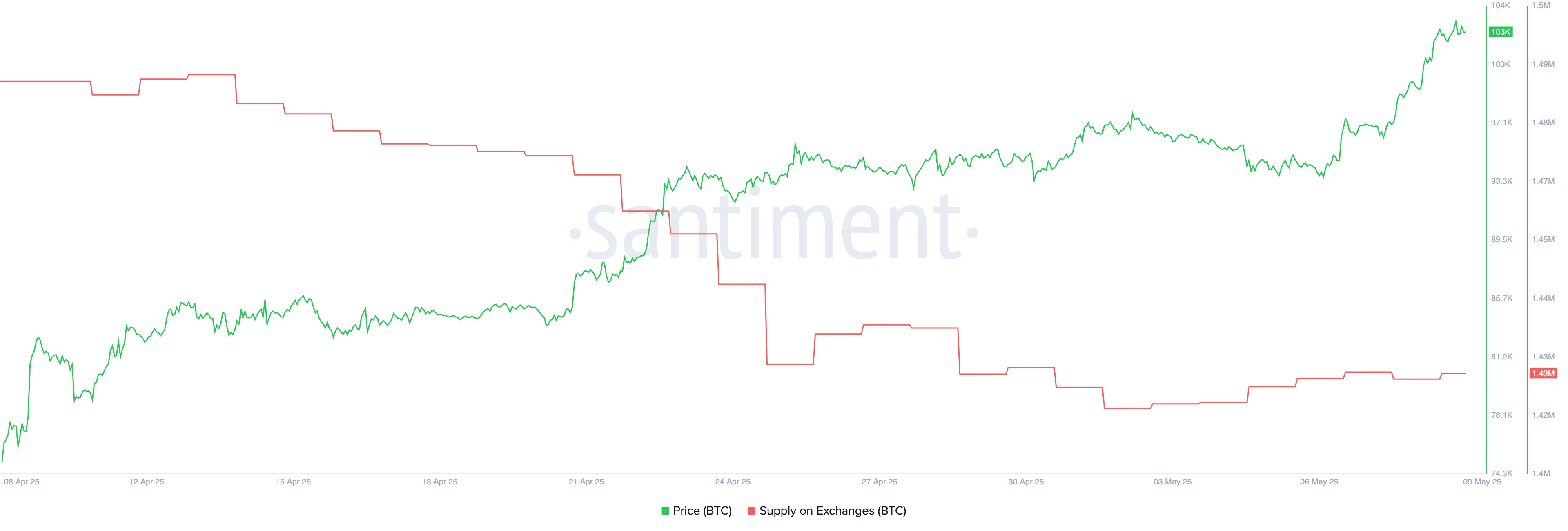

BTC Exchange Supply stabilized after sharp collapse while holding the bullish trend

Between April 13 and April 25, the Bitcoin supply of exchanges found a sharp and consistent decline, which fell from 1.49 million to 1.43 million BTC. The 60,000 BTC collapse in just 12 days reflects one of the most significant streams seen in recent weeks, suggesting a strong accumulation of accumulation throughout the market.

A reduction of bitcoin supply to exchanges is usually seen as a bullish signal. This indicates that investors are transferring their BTC to cold storage or long -term handling, reducing the amount available for immediate sale. Conversely, an increase in exchange supply may indicate increased sales pressure, as more BTCs are available for potential extermination – a bearish signing.

Due to the sharp collapse, the BTC supply to the exchanges has stabilized around 1.43 million. This integration -this includes suggesting that investors are currently holding their positions rather than preparing to sell, which can support the ongoing price strength in the near term.

The Ichimoku Cloud for BTC shows a strong momentum. The price is fixed above the green cloud (kumo), indicating a clear spurt.

The Tenkan-Sen (Blue Line) and Kijun-Sen (Red Line) slope upwards, along with the tenkan-sen positioned above the kijun-sen-another confirmation of bullish strength.

The leading span A (top of the green cloud) is at the top span B (bottom of the cloud), and the cloud at the fore is thick and rising, suggesting a strong level of support and continuous strength.

The lagging span (green line) is positioned above the cloud, which further supports the bullish perspective. Unless the price closes under the blue tenkan-sen or the cloud begins to thin or turn red, the bias remains strong bullish.

Bitcoin's uptrend is intact, but $ 99,000 support must be handled

Bitcoin EMA lines currently indicate strong bullish momentum, with short -term average positioned above the longer ones. If this upward trend holds, the price of Bitcoin can challenge the resistance to $ 106,296.

A successful upper level breakout can trigger a move towards $ 109,312, which is potential opening the door for a historical test of the $ 110,000 mark for the first time.

However, if Bitcoin loses its vapor, the main level to watch is the support of $ 99,472.

A drop below can change emotions and push the price up to the next major support to $ 94,118.

Refusal

In accordance with the guidelines of the trust project, this price assessment article is for information purposes only and should not consider financial or investment advice. Beincrypto is focused on accurate, unparalleled reporting, but market conditions are subject to change without notice. Always do your own research and consult a professional before making any financial decisions. Please note that our terms and conditions, privacy policy, and disclaimers are updated.