US option market now betting the Fed won’t cut rates at all in 2025

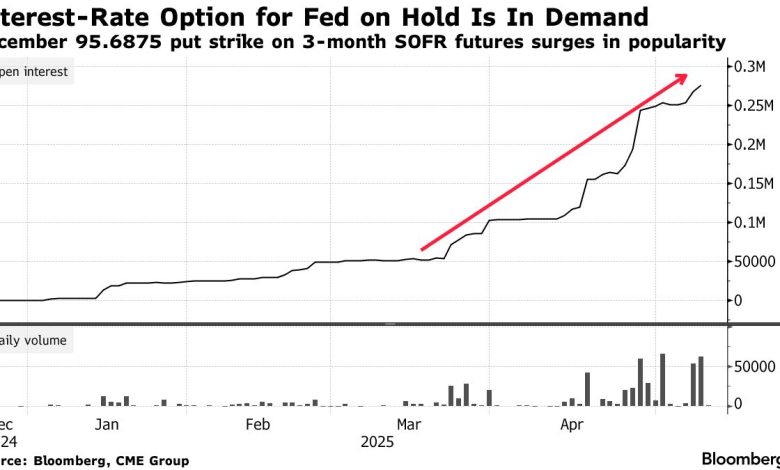

Traders in the US options market throw serious money with an idea: that the Fed will maintain rates frozen by 2025. The stakes are clear and strong. It is tied to an option to be placed in December 2025 Secured Overnight Financing Rate (SOFR) Futures Contract.

The welga-95.6875 price-is less than the current price of SOFR futures, which is still factors to three quarter-point cuts before the end of the year. Anyone who buys these contracts calls the bullshit on that prediction.

This is not a few quiet playing in the backroom. This is a whole offensive. Trade will only be paid if the price of futures sinks close to 95.6875 mark, which means that expectations for rate cuts will need to die completely.

To date, open interest interest has been over 275,000 contracts, and the size has exploded over the last few weeks. It was selected by speed after the latest Fed policy meeting – the one in which they held and left rates at 4.25% to 4.5%.

Only one quote is required from that session: Jerome Powell, the Fed Chair, said the current level is “suitable for current economic conditions” and will not move unless the conditions.

Many merchants enter as futures and open interest spikes fall

Many more firepowers were added after Wednesday. On Thursday, the SOFR Futures dropped again, and opened interest at 95.6875 to put more. It followed a market reaction to better than-expect economic data and a rising stock market.

Entrepreneurs began their previous belief that the Fed would be able to join the cuts. That belief continues to fade. And while fading, this option gets value.

Since March, entrepreneurs have spent nearly $ 25 million to buy nearly 250,000 in these contracts, Bloomberg reported. The number of individual merchants in the position is unknown, but the volume says everything. They bet the Fed remains exactly where it is.

This trade also feeds a comment made by President Donald Trump on Thursday. Speaking to the White House, Trump told Americans to buy stocks based on the upcoming development with the UK trade deal. The stock market jumped right away.

Optimism was kicked. But that could be reviewed quickly, as Trump also mentioned on Friday that he could slap an 80% tariff on Chinese imports. Just before the weekend negotiations in Beijing

The people involved in setup Reported Say the US can rather push for something less serious, such as getting tariffs below 60% to start.

But any change there can be a swing at how the Fed reacted for the rest of the year. If the trading talk crash and burn, the massive stakes may lose steam -or it may be deeper into the money.

WisDomtree is nothing to see a reason for fed cuts

“Unless something bad happens between now and June, that means the Fed doesn't have to go,” said Kevin Flanagan, the head of a fixed wisdomtree revenue approach. Kevin pointed to the weakness of short -term produce, especially since the Fed's March projection still included two cuts.

Meanwhile, battle lines form the Treasury futures market. On the one hand, asset managers are stacked in a long position, the betting asset will fall. For the last eight straight weeks, they increased their exposure to the equivalent of 1.3 million 10-year note of futures.

On the other hand, the fence funds are stacked with short positions, adding nearly 1 million contracts to their total in just five weeks.

The biggest change last week came in five years. Asset managers extended their net long $ 7.4 million per DV01, while fence funds pushed their net short up $ 7.7 million per DV01. That's not a quiet disagreement. It was a full -fledged war between bulls and bears how far it would come out.

So far, the Fed has not blinks. Nor people bet no.

Cryptopolitan Academy: Tired of market swings? Learn how the Defi can help you develop a steady passive income. Register now