Here you will find out how much S&P 500 is from the Goldman Sachs recession warn

⚈ Economists warn against the potential recession, despite the market profits, referring to macroeconomic problems.

⚈ Goldman Sachs maintains the recession's prospects by giving the bullish gold price target with caution.

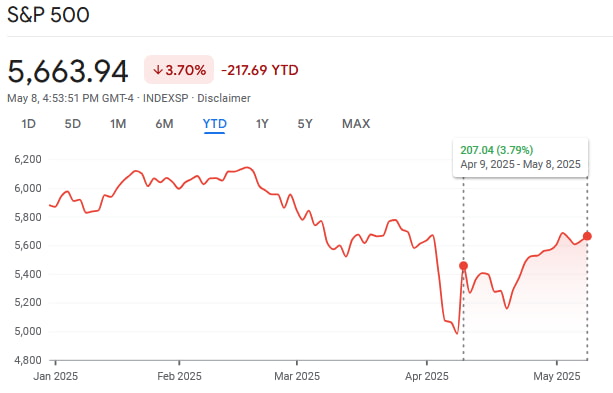

Despite a warning from a giant stern of the banking on April 9, the economic downturn and the greater drop in stocks have not been realized since then – the S&P 500 has actually risen since the early April tariff shock.

During the International Investment Bank predictionThe S&P 500 was 5456, marking the 9.52% movement from the end of the day after the previous day of the tariff policy.

On 7 May, the comparative index had reached 5663 -the 3.79% higher during the recession of the Goldman Sachs recession.

Goldman Sachs' recession warning may have been incorrect – but the troubles still remain

Despite the current S&P 500 setback, the main concerns are – macroeconomic conditions and trade disputes, still constant concern.

In fact, the consensus seems to be that this issue is only delayed instead of resolved. Top Economist David Rosenberg called on investors to clean his portfolios, claiming that about 60% of the US economy is in or near the economic downturn.

The CEO of JPMorgan (CEO) Jamie Dimon warned that the future scenario is Paul Tudor Jones, Head of the Organic Recession-Biljard Traditions, who now considers the stock market crash inevitable. In addition, oil demand is reduced, which is a wider power of the health of the economy.

In the end, Goldman Sachs has not changed his prospect – the recent gold bullish price goal, which clearly shows that the banking giant still considers the recession as an opportunity.

Highlighted image via Shutterstock