Bitcoin ETFs Reach Record Inflows After Market Downturn

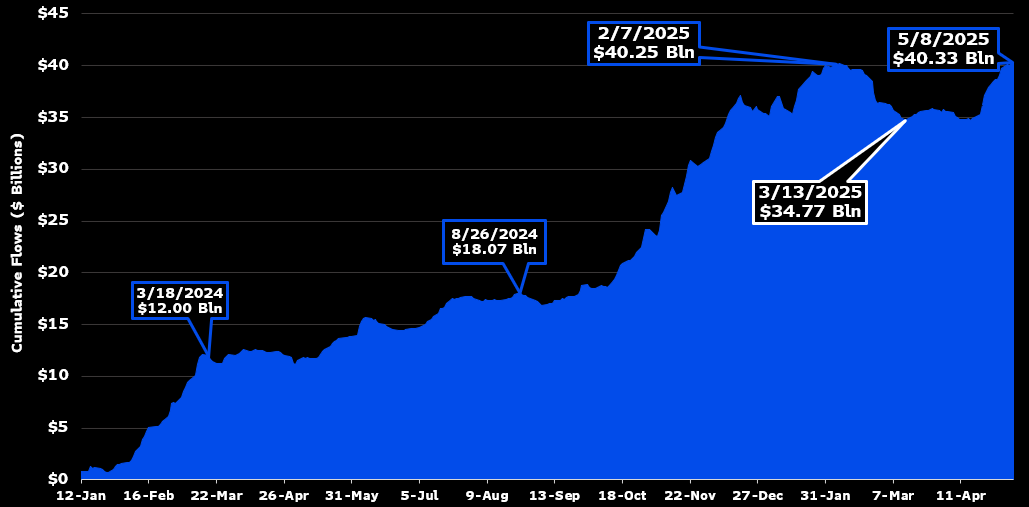

The latest data claims that Bitcoin ETF spots have exceeded their previous flow record. The flowers are currently sitting at $ 40.33 billion, despite more than $ 5 billion in the last two months.

Despite the climate of intense fear in crypto markets, Bitcoin ETFs have seen relatively limited losses during this time. By reclaiming this note very fast, the market showed a wonderful elastic.

Bitcoin ETF

Since the Bitcoin ETFS first launched in 2024, they have completely changed the crypto industry. Analysts called Blackrock's Ibit “are the greatest launch in ETF history,” which reflects their market appeal.

Now the data reflects another encouraging success for bitcoin ETFs, as their outflows exceed a full time List Set in February:

Shortly after Bitcoin's ETF spots exceeded $ 40 billion in the flow, the market saw a massive return. More than $ 5 billion in the flows have consumed all the achievements in 2025, causing the offering of those who gave their BTC reserves.

These firms collectively had a rugged demanding for Bitcoin, so their collective market raises concerns of greater problems.

These losses are clearly caused by fear of a backward and threat of Trump's tariffs. However, a recovery began in late April.

Although Bitcoin ETFS started their rebound, the flowers fell to a 2025 low. This dynamic is part of why ETF's analyst Eric Balchunas found this metric that benefits the market analysis: very difficult fake.

“Lifetime Net Flow is the most important measure to watch in my opinion: very difficult to grow, pure reality, no BS. [It’s] Awesome [that] They were able to do this with the new high water score soon after the world was over. Byproduct of almost anyone to leave, left only a small hole to dig, ”Balchunas claimed on social media.

In other words, the thought of the “diamond hands” of the crypto community may have defined this sharp circulation. At the height of the tariff panic, the markets are in extreme fear, the lowest level of investor confidence since the fall of the FTX.

In this light, these products are performed well. Two months later, the Bitcoin ETFs enjoyed the same flow again.

Of course, the record of this flow does not guarantee that everything will remain sunny for BTC ETFs. Bitcoin recently claimed $ 100,000, which sparked a market flow for this market, but some bearish signs take on trading options.

So far, however, this success is noteworthy. ETF's successes have exploded, and Bitcoin has seen Trade's liquidity increase in recent weeks.

Refusal

In compliance with the guidelines of the trust project, the beincrypto focuses on unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify the facts independently and consult a professional before making any decisions based on this content. Please note that our terms and conditions, privacy policy, and disclaimers are updated.