Single Trade Chat Optimism

Do weekend trade talks are pushing stock to new ups?

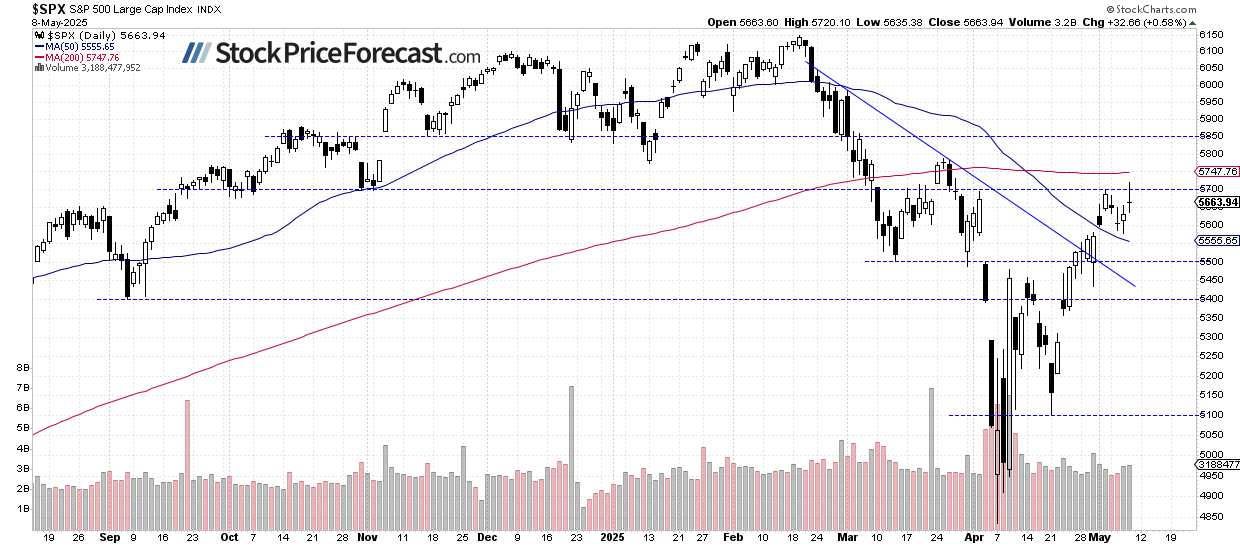

The S&P 500 reached 0.58%on Thursday, but closed down the volatility caused by the development of 5700 obstacles. The futures are a bit positive this morning as the S&P 500 should open 0.2% higher as investors retain careful optimism before US-China trade talks designed this weekend in Switzerland.

The markets closely follow these upcoming negotiations between US Treasury Secretary Scott Bessent and their Chinese colleagues between their Chinese colleagues. Unlike the United Kingdom, China was excluded from the Trump Tarest Beauty and is currently facing US liabilities at least 145%, in Beijing, 125%of mutual fees applied.

Investor feelings have improved, as shown on Wednesday in a sentimental study by AAII investors, stating that 29.4% of individual investors are bullish, while 51.5% are suffering.

The S&P 500 continues short -term consolidation, probably a tide correction. Thursday's rally failed to push 5,700 resistance decisively, indicating the hesitation between buyers despite the positive US-UK trade transaction.

