Onyxcoin Rises but Faces Key Resistance in Choppy Market

Despite growing bullish feelings throughout the broader crypto market, Onyxcoin (XCN) gained only 5% last week. Although trade volume jumped at 77.7% today, up to $ 82.3 million, Altcoin continues to face resistance.

The momentum rises, along with the climb of the RSI and a gold cross that forms. But not all signals are bullish. BBTrend remains negative, showing care. Traders are watching to see if XCN can handle the breakout or if the bears will take it.

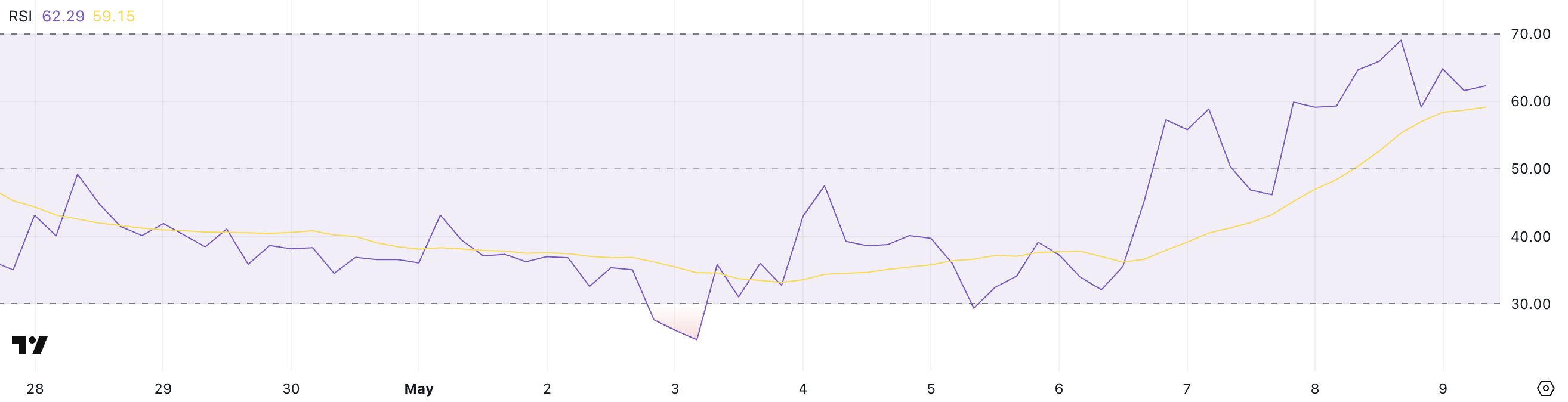

XCN RSI has fallen to 62 while Bullish Momentum builds

Onyxcoin has shown a strong outbreak in momentum, with the Kamag -child index (RSI) rising from 46.15 to 62.29 in just two days.

The rapid increase in this signal has increased the pressure of the purchase and suggests that bullish feelings gain strength.

RSI is a widely used momentum indicator range from 0 to 100 – the readings above 70 usually indicate excessive conditions, while levels below 30 suggest that the possession may be excessive.

At RSI of XCN today at 62.29, the token is close to excessive territory but there is still room to climb.

Essentially, Onyxcoin has not crossed 70 thresholds since April 23, which has been featured while the momentum is building, it has not yet reached the levels that are often preceded by a pullback.

If the RSI continues to rise, it can support additional prices, even if entrepreneurs will be watched closely for signs of fatigue.

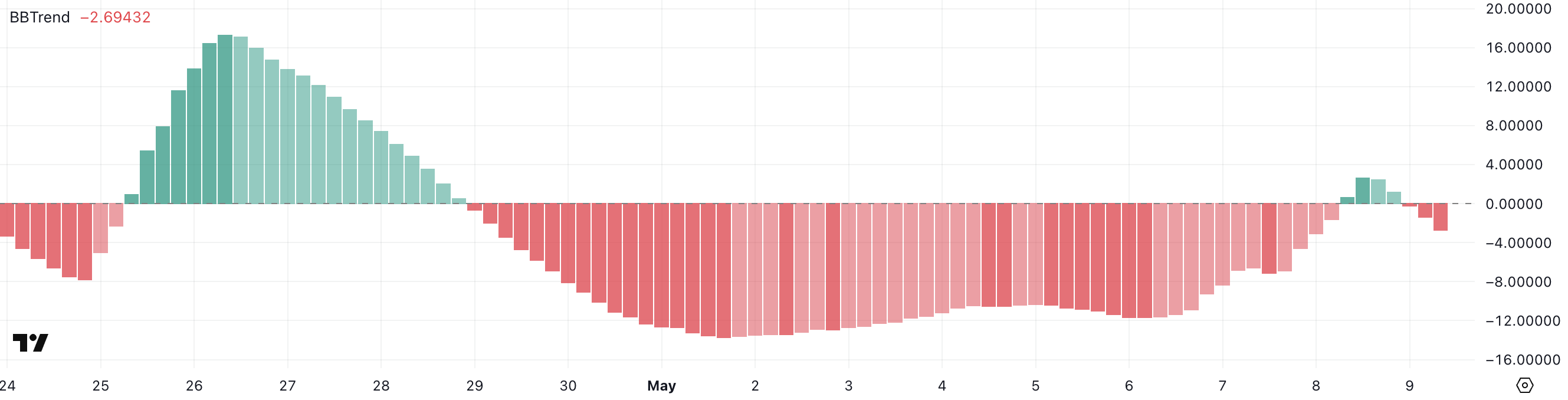

Bbtrend of Onyxcoin became negative again after short recovery

The Onyxcoin Bbtrend indicator is currently in -2.69, reflecting a modified weakness in momentum after a short recovery. Between April 29 and May 8, BBTrend remained negative, signing a bearish bias during that stretch.

On May 8, the short-term indicator slumped into the positive territory, looking at 2.66-washing a potential recovery-but that move was short-lived.

In the last few hours, the BBTrend has been reversed again, falling strongly from -1.41 to -2.69, which adopts a return to bearish pressure in the short term.

Bbtrend (Bollinger Band Trend) is a technical indicator that measures the strength and direction of a trend based on the distance between the price and bollinger bands.

Positive values usually indicate upward momentum and a potential continuation of bullish price action, while negative values point to the downward momentum and increasing sales pressure.

With XCN's BBTrend which is now deep in negative territory, it is suggested that the bearish sentiment is regulated. Unless the indicator returns to the positive as soon as possible, the current setup indicates the limited reversal and the possibility of additional price weakness in the near term.

Golden Cross forms on Onyxcoin: Can XCN be broken by resistance?

Onyxcoin (XCN) is formed only by a Golden Cross-a bullish technical pattern in which the short-term move of the average crosses above the long-term average move.

This development often indicates the beginning of a potential uprising. If the momentum continues, XCN can test the resistance to $ 0.020.

A breakout at that upper level can provide the way for additional acquisitions towards $ 0.024, and if the rally maintains, the price can climb as high as $ 0.0273. Onyxcoin is one of the hottest altcoins of 2025, up to 118% in the last 30 days.

However, if the uptrend fails, basic levels of support can play.

The first place to watch is $ 0.0175 – if that level is damaged, XCN can drop to $ 0.0164.

Continued weakness can drag the price even less than $ 0.0156.

Refusal

In accordance with the guidelines of the trust project, this price assessment article is for information purposes only and should not consider financial or investment advice. Beincrypto is focused on accurate, unparalleled reporting, but market conditions are subject to change without notice. Always do your own research and consult a professional before making any financial decisions. Please note that our terms and conditions, privacy policy, and disclaimers are updated.