Will BTC Price Hold or Face Selling Pressure?

The price of bitcoin holds tightly above the important $ 100,000 mark, while holders continue to buy every time the price goes down. The recent bounce back has led to analysts and merchants to predict various price targets in the future based on their research and opinion. Although bitcoins are at risk for a sale in advance, some major on-chain metrics are rising, supporting this ongoing recovery.

More than 97% of income holders

Bitcoin's climbing past $ 100,000 changed the market sentiment in a big way, which helped avoid tensions in the US-China trade situation. While ruining this price is the main level, many entrepreneurs estimate against Bitcoin have gained heavy losses. According to coinglass, approximately $ 279 million in Bitcoin positions has been liquid in the past 24 hours. Here, $ 243.3 million destruction is derived from sellers and $ 35.7 million from buyers.

While open interest dropped by 3.2% to $ 67.1 billion, the amount of trade continued to climb, showing ongoing market activity.

Also read: It's too late to buy Bitcoin? Samson Mow has issued a Bull Run Warning as the price destroys $ 103k

Bitcoin's $ 100k breakout also found significant institutional interests. Bitcoin ETF spots have seen $ 142.3 million in net inflows, showing strong institutional interests, according to Farside investors. ARK's ETF led $ 54 million, followed by Fidelity with $ 39 million and blackrock with $ 37 million. Blackrock also bought more than 86 BTCs worth $ 8.4 million in a transaction.

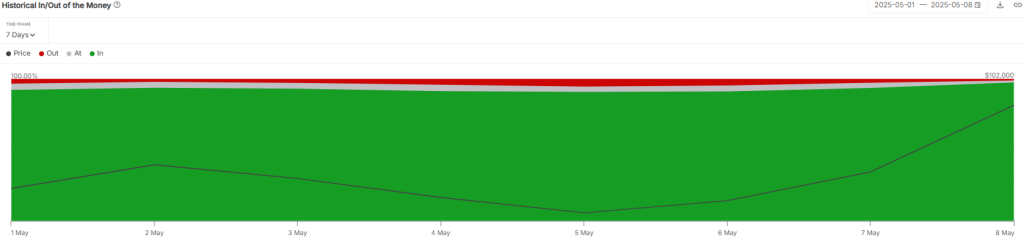

Data from IntoteBlock shows that more than 97% of Bitcoin holders are now earning after BTC has passed the $ 100k mark. While this is a positive sign for long-term investors, it can also lead to the sale of pressure in the short term, as more holders can decide to cash in on their acquisitions.

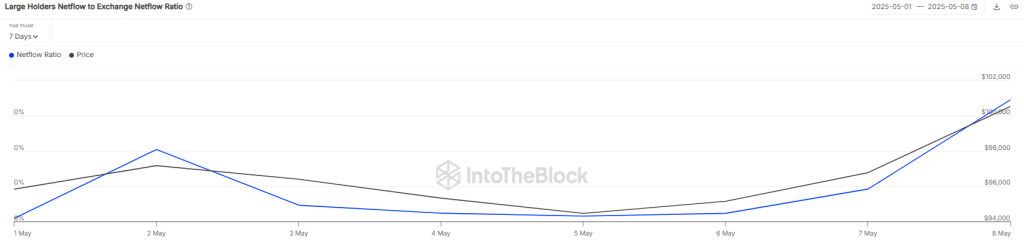

At the same time, whales add to the volatility of the market. The volume of large transactions has increased dramatically, rising from $ 68.45 billion to $ 72.67 billion, indicating an increase in activity in large players.

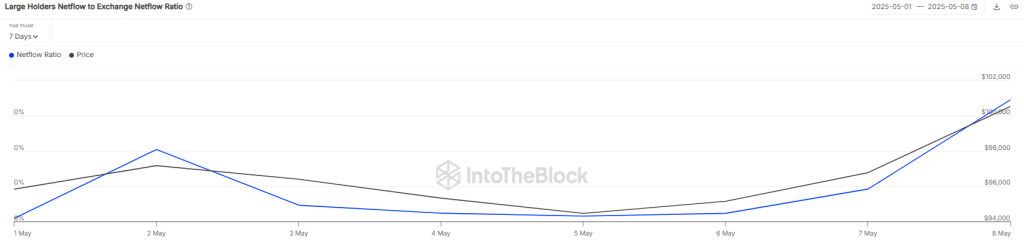

More noteworthy, the huge Netflow to exchange ratio jumped to 0.17%, meaning that big investors are moving more bitcoin in exchanges. This type of behavior often signed that whales are preparing to sell as BTC prices, which can lead to short-term price collapse or market swings if selling volume spikes.

What's next for BTC price?

Bitcoin is aggressively maintaining the purchase demand above the EMA20 line, showing that traders are still confident and willing to buy when the price is sinking. However, sellers put a minor resistance to $ 104,360. As of writing, the BTC price is trading at $ 102,483, which has dropped more than 1.13% in the last 24 hours.

There are some minor resistance around $ 104K, but if Bitcoin destroys that, it can head to the key $ 109,500 level. This is a huge psychological barrier, and sellers are likely to try to prevent the price from higher. If Bitcoin manages to push the past $ 110k, it can make a new ATH.

However, the bears are running out of time. To regain control, they need to push the price below the 20-day transfer of the average and keep it there. If that happens, Bitcoin can fall for about $ 93,500, close to the 50-day average move.