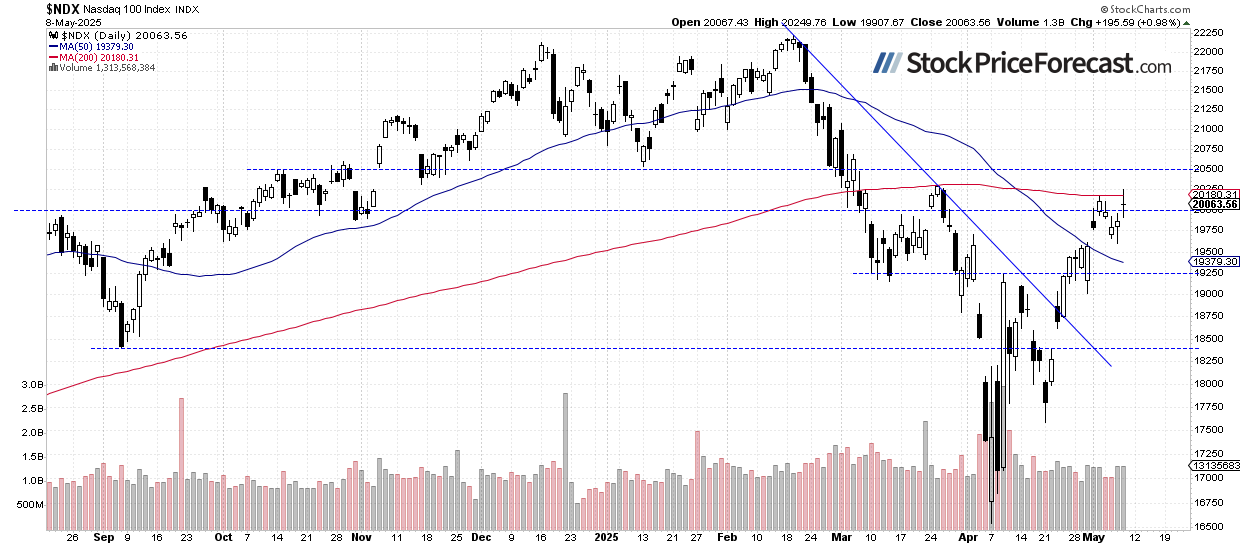

Nasdaq 100: Looking in China speaks carefully

Nasdaq is particularly sensitive to the development of US-China relations, where many major capitalization technology companies have significant exposure to the Chinese market.

Yesterday it reached 0.98%, moving back to 20,000 levels and this morning it is likely to open 0.4% higher.

