Nifty 50 feels the heat of Geopolitical Tensions

- Summary:

- Nifty is trading stable in response to Fed's geopolitical tensions and policies. Check the trends in the sector and top movers with technical views.

As Nifty 50 is the Benchmark index of the Indian Stock Market and represents the performance of the top 50 largest and most rolling companies listed in the National Stock Exchange of India (NSE). Thus, this index will be very sensitive to any degree of uncertainty that occurs in the market. That's what is happening so far for the funny 50 amid the tension increase between India and Pakistan.

Nifty 50 Technical Analysis:

At the end of the Wednesday trading session, Indian stocks closed higher with indices moving upward. The index rose 0.14% while the Sensex rose by almost 0.13%.

While today, May 8th, they are flat not moving or down. And this was in response to India's “Operation Sindoor” yesterday and the decision of the US Federal Reserve last night.

However, the smaller and mid-size companies listed do somewhat better than the main indexes. (News in Indian stock market)

If we look at different sectors, we can see that entrepreneurs sell auto stocks, consumer goods, metal, oil and gas, and pharma. On the other hand, they buy stocks related to it, banks, and media.

The leading bullish stock in The Nifty at noon is Tata Motors, Titan, HCL tech, and Kotak Mahindra. They rise around 1: 1.8%.

In short, Nifty 50 is now quite stable as the entire Indian stock market, as the market is trying to dissolve ongoing events such as military operations and the US Federal Federal, so some sectors do better than others based on how they react. So there is a sense of uncertainty in the market.

See also

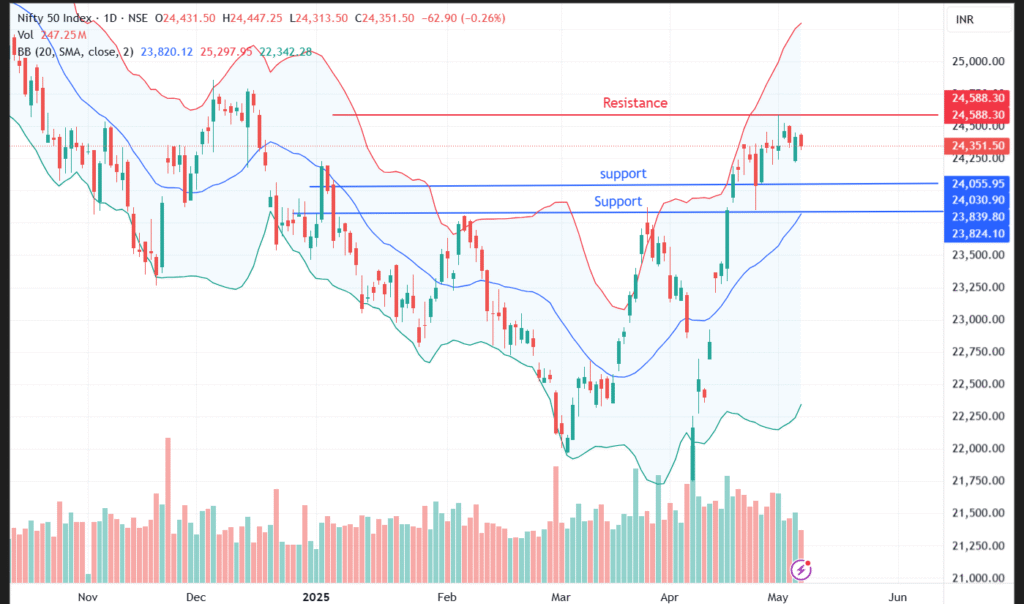

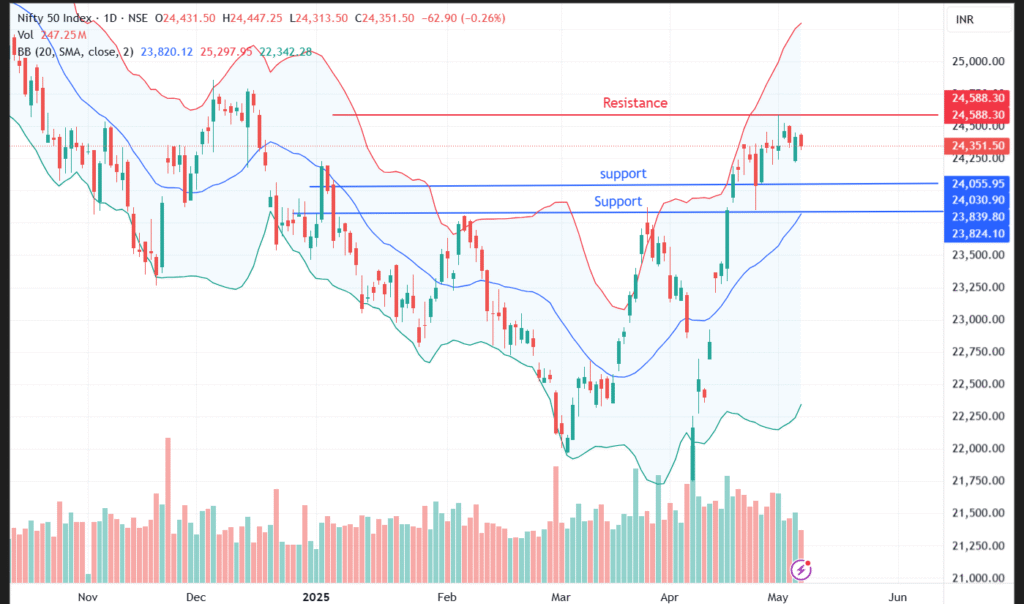

As mentioned in the live chart below, Nifty 50 is still trading under the treated high of $ 24,500, which puts the price under the pressure of this strong resistance, so it is likely to decrease if we see a clear day near the bottom $ 24,310, and it will open the door to reach the support levels of $ 24,055 and then $ 24,030.

If the price cannot be damaged at these price support levels will be trade in the same range between $ 24,350 and $ 24,030.