Crude Oil Price Struggles amid Geopolitical tensions

- Summary:

- Discover these factors affect crude oil oils with technical levels, and what will follow in the market.

Increasing the direction of oil production is spreading rapidly in the market today. In response to the US putting independent refineries from China on the penalty list, Chinese oil refineries continued to import large amounts of crude oil oil in April. The imports reach 11.7 million barrels per day, according to data from custom authority.

Although it was lower last month, it was 7.5% more than last year. The only advantage is from significant collapse to oil prices.

Also, Kazakhstan continues to produce more oil than agreed, and there seems to be no plan to reduce production in May. These methods can lead to Saudi Arabia to increase oil production in July, which will strengthen risks that are harmful to oil prices.

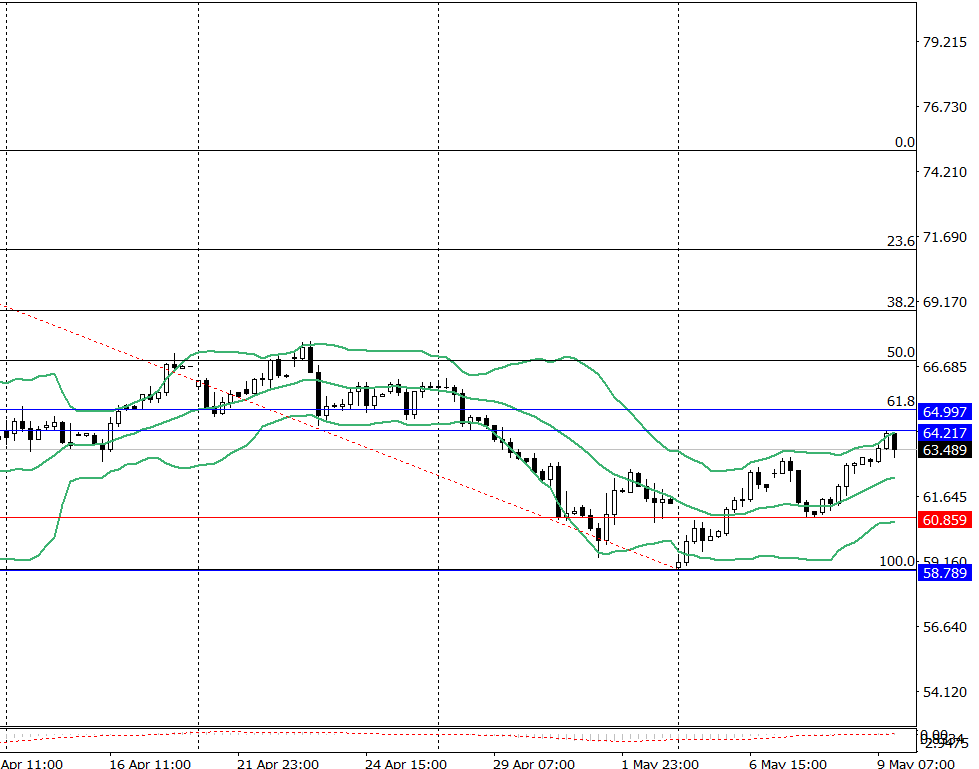

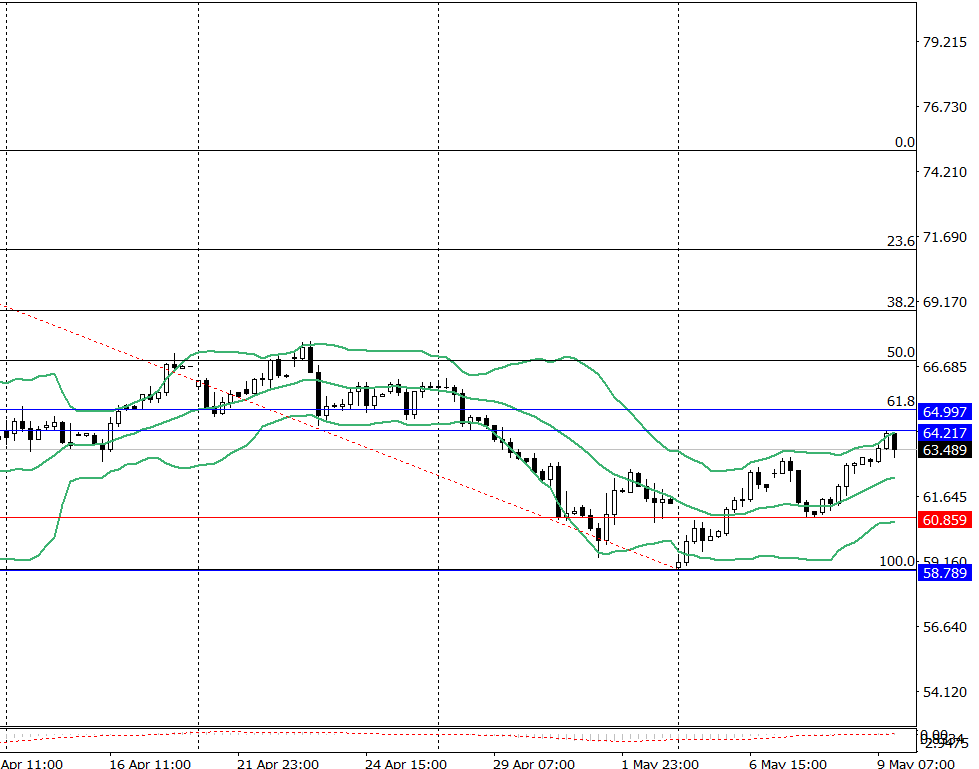

Technical Levels for crude oil prices:

Today, crude oil has encountered a land and a great support of $ 60.85, and has successfully climbed to reach 63.48, so if the price can break the bollinger band resistance of $ 64.21, it can climb a second resistance to $ 64.99.

On the bearish side, any sun -day clearly close to under $ 62.30 will lead to a significant downtrend to reach even lower levels.

Factors affecting Brent oil prices today:

Geopolitical Tensions:

Continued US-China trade discussions can significantly affect oil prices, while any signs of prevention or increased tensions can move prices.

Supply and Demand: OPEC+ Production Decisions:

This is important for oil prices such as when OPEC+ has decided to increase production, this leads to a transition to prices down and vice versa. Also, reports on crude oil oil inventory can influence prices, as increasing mean of higher supply and decreases means higher demand.

See also

Global economic growth:

It is a major driver of oil demand, as long as global economic growth remains downward, oil prices may be under pressure. In conclusion, the current price for Brent oil is under pressure due to the factors mentioned above, and the bearish direction is still recommended.

You can also check, oil price edges in weak dollars, geopolitical risk