Bitcoin Faces Bearish Pressure Ahead of $3 Billion Options Expiry

Crypto market braces for significant movements of over $ 3 billion in Bitcoin and Ethereum options will expire today.

With the large contracts and maximum pain points determined, how can these expired choices affect market volatility?

Crypto markets request $ 3 billion options to expire

According to deribit data, approximately $ 2.65 billion in Bitcoin options is set to expire today. The maximum disease point for these options is $ 94,000, accompanied by a put-to-call ratio of 1.05.

This expiry includes 25,925 contracts, slightly fewer than 26,949 contracts last week.

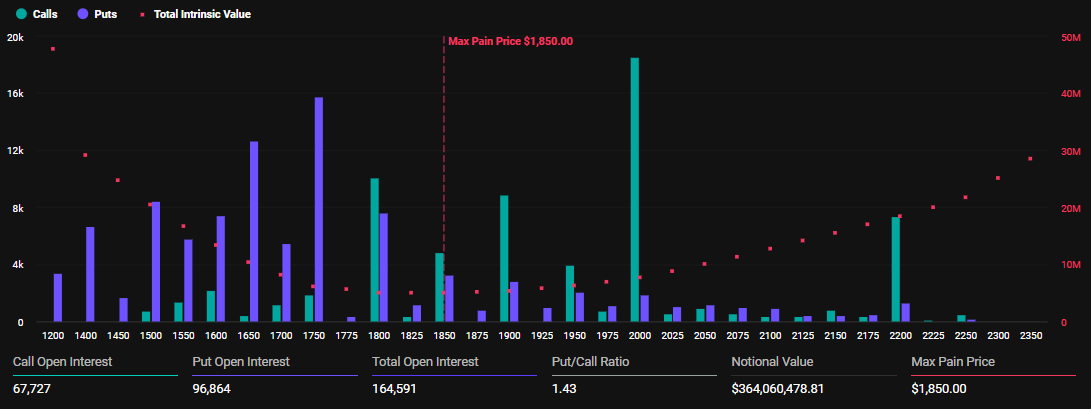

Ethereum also sees the expiry of 164,591 contracts, less than the 184,296 open interest of last week. Expired contracts have a notional value of $ 364.06 million. The maximum disease point for these contracts is $ 1,850, with a put-to-call ratio of 1.43.

In the sales of Bitcoin and Ethereum that exceed purchase calls, the analysts in Greeks.Live mention a predominantly sentiment on the market.

“The group seems to be leaning against entrepreneurs who are positioning for potential downside movements,” write Greeks.live.

For Bitcoin, this sentiment becomes brighter in this Max's disease level below the current price of $ 102,570. Based on Max Pain theory, prices tend to draw towards strike prices while options close to expiry.

Based on this, analysts in Greeks.live note that some entrepreneurs are watching $ 93,00000 to $ 99,000 price levels. They also mentioned a lack of enthusiasm for the BTC's foray that past the $ 100,000 milestone.

“The market is described as a boring chop with entrepreneurs looking to achieve decay time while maintaining exposure to the downside,” the analysts added.

Positioning the skews bearish, max pain is sitting below the price

Meanwhile, with put-to-call ratios above one for both Bitcoin and Ethereum, there are more placement options (bearish bets) than call options (bullish bets). Many other entrepreneurs have estimated the price will decline.

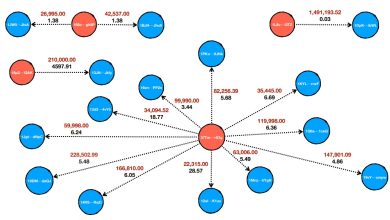

The histograms in the images above confirm it. The BTC Open Interest Chart shows a significant concentration of option contracts in strike prices below the current BTC price of $ 102,570, especially between $ 93,000 around $ 100,000 prices.

The clustering of the contracts of the lower strikes indicates that entrepreneurs are positioning for a potential price collapse, therefore the bearish skew.

It comes in the middle of the hope of a weekend -change, which can threaten Bitcoin's reversed potential. As Beincrypto reports, envoys from China and the US will meet in Switzerland over the weekend for trade talks.

However, concerns take the risk of a breakdown in tariff conversations. The meeting was to mark the first official trade communication since President Trump's tariffs rose to Chinese imports by 145%.

However, Treasury Secretary Scott Bescent announced that the US did not look to rot. Meanwhile, in an announcement on Thursday, the China Embassy in Washington said it would not allow any attempt to force or force China.

China is focused on protecting legitimate interests and promoting international fairness and justice. The general emotion is that Beijing is very skeptical of US aspirations.

“In any potential communication or conversation, if the US does not correct the wrong unilateral tariffs, it will show a complete lack of loyalty and will further ruin one's trust in one Nakasa said.

In any of the sides that offer concrete concessions ahead of the meeting, crypto entrepreneurs are afraid that the summit may end with another diplomatic miscarriage.

Against this backdrop, any indication of the increase can act as a volatility of volatility, dazzling the reversal of Bitcoin's potential. On the other hand, a positive development at the meeting could provide tails for Bitcoin, as it happened when Trump announced a major deal with the UK.

“Donald Trump has just dropped a massive new trade deal in the UK, his first since the launch of global tariffs. The markets have exploded. Bitcoin has only shot $ 100,000 in the first time since February,” a user noticed In X (Twitter).

Refusal

In compliance with the guidelines of the trust project, the beincrypto focuses on unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify the facts independently and consult a professional before making any decisions based on this content. Please note that our terms and conditions, privacy policy, and disclaimers are updated.