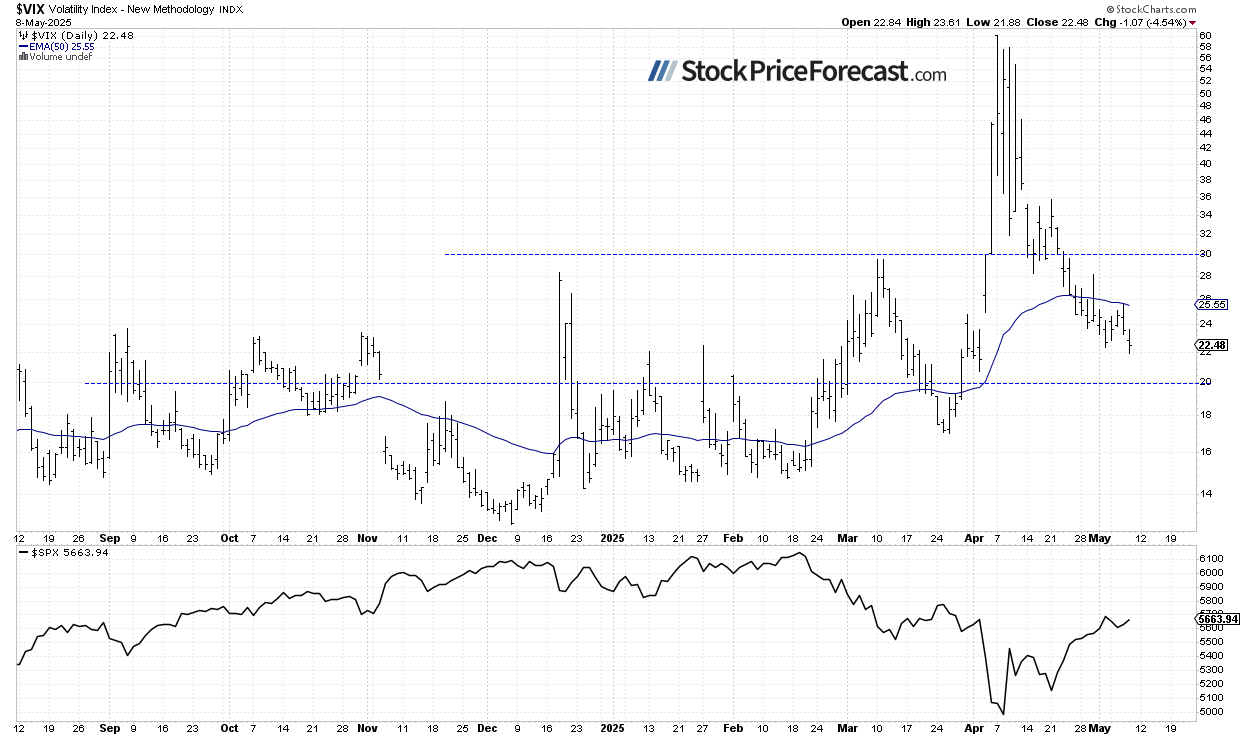

Vix dip into new locals in the lowest lowest

Yesterday, the volatility index fell to a new local lowest level of 21.88, indicating that the market continues to shrink in the early April panic regime.

Historically, the decline in the VIX shows less fear in the market and the decline in stock market is accompanied by VIX. The lower the VIX, the greater the likelihood of reversing the market. On the contrary, the higher the VixThe greater is the likelihood of a market upward pointing.

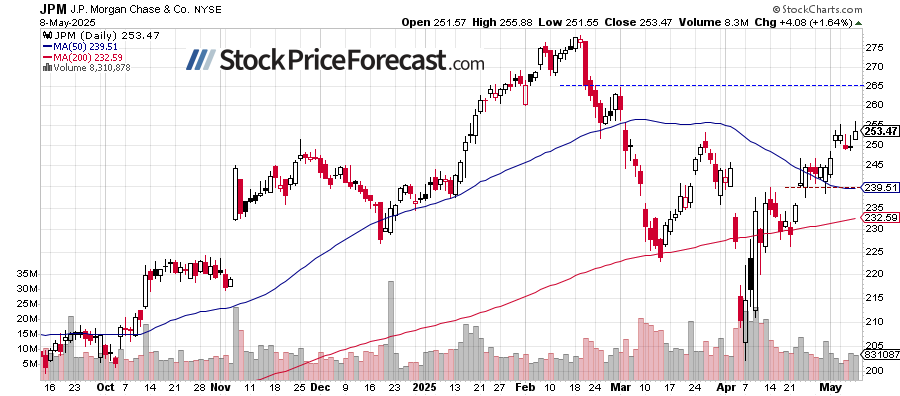

The idea of trading shares – JPM

The long position of JPM shares was opened on May 5 at $ 251.18. And there is a profit right now. Stop loss level is $ 240.00 and a profit achieving $ 265.

The stock went higher last Friday, which is a positive signal, indicating that it is likely to continue its rise. The expected duration of trade is 1-2 weeks; But I will keep you up to date on all the changes outlookTo.

S&P 500 Future Agreement: Side Movement

This morning, the S&P 500 futures contract will trade at 5700 levels, extending short -term consolidation.

The resistance persists about 5700-5,720, while the support is 5,600, denoted by recent lowest.

This lateral movement does not signal the weakness, but rather the healthy circulating, where early buyers make a profit. These breaks often create good chances of entering those who missed the original move, setting the next potential foot higher than the tide continues.

Conclusion

It is expected that the S&P 500 will open a little higher this morning, continuing to test the key 5700. All the glances will be at the upcoming US-China commercial dispensers this weekend, which may affect the market direction next week.

Here is a division:

- The S&P 500 reached 0.58%on Thursday, but closed below 5,700 obstacles.

- Futures today show a modest 0.2% higher open, as markets are being used to wait and watch the weekend trade negotiations.

Do you want free follow -up to the above article and the details are not available to 99%+ investors? Sign up for our free information page